Answered step by step

Verified Expert Solution

Question

1 Approved Answer

yu Illustration 59. Ravindra Singh, Sundaram and Telewani were partners sharing profits and losses in the proportion of 1/2,1/3 and 1/6 respectively. Telewani expired on

yu

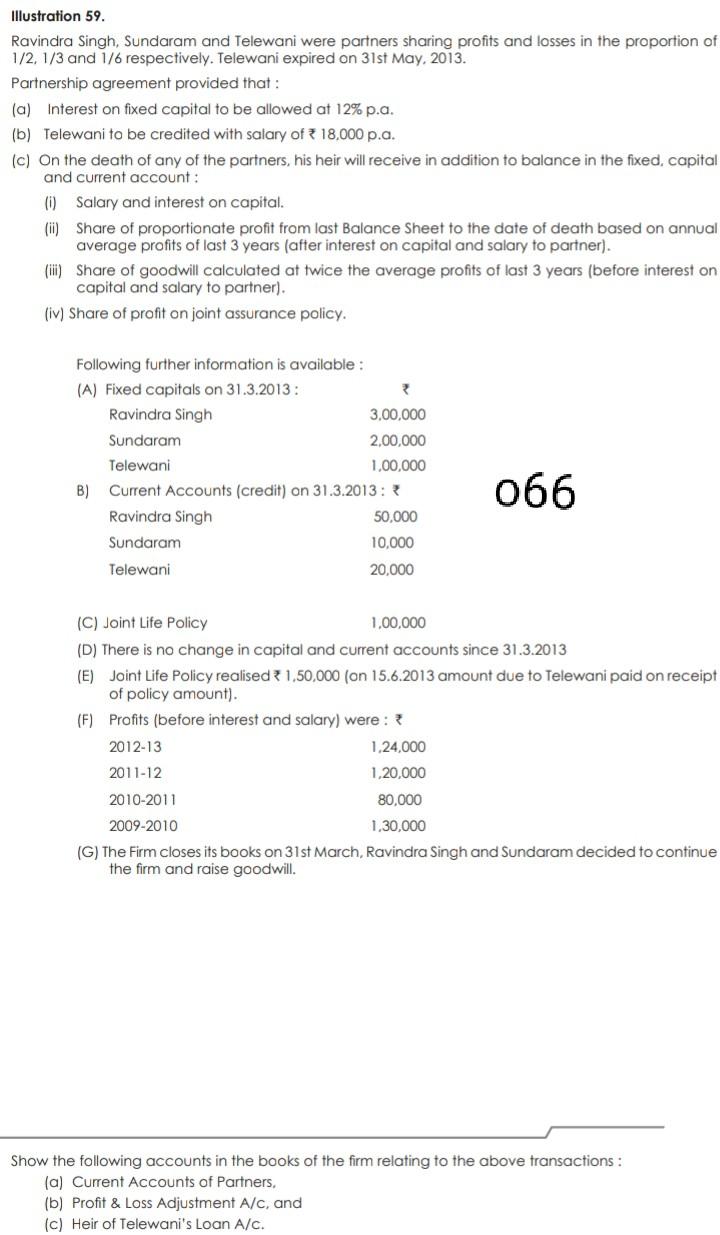

Illustration 59. Ravindra Singh, Sundaram and Telewani were partners sharing profits and losses in the proportion of 1/2,1/3 and 1/6 respectively. Telewani expired on 31st May, 2013. Partnership agreement provided that: (a) Interest on fixed capital to be allowed at 12% p.a. (b) Telewani to be credited with salary of 18,000 p.a. (c) On the death of any of the partners, his heir will receive in addition to balance in the fixed, capital and current account: (0) Salary and interest on capital. (ii) Share of proportionate profit from last Balance Sheet to the date of death based on annual average profits of last 3 years after interest on capital and salary to partner). (ii) Share of goodwill calculated at twice the average profits of last 3 years before interest on capital and salary to partner). (iv) Share of profit on joint assurance policy. Following further information is available: (A) Fixed capitals on 31.3.2013: Ravindra Singh 3,00,000 Sundaram 2,00,000 Telewani 1,00,000 B) Current Accounts (credit) on 31.3.2013: Ravindra Singh 50,000 Sundaram 10,000 Telewani 20,000 066 (C) Joint Life Policy 1,00,000 (D) There is no change in capital and current accounts since 31.3.2013 (E) Joint Life Policy realised 1.50,000 (on 15.6.2013 amount due to Telewani paid on receipt of policy amount) (F) Profits (before interest and salary) were: 2012-13 1,24,000 2011-12 1,20,000 2010-2011 80,000 2009-2010 1,30,000 (G) The Firm closes its books on 31st March, Ravindra Singh and Sundaram decided to continue the firm and raise goodwill. Show the following accounts in the books of the firm relating to the above transactions : (a) Current Accounts of Partners, (b) Profit & Loss Adjustment A/c, and (c) Heir of Telewani's Loan A/cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started