Answered step by step

Verified Expert Solution

Question

1 Approved Answer

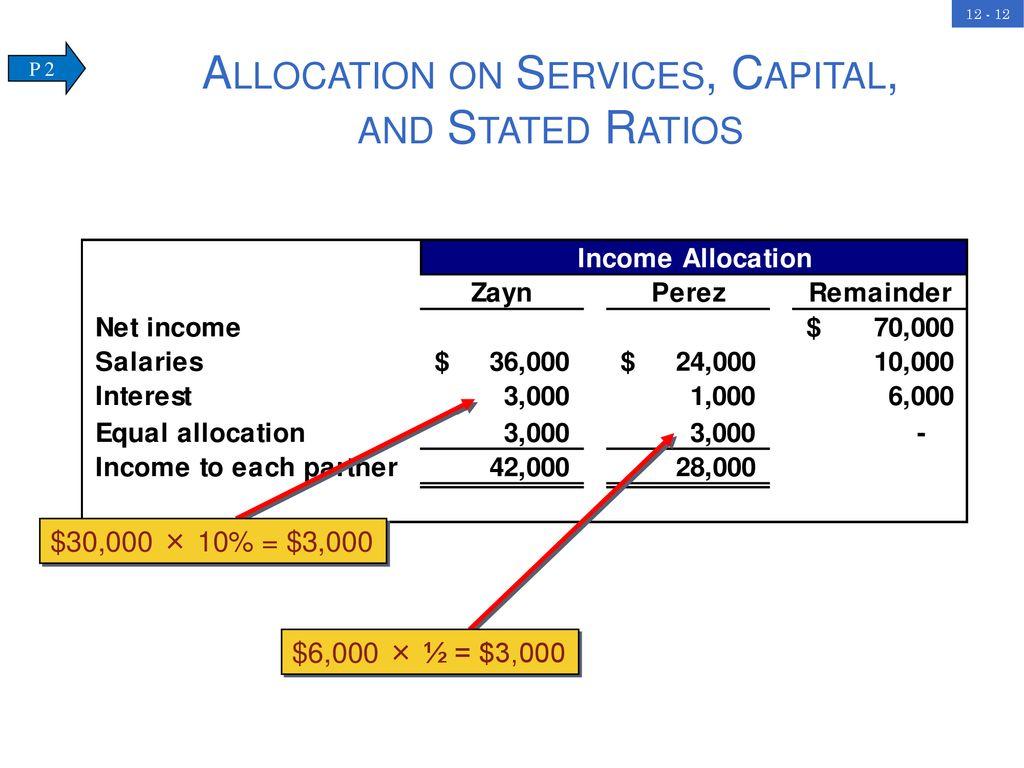

Zaync receives a $36,000 annual salary and allowance and Perez receives an allowance of $24,000. Each partner is allowed an annual interest allowance of 10%

Zaync receives a $36,000 annual salary and allowance and Perez receives an allowance of $24,000.

Each partner is allowed an annual interest allowance of 10% on their beginning capital balance.

Any remaining balance of income and loss is allocated equally.

Net income 70,000

How do they get the 6000 and 30000 10% and 1/2?

Can you explain I felt confused about this problem?

P2 ALLOCATION ON SERVICES, CAPITAL, AND STATED RATIOS Net income Salaries Interest Equal allocation Income to each partner $30,000 10% = $3,000 $ Zayn 36,000 3,000 3,000 42,000 $6,000 x 12 = $3,000 Income Allocation Perez 24,000 1,000 3,000 28,000 Remainder 70,000 10,000 6,000 12-12

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To allocate the income the following steps are taken The salaries and allowances are deduct...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started