Answered step by step

Verified Expert Solution

Question

1 Approved Answer

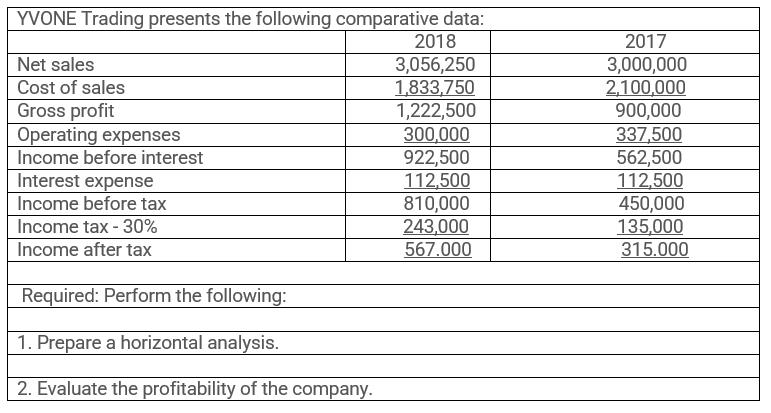

YVONE Trading presents the following comparative data: 2018 3,056,250 1,833,750 1,222,500 300,000 922,500 112,500 810,000 243,000 567.000 Net sales Cost of sales Gross profit

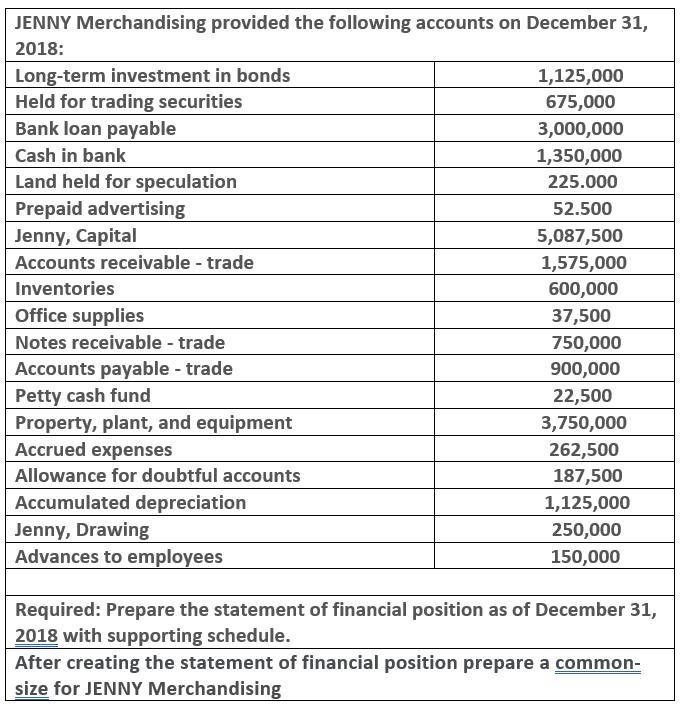

YVONE Trading presents the following comparative data: 2018 3,056,250 1,833,750 1,222,500 300,000 922,500 112,500 810,000 243,000 567.000 Net sales Cost of sales Gross profit Operating expenses Income before interest Interest expense Income before tax Income tax - 30% Income after tax Required: Perform the following: 1. Prepare a horizontal analysis. 2. Evaluate the profitability of the company. 2017 3,000,000 2,100,000 900,000 337,500 562,500 112,500 450,000 135,000 315.000 JENNY Merchandising provided the following accounts on December 31, 2018: Long-term investment in bonds Held for trading securities Bank loan payable Cash in bank Land held for speculation Prepaid advertising Jenny, Capital Accounts receivable - trade Inventories Office supplies Notes receivable - trade Accounts payable - trade Petty cash fund Property, plant, and equipment Accrued expenses Allowance for doubtful accounts Accumulated depreciation Jenny, Drawing Advances to employees 1,125,000 675,000 3,000,000 1,350,000 225.000 52.500 5,087,500 1,575,000 600,000 37,500 750,000 900,000 22,500 3,750,000 262,500 187,500 1,125,000 250,000 150,000 Required: Prepare the statement of financial position as of December 31, 2018 with supporting schedule. After creating the statement of financial position prepare a common- size for JENNY Merchandising

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Question 11 Question 12 Question 21 Answer To prep...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started