Answered step by step

Verified Expert Solution

Question

1 Approved Answer

yy *V22 Step 1 Prepare a Bank Reconciliation Statement taking the balance as per Pass Book as the starting point. Step 2 Find out the

yy

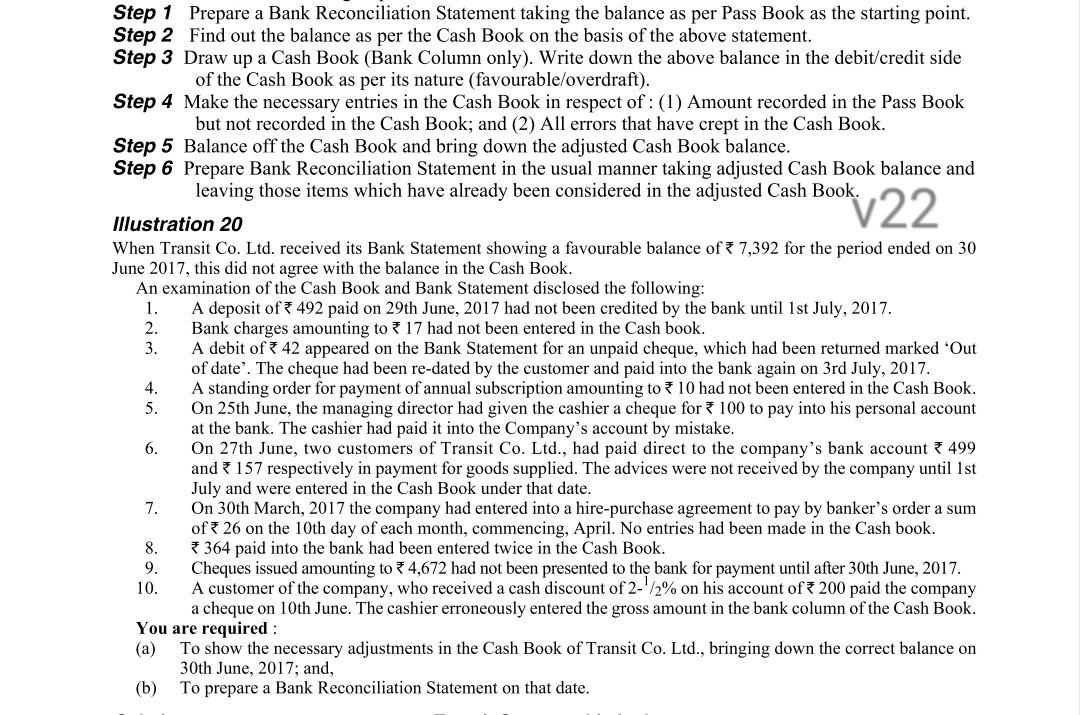

*V22 Step 1 Prepare a Bank Reconciliation Statement taking the balance as per Pass Book as the starting point. Step 2 Find out the balance as per the Cash Book on the basis of the above statement. Step 3 Draw up a Cash Book (Bank Column only). Write down the above balance in the debit/credit side of the Cash Book as per its nature (favourable/overdraft). Step 4 Make the necessary entries in the Cash Book in respect of : (1) Amount recorded in the Pass Book but not recorded in the Cash Book; and (2) All errors that have crept in the Cash Book. Step 5 Balance off the Cash Book and bring down the adjusted Cash Book balance. Step 6 Prepare Bank Reconciliation Statement in the usual manner taking adjusted Cash Book balance and leaving those items which have already been considered in the adjusted Cash Book. Illustration 20 When Transit Co. Ltd. received its Bank Statement showing a favourable balance of 37,392 for the period ended on 30 June 2017, this did not agree with the balance in the Cash Book. An examination of the Cash Book and Bank Statement disclosed the following: 1. A deposit of 492 paid on 29th June, 2017 had not been credited by the bank until 1st July, 2017. 2. Bank charges amounting to 17 had not been entered in the Cash book. 3. A debit of 42 appeared on the Bank Statement for an unpaid cheque, which had been returned marked Out of date'. The cheque had been re-dated by the customer and paid into the bank again on 3rd July, 2017. 4. A standing order for payment of annual subscription amounting to 10 had not been entered in the Cash Book. 5. On 25th June, the managing director had given the cashier a cheque for 100 to pay into his personal account at the bank. The cashier had paid it into the Company's account by mistake. 6. On 27th June, two customers of Transit Co. Ltd., had paid direct to the company's bank account * 499 and 157 respectively in payment for goods supplied. The advices were not received by the company until Ist July and were entered in the Cash Book under that date. 7. On 30th March, 2017 the company had entered into a hire-purchase agreement to pay by banker's order a sum of 26 on the 10th day of each month, commencing, April. No entries had been made in the Cash book. 8. 3 364 paid into the bank had been entered twice in the Cash Book. Cheques issued amounting to 4,672 had not been presented to the bank for payment until after 30th June, 2017 10. A customer of the company, who received a cash discount of 2-/2% on his account of 200 paid the company a cheque on 10th June. The cashier erroneously entered the gross amount in the bank column of the Cash Book. You are required: (a) To show the necessary adjustments in the Cash Book of Transit Co. Ltd., bringing down the correct balance on 30th June, 2017; and, (b) To prepare a Bank Reconciliation Statement on that date. 9Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started