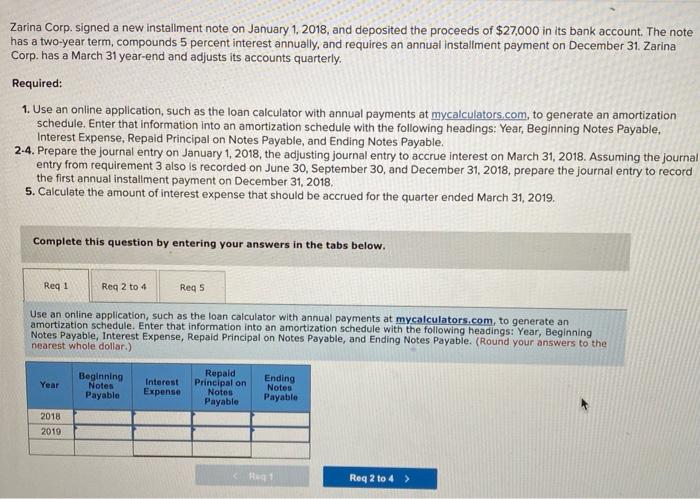

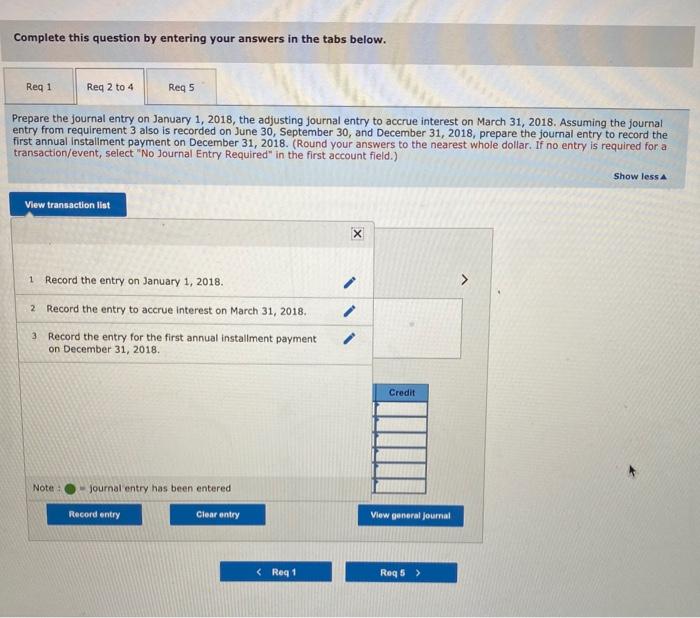

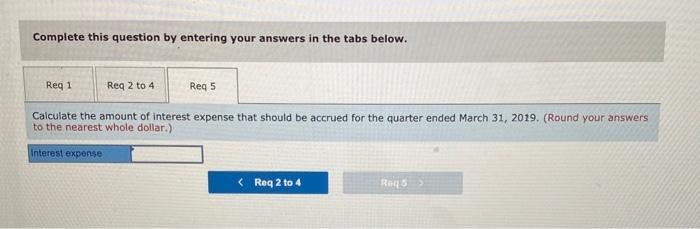

Zarina Corp. signed a new installment note on January 1, 2018, and deposited the proceeds of $27,000 in its bank account. The note has a two-year term, compounds 5 percent interest annually, and requires an annual installment payment on December 31. Zarina Corp. has a March 31 year-end and adjusts its accounts quarterly Required: 1. Use an online application, such as the loan calculator with annual payments at mycalculators.com, to generate an amortization schedule. Enter that information into an amortization schedule with the following headings: Year, Beginning Notes Payable. Interest Expense, Repaid Principal on Notes Payable, and Ending Notes Payable. 2.4. Prepare the journal entry on January 1, 2018, the adjusting journal entry to accrue interest on March 31, 2018. Assuming the journal entry from requirement 3 also is recorded on June 30, September 30, and December 31, 2018, prepare the journal entry to record the first annual installment payment on December 31, 2018 5. Calculate the amount of interest expense that should be accrued for the quarter ended March 31, 2019. Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Reg 5 Use an online application, such as the loan calculator with annual payments at mycalculators.com, to generate an amortization schedule. Enter that information into an amortization schedule with the following headings: Year, Beginning Notes Payable, Interest Expense, Repaid Principal on Notes Payable, and Ending Notes Payable. (Round your answers to the nearest whole dollar.) Year Beginning Notes Payable Interest Expense Repaid Principal on Notes Payable Ending Notes Payable 2018 2019 Req 2 to 4 > Complete this question by entering your answers in the tabs below. Req 1 Reg 2 to 4 Reg 5 Prepare the journal entry on January 1, 2018, the adjusting journal entry to accrue interest on March 31, 2018. Assuming the journal entry from requirement 3 also is recorded on June 30, September 30, and December 31, 2018, prepare the journal entry to record the first annual installment payment on December 31, 2018. (Round your answers to the nearest whole dollar. If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Show less View transaction list 1 Record the entry on January 1, 2018. 1 1 2 Record the entry to accrue Interest on March 31, 2018 3. Record the entry for the first annual installment payment on December 31, 2018. Credit Note Journal entry has been entered Record entry Clear entry View general Journal Complete this question by entering your answers in the tabs below. Reg 1 Reg 2 to 4 Req 5 Calculate the amount of interest expense that should be accrued for the quarter ended March 31, 2019. (Round your answers to the nearest whole dollar.) Interest expense