Answered step by step

Verified Expert Solution

Question

1 Approved Answer

YY Company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate

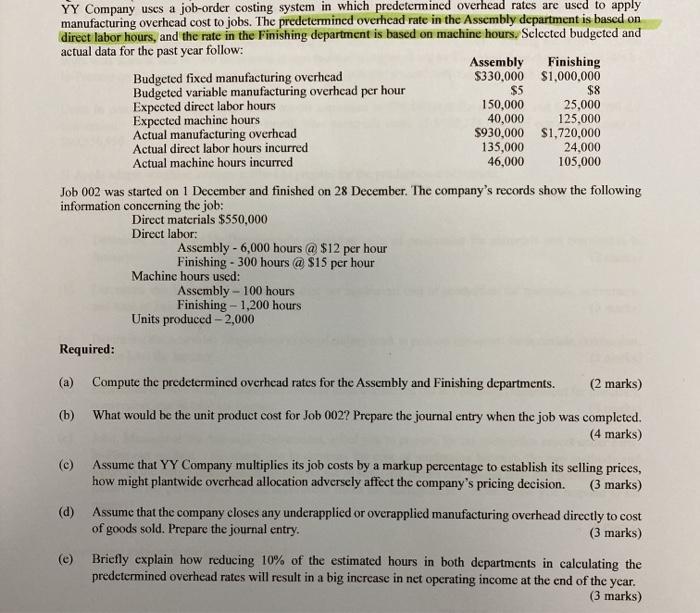

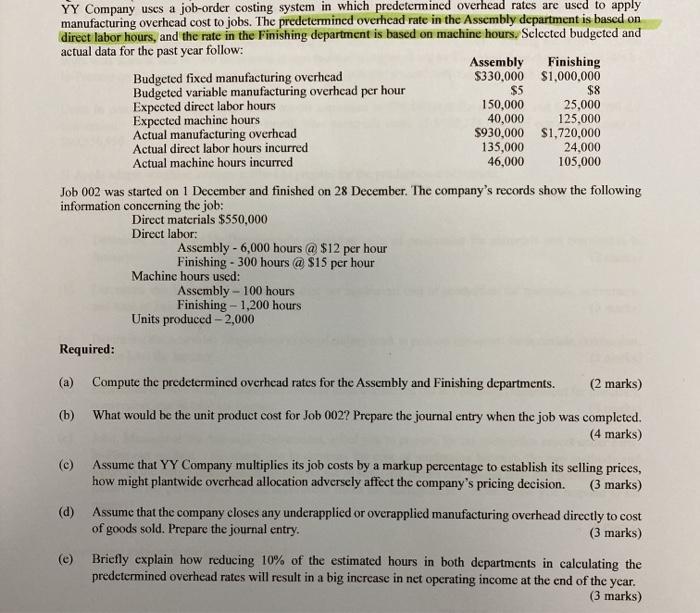

YY Company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Assembly department is based on direct labor hours, and the rate in the Finishing department is based on machine hours. Selected budgeted and actual data for the past year follow: Assembly Finishing Budgeted fixed manufacturing overhead $330.000 $1,000,000 Budgeted variable manufacturing overhead per hour $5 $8 Expected direct labor hours 150,000 25,000 Expected machine hours 40,000 125,000 Actual manufacturing overhead $930,000 $1,720,000 Actual direct labor hours incurred 135,000 24.000 Actual machine hours incurred 46,000 105,000 Job 002 was started on 1 December and finished on 28 December. The company's records show the following information concerning the job: Direct materials $550,000 Direct labor: Assembly - 6,000 hours @ $12 per hour Finishing - 300 hours @ $15 per hour Machine hours used: Assembly - 100 hours Finishing - 1,200 hours Units produced - 2,000 Required: (a) Compute the predetermined overhead rates for the Assembly and Finishing departments. (2 marks) (b) What would be the unit product cost for Job 0022 Prepare the journal entry when the job was completed. (4 marks) (c) Assume that YY Company multiplies its job costs by a markup percentage to establish its selling prices, how might plantwide overhead allocation adversely affect the company's pricing decision. (3 marks) (d) Assume that the company closes any underapplied or overapplied manufacturing overhead directly to cost of goods sold. Prepare the journal entry. (3 marks) (e) Briefly explain how reducing 10% of the estimated hours in both departments in calculating the predetermined overhead rates will result in a big increase in net operating income at the end of the year. (3 marks) YY Company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Assembly department is based on direct labor hours, and the rate in the Finishing department is based on machine hours. Selected budgeted and actual data for the past year follow: Assembly Finishing Budgeted fixed manufacturing overhead $330.000 $1,000,000 Budgeted variable manufacturing overhead per hour $5 $8 Expected direct labor hours 150,000 25,000 Expected machine hours 40,000 125,000 Actual manufacturing overhead $930,000 $1,720,000 Actual direct labor hours incurred 135,000 24.000 Actual machine hours incurred 46,000 105,000 Job 002 was started on 1 December and finished on 28 December. The company's records show the following information concerning the job: Direct materials $550,000 Direct labor: Assembly - 6,000 hours @ $12 per hour Finishing - 300 hours @ $15 per hour Machine hours used: Assembly - 100 hours Finishing - 1,200 hours Units produced - 2,000 Required: (a) Compute the predetermined overhead rates for the Assembly and Finishing departments. (2 marks) (b) What would be the unit product cost for Job 0022 Prepare the journal entry when the job was completed. (4 marks) (c) Assume that YY Company multiplies its job costs by a markup percentage to establish its selling prices, how might plantwide overhead allocation adversely affect the company's pricing decision. (3 marks) (d) Assume that the company closes any underapplied or overapplied manufacturing overhead directly to cost of goods sold. Prepare the journal entry. (3 marks) (e) Briefly explain how reducing 10% of the estimated hours in both departments in calculating the predetermined overhead rates will result in a big increase in net operating income at the end of the year

YY Company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Assembly department is based on direct labor hours, and the rate in the Finishing department is based on machine hours. Selected budgeted and actual data for the past year follow: Assembly Finishing Budgeted fixed manufacturing overhead $330.000 $1,000,000 Budgeted variable manufacturing overhead per hour $5 $8 Expected direct labor hours 150,000 25,000 Expected machine hours 40,000 125,000 Actual manufacturing overhead $930,000 $1,720,000 Actual direct labor hours incurred 135,000 24.000 Actual machine hours incurred 46,000 105,000 Job 002 was started on 1 December and finished on 28 December. The company's records show the following information concerning the job: Direct materials $550,000 Direct labor: Assembly - 6,000 hours @ $12 per hour Finishing - 300 hours @ $15 per hour Machine hours used: Assembly - 100 hours Finishing - 1,200 hours Units produced - 2,000 Required: (a) Compute the predetermined overhead rates for the Assembly and Finishing departments. (2 marks) (b) What would be the unit product cost for Job 0022 Prepare the journal entry when the job was completed. (4 marks) (c) Assume that YY Company multiplies its job costs by a markup percentage to establish its selling prices, how might plantwide overhead allocation adversely affect the company's pricing decision. (3 marks) (d) Assume that the company closes any underapplied or overapplied manufacturing overhead directly to cost of goods sold. Prepare the journal entry. (3 marks) (e) Briefly explain how reducing 10% of the estimated hours in both departments in calculating the predetermined overhead rates will result in a big increase in net operating income at the end of the year. (3 marks) YY Company uses a job-order costing system in which predetermined overhead rates are used to apply manufacturing overhead cost to jobs. The predetermined overhead rate in the Assembly department is based on direct labor hours, and the rate in the Finishing department is based on machine hours. Selected budgeted and actual data for the past year follow: Assembly Finishing Budgeted fixed manufacturing overhead $330.000 $1,000,000 Budgeted variable manufacturing overhead per hour $5 $8 Expected direct labor hours 150,000 25,000 Expected machine hours 40,000 125,000 Actual manufacturing overhead $930,000 $1,720,000 Actual direct labor hours incurred 135,000 24.000 Actual machine hours incurred 46,000 105,000 Job 002 was started on 1 December and finished on 28 December. The company's records show the following information concerning the job: Direct materials $550,000 Direct labor: Assembly - 6,000 hours @ $12 per hour Finishing - 300 hours @ $15 per hour Machine hours used: Assembly - 100 hours Finishing - 1,200 hours Units produced - 2,000 Required: (a) Compute the predetermined overhead rates for the Assembly and Finishing departments. (2 marks) (b) What would be the unit product cost for Job 0022 Prepare the journal entry when the job was completed. (4 marks) (c) Assume that YY Company multiplies its job costs by a markup percentage to establish its selling prices, how might plantwide overhead allocation adversely affect the company's pricing decision. (3 marks) (d) Assume that the company closes any underapplied or overapplied manufacturing overhead directly to cost of goods sold. Prepare the journal entry. (3 marks) (e) Briefly explain how reducing 10% of the estimated hours in both departments in calculating the predetermined overhead rates will result in a big increase in net operating income at the end of the year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started