Question

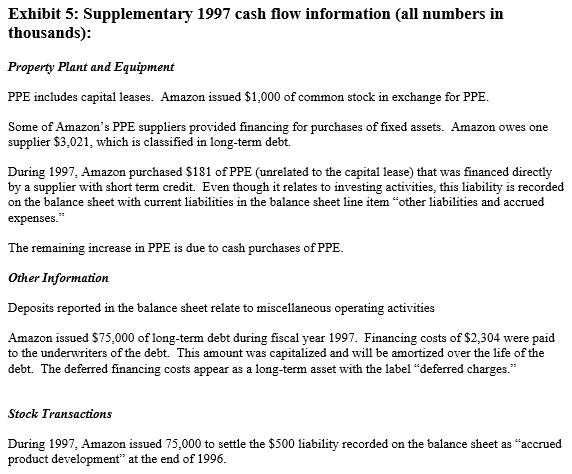

Prepare a direct-method operating section of the statement of cash flows for 1997 using the information available in the balance sheet and income statement (Exhibits

Prepare a direct-method operating section of the statement of cash flows for 1997 using the information available in the balance sheet and income statement (Exhibits 3 and 4), as well as the supplementary cash flow information (Exhibit 5). The below-attached template on the following page may be useful in answering this question. Be sure to explain your answers in summary form and list the additions/subtractions and where from the income statement and balance sheet these numbers are being pulled from for your final calculation (explain your logic).

TEMPLATE BELOW:

Income Statement | Adjustments | Cash Flow (Direct-method) | |||||

Net sales | 147,758 | +/– | = | Cash from Customers | |||

Cost of sales | –118,945 | +/– | = | Cash Paid for Inventory | |||

Marketing and sales | –38,964 | +/– | = | Cash paid for marketing | |||

Product development | –12,485 | +/– | = | Cash paid for product dev. | |||

General and administrative | –1,831 | +/– | = | Cash flow paid for G&A | |||

Interest income | 1,898 | +/– | = | Interest received | |||

Interest expense | –279 | +/– | = | Interest Paid | |||

Depr. and amort. | –3,388 | +/– | = | ||||

Amort. of compensation | –1,354 | +/– | = | ||||

Net Loss | –27,590 | CFO | |||||

(Note that the template disaggregates total “General and administrative expenses” reported in the Statement of Operations into three categories: (i) General and administrative, (ii) Depreciation and amortization, and (iii) Amortization of compensation)

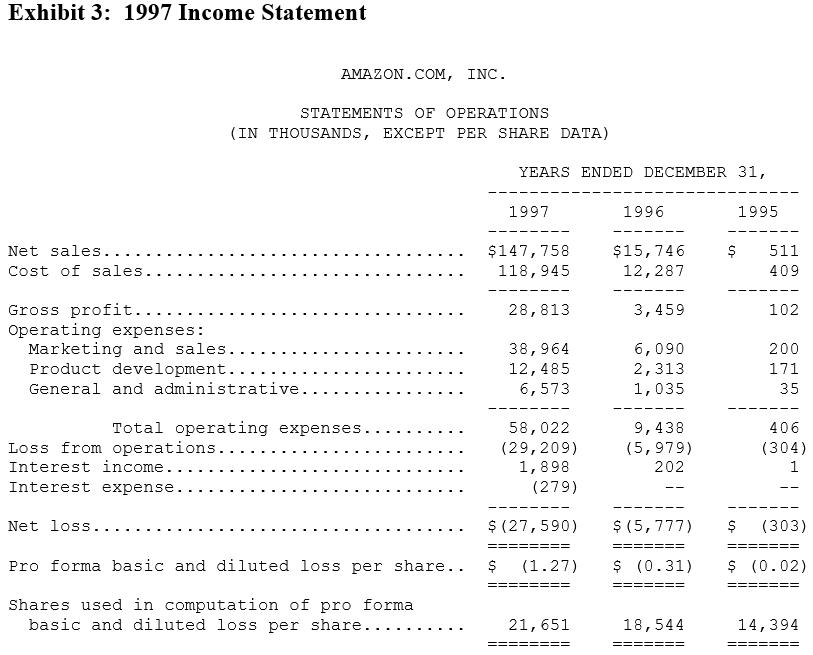

Exhibit 3: 1997 Income Statement Net sales... Cost of sales.. Gross profit..... Operating expenses: Marketing and sales.. Product development... General and administrative. STATEMENTS OF OPERATIONS (IN THOUSANDS, EXCEPT PER SHARE DATA) AMAZON.COM, INC. Total operating expenses. Loss from operations.. Interest income... Interest expense. Net loss.... Pro forma basic and diluted loss per share.. Shares used in computation of pro forma basic and diluted loss per share.... YEARS ENDED DECEMBER 31, 1997 L $147,758 118,945 28,813 38,964 12,485 6,573 58,022 (29,209) 1,898 (279) $ (27,590) === ===== $ (1.27) 21, 651 1996 $15,746 12,287 3,459 6,090 2,313 1,035 9,438 (5,979) 202 -- == $ 18,544 1995 511 409 102 200 171 35 = $ (5,777) $ (303) == ===== $ (0.31) 406 (304) 1 ======= $ (0.02) ==== 14,394

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Description Cash Sales Cash Paid to Suppliers Cash Paid for Marketing and Sales Cash Paid for Pr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started