Answered step by step

Verified Expert Solution

Question

1 Approved Answer

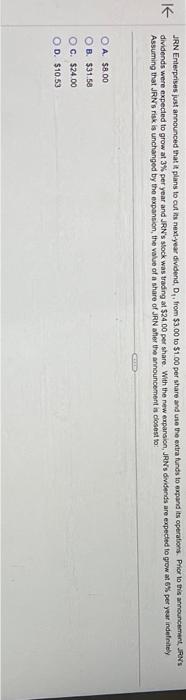

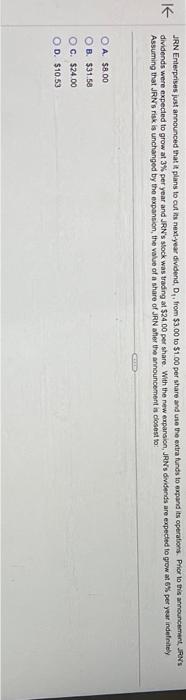

z JRN Enterprises just announced that it plans to cut is next-year dividend, D1, from $3.00 to $1.00 per share and use the extra funds

z

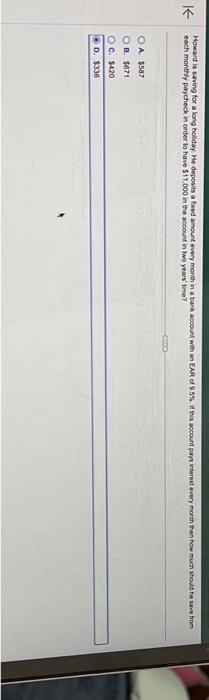

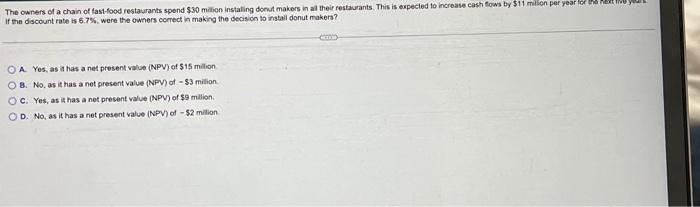

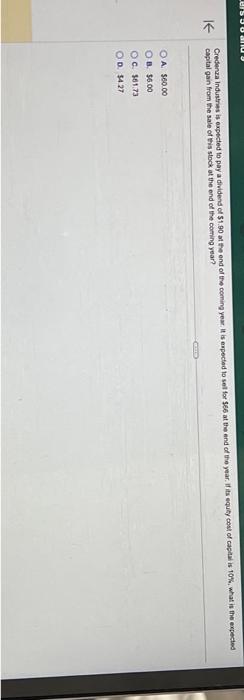

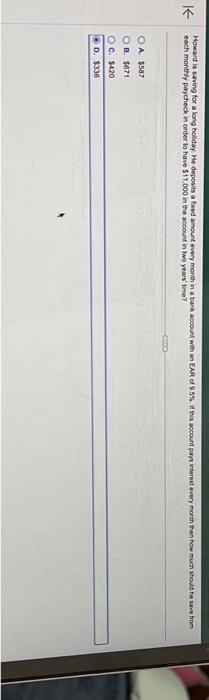

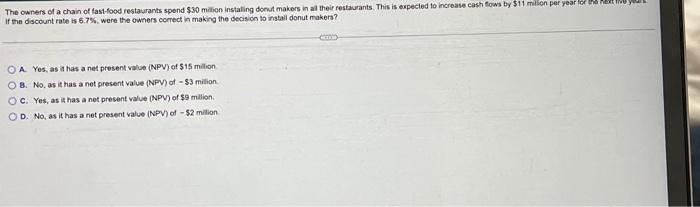

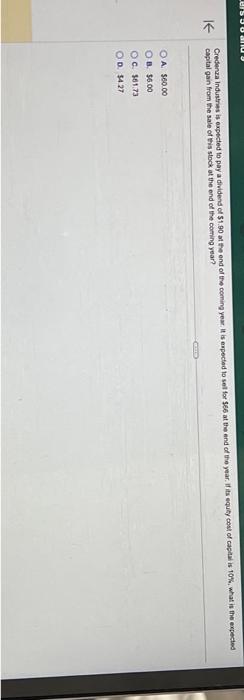

JRN Enterprises just announced that it plans to cut is next-year dividend, D1, from $3.00 to $1.00 per share and use the extra funds to expand its operations. Prior io this announcement. JPers dividends were expected to grow at 3% per year and JRN's sock was trading at $24.00 per share. With the rew expansion, JPNis dividends are expected to grow at 6$ per year indefintey Assuming that JRNs risk is unchanged by the expansion, the value of a share of JRN afher the announcement is closest to: A. $8.00 B. $31.50 C. $24.00 D. $10.53 capital gain from the sale of this stock at the end of the coming year? A. $6000 B. 56.00 C. $61.73 D. $4.27 The owners of a chain of fast-food restaurants spend $30 milion instaling donut makers in al their restaurants. This is expected to increase cash flows by $11 milion per year if the discount rate is 6.7%, were the owners correct in making the decision to install donut makers? A. Yes, as 1 has a net present value (NPV) of $15 milion. B. No, as it has a net present value (NPV) of $3 milion C. Yes, as is has a net present value (NPV) of $9 mulion. D. No, as it has a net present value (NPV) of $2 milion each monthly parcheck in order to have $11,000 in the account in two years' the? A. $587 B. $671 C. $420 D. $336

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started