Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Yuting is considering buying a unit of townhome in Clearwater and renting it out for the income. The townhome will cost $ 2 2 0

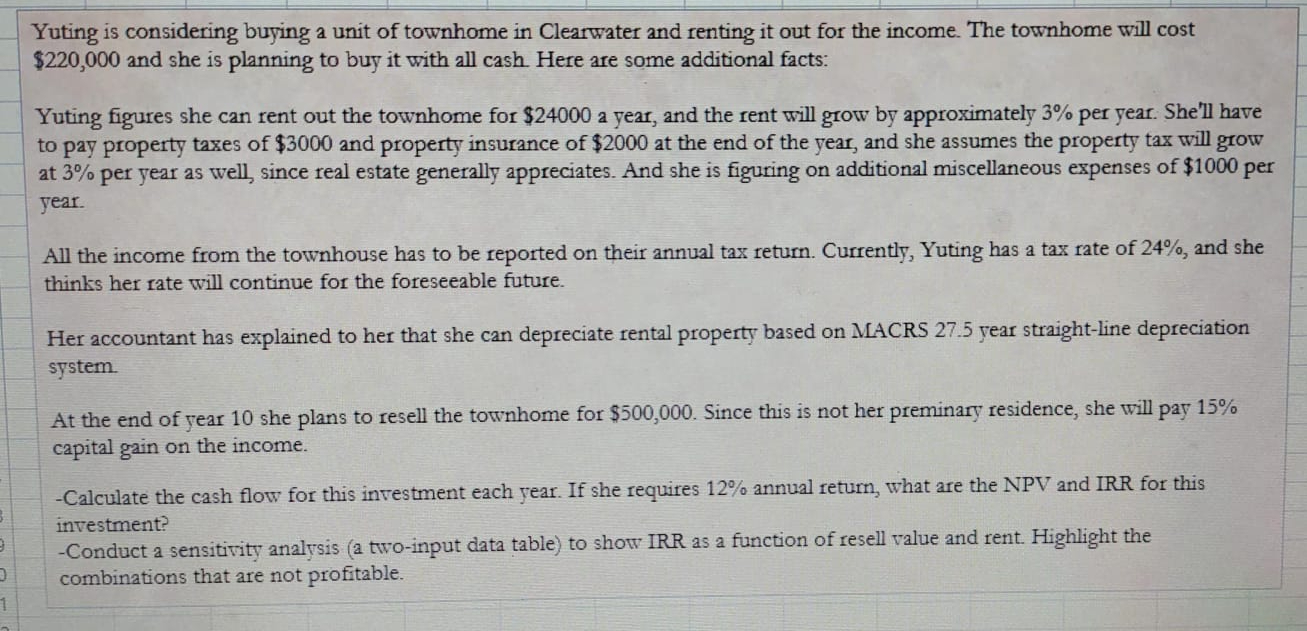

Yuting is considering buying a unit of townhome in Clearwater and renting it out for the income. The townhome will cost $ and she is planning to buy it with all cash. Here are some additional facts:

Yuting figures she can rent out the townhome for $ a year, and the rent will grow by approximately per year. She'll have to pay property taxes of $ and property insurance of $ at the end of the year, and she assumes the property tax will grow at per year as well, since real estate generally appreciates. And she is figuring on additional miscellaneous expenses of $ per year.

All the income from the townhouse has to be reported on their annual tax return. Currently, Yuting has a tax rate of and she thinks her rate will continue for the foreseeable future.

Her accountant has explained to her that she can depreciate rental property based on MACRS year straightline depreciation system.

At the end of year she plans to resell the townhome for $ Since this is not her preminary residence, she will pay capital gain on the income.

Calculate the cash flow for this investment each year. If she requires annual return, what are the NPV and IRR for this investment?

Conduct a sensitivity analysis a twoinput data table to show IRR as a function of resell value and rent. Highlight the combinations that are not profitable.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started