.Zach is a full-time exempt employee in Hanover, New Hampshire, who earns $142,000 annually. He is single with no dependents per his 2021 Form

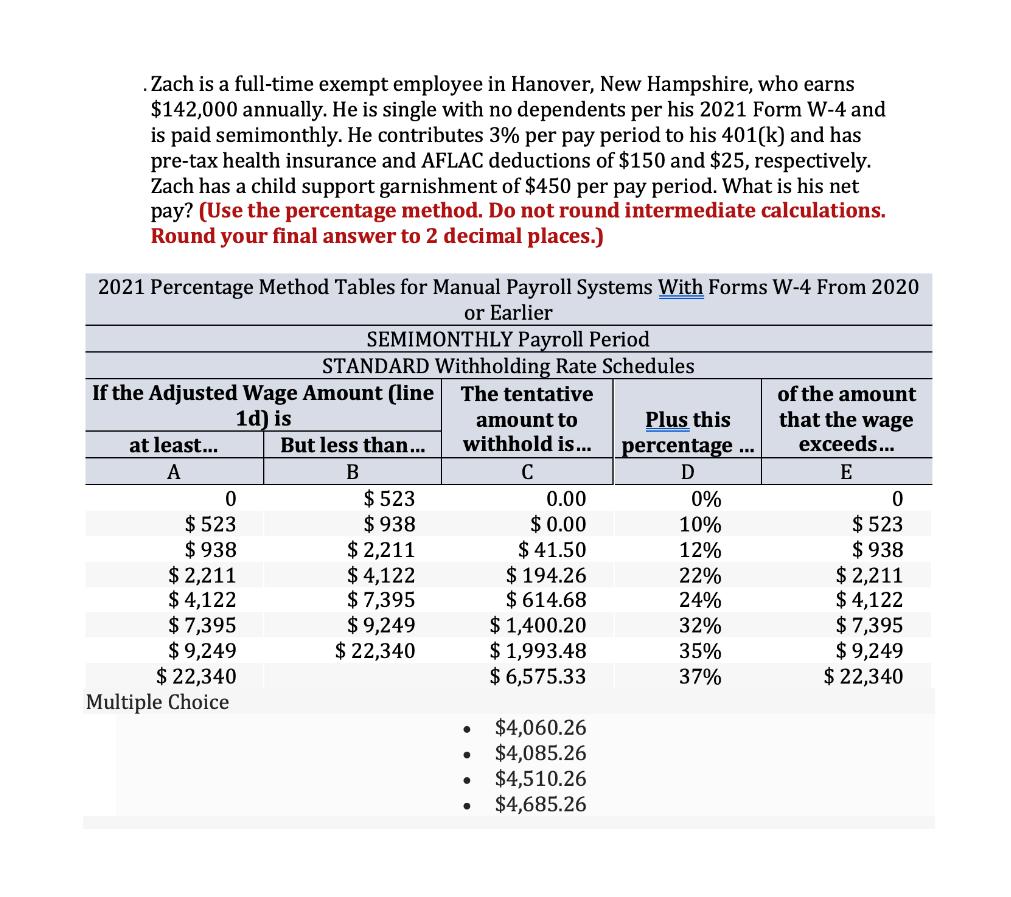

.Zach is a full-time exempt employee in Hanover, New Hampshire, who earns $142,000 annually. He is single with no dependents per his 2021 Form W-4 and is paid semimonthly. He contributes 3% per pay period to his 401(k) and has pre-tax health insurance and AFLAC deductions of $150 and $25, respectively. Zach has a child support garnishment of $450 per pay period. What is his net pay? (Use the percentage method. Do not round intermediate calculations. Round your final answer to 2 decimal places.) 2021 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Earlier If the Adjusted Wage Amount (line The tentative 1d) is at least... A 0 $523 $938 $ 2,211 $4,122 $7,395 SEMIMONTHLY Payroll Period STANDARD Withholding Rate Schedules $9,249 $ 22,340 Multiple Choice But less than... B $ 523 $938 $ 2,211 $4,122 $ 7,395 $9,249 $ 22,340 amount to withhold is... C 0.00 $ 0.00 $41.50 $194.26 $614.68 $1,400.20 $ 1,993.48 $ 6,575.33 $4,060.26 $4,085.26 $4,510.26 $4,685.26 Plus this percentage ... D 0% 10% 12% 22% 24% 32% 35% 37% of the amount that the wage exceeds... E 0 $ 523 $938 $2,211 $4,122 $7,395 $9,249 $ 22,340

Step by Step Solution

3.35 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The Answer is 406026 Calcul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started