Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zachary Corporation produces products that it sells for $21 each. Variable costs per unit are $8, and annual fixed costs are $266,500. Zachary desires

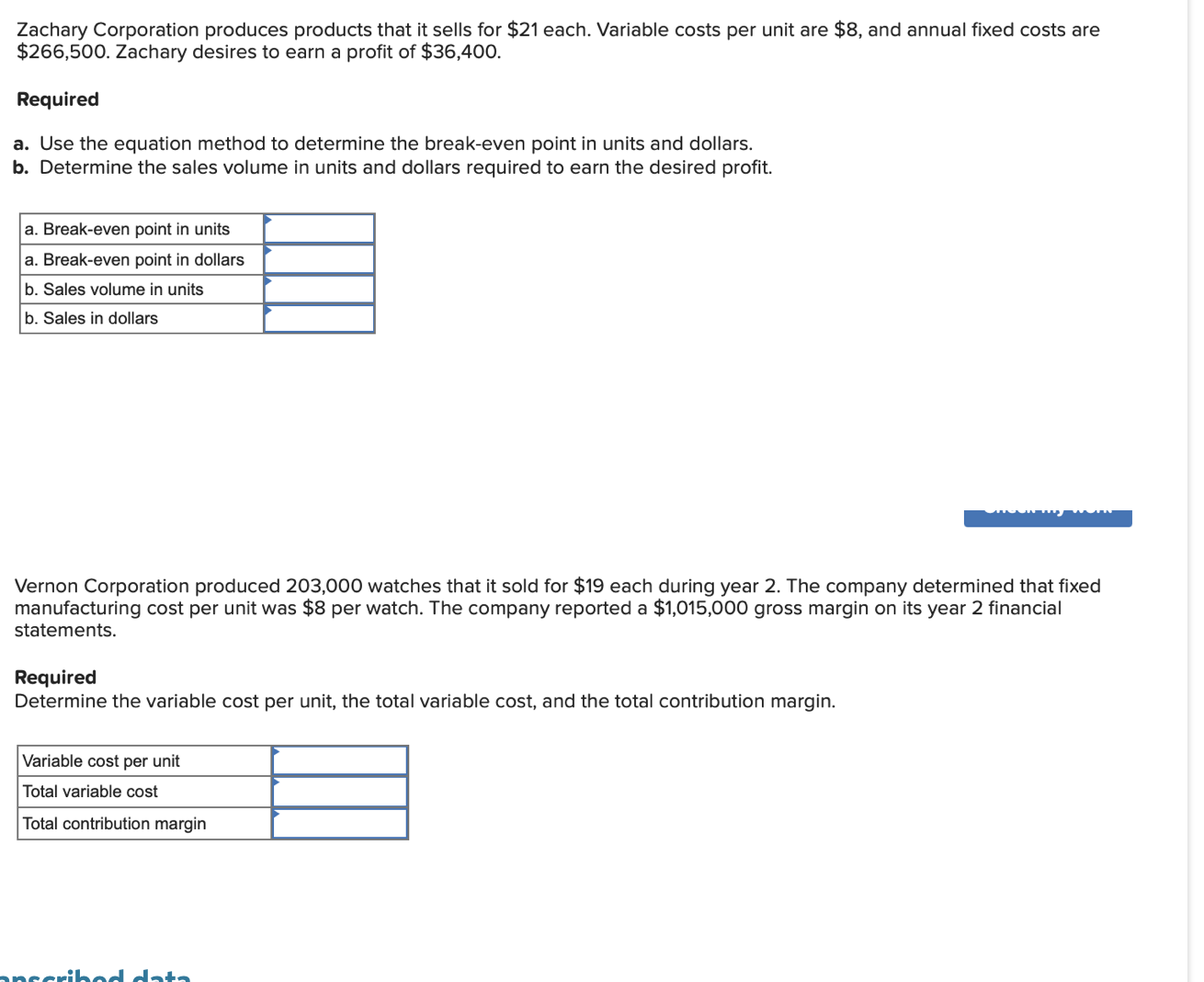

Zachary Corporation produces products that it sells for $21 each. Variable costs per unit are $8, and annual fixed costs are $266,500. Zachary desires to earn a profit of $36,400. Required a. Use the equation method to determine the break-even point in units and dollars. b. Determine the sales volume in units and dollars required to earn the desired profit. a. Break-even point in units a. Break-even point in dollars b. Sales volume in units b. Sales in dollars Vernon Corporation produced 203,000 watches that it sold for $19 each during year 2. The company determined that fixed manufacturing cost per unit was $8 per watch. The company reported a $1,015,000 gross margin on its year 2 financial statements. Required Determine the variable cost per unit, the total variable cost, and the total contribution margin. Variable cost per unit Total variable cost Total contribution margin anscribod data

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate the breakeven point and the sales volume required to earn the desired profit for Zachary ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started