Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ZAG Ltd. borrowed $380,000 from its bank on January 1, 20X1. The loan requires fixed annual payments (includes both interest at 5% and principal)

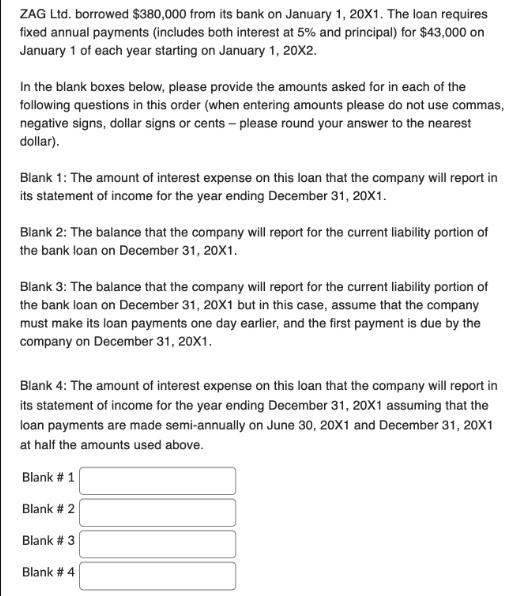

ZAG Ltd. borrowed $380,000 from its bank on January 1, 20X1. The loan requires fixed annual payments (includes both interest at 5% and principal) for $43,000 on January 1 of each year starting on January 1, 20X2. In the blank boxes below, please provide the amounts asked for in each of the following questions in this order (when entering amounts please do not use commas, negative signs, dollar signs or cents - please round your answer to the nearest dollar). Blank 1: The amount of interest expense on this loan that the company will report in its statement of income for the year ending December 31, 20X1. Blank 2: The balance that the company will report for the current liability portion of the bank loan on December 31, 20X1. Blank 3: The balance that the company will report for the current liability portion of the bank loan on December 31, 20X1 but in this case, assume that the company must make its loan payments one day earlier, and the first payment is due by the company on December 31, 20X1. Blank 4: The amount of interest expense on this loan that the company will report in its statement of income for the year ending December 31, 20X1 assuming that the loan payments are made semi-annually on June 30, 20X1 and December 31, 20X1 at half the amounts used above. Blank # 1 Blank # 2 Blank # 3 Blank # 4

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Lets break down each of the blanks one by one Blank 1 The amount of interest expense on this loan that the company will report in its statement of inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started