Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zayn & Seri Enterprise (ZSE) has been very successful in condiments and spices business. Products include range of condiments or food seasoning such as soy

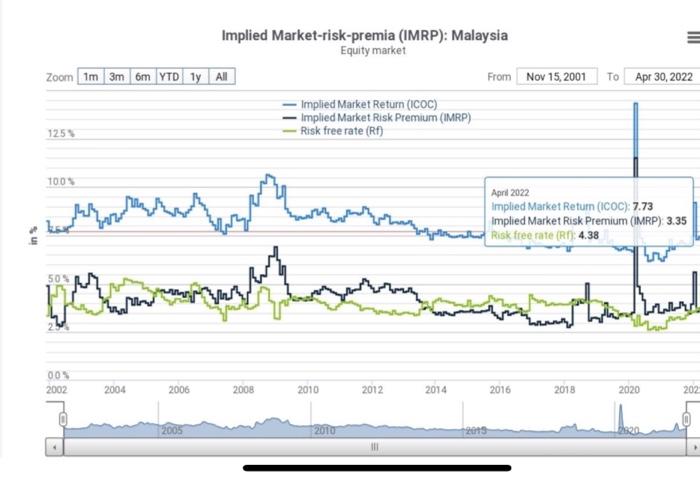

Zayn & Seri Enterprise (ZSE) has been very successful in condiments and spices business. Products include range of condiments or food seasoning such as soy sauce and range of spices such as cumin etc. Spices make up for 70 percent of ZSE revenues. Presently, all spices and condiments raw materials were sourced from the local producers. Problems faced by ZSE are ups and downs of raw materials costs as well as quality control. To ensure the sustainability of ZSE business in the future, Mr. Zainul, the company CEO has presented to the board on the latest investment plan to produce high quality range of condiments and spices. Plan inclusive of investment in new machines to process the imported high quality materials and to purchase few hectares of land. Later investment is to cultivate plant for spices and condiments production and to facilitate bio-related food research. Mr. Zainul has convinced the board members that competitive advantage of this industry is through the product development and quality of the product. Total investment estimated at half a billion Malaysia ringgit. For the financial year 2021, earnings stood at RM220 million, total debt amounted to RM 404.32 million and net working capital stood at 45 million. As ZYE is not yet public, a market-based cost of capital must be estimated based on business of similar risk (pure play approach). A possible match is Dewi Spice Co. with beta of 1.3. Analyst predicting revenue growth of around 7 to 8 percent for the next 10 years and then tempering down to a constant growth rate of 4 percent. Credit spreads of Malaysian corporate bonds of similar rating and maturity to ZYE is 162 basis points.

Mr. Zainul and management team has presented to the board to raise capital through initial public offering. IPO process starts when ZYE file the registration statement with Security Commission, followed by preliminary offering prospectus or red herring, tombstone and disclosure of all ZYE information to public through prospectus. Total new number of shares to be sold in the offering is 370 million, which would grow the total number of shares outstanding from 530 to 900 million.

Investment Bank has presented the following key assumptions for 10 years period for valuation of ZYE:

Sales: 8 percent for each of the first 5 first years and 7.5 percent for each of the later years COGS/Sales: 65 percent for each of the first 5 years and 50 percent for each of the later years

SG&A/Sales: 23 percent for each of the first 5 years and 20 percent for each of the later years

Current Assets/Sales: 40 percent per year Current liabilities/Sales: 15 percent per year Taxes: 24 percent

Based on the information provided, answer the following questions:

don't explain to me just answer the question

Question 1

Assume target capital structure of ZYE is 25 percent debt and 75 percent equity, estimate ZYEs cost of capital.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started