Answered step by step

Verified Expert Solution

Question

1 Approved Answer

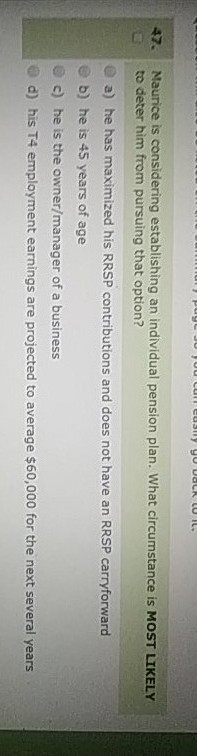

YU DALLU IL Maurice is considering establishing an individual pension plan. What circumstance is MOST LIKELY to deter him from pursuing that option? e a)

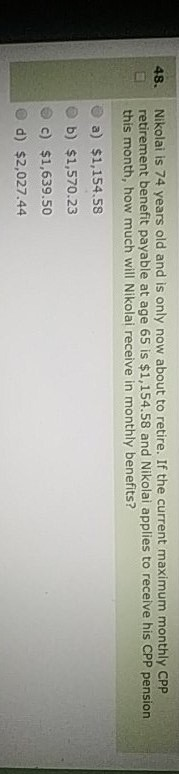

YU DALLU IL Maurice is considering establishing an individual pension plan. What circumstance is MOST LIKELY to deter him from pursuing that option? e a) he has maximized his RRSP contributions and does not have an RRSP carryforward b) he is 45 years of age c) he is the owner/manager of a business d) his T4 employment earnings are projected to average $60,000 for the next several years 48. Nikolai is 74 years old and is only now about to retire. If the current maximum monthly CPP retirement benefit payable at age 65 is $1,154.58 and Nikolai applies to receive his CPP pension this month, how much will Nikolai receive in monthly benefits? a) $1,154.58 b) $1,570.23 c) $1,639.50 d) $2,027.44

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started