Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zboy Corp is liquidating. Upon liquidation, it will distribute the assets to its two shareholders, Lee (40% shareholder) and Kelly (60% shareholder). The assets

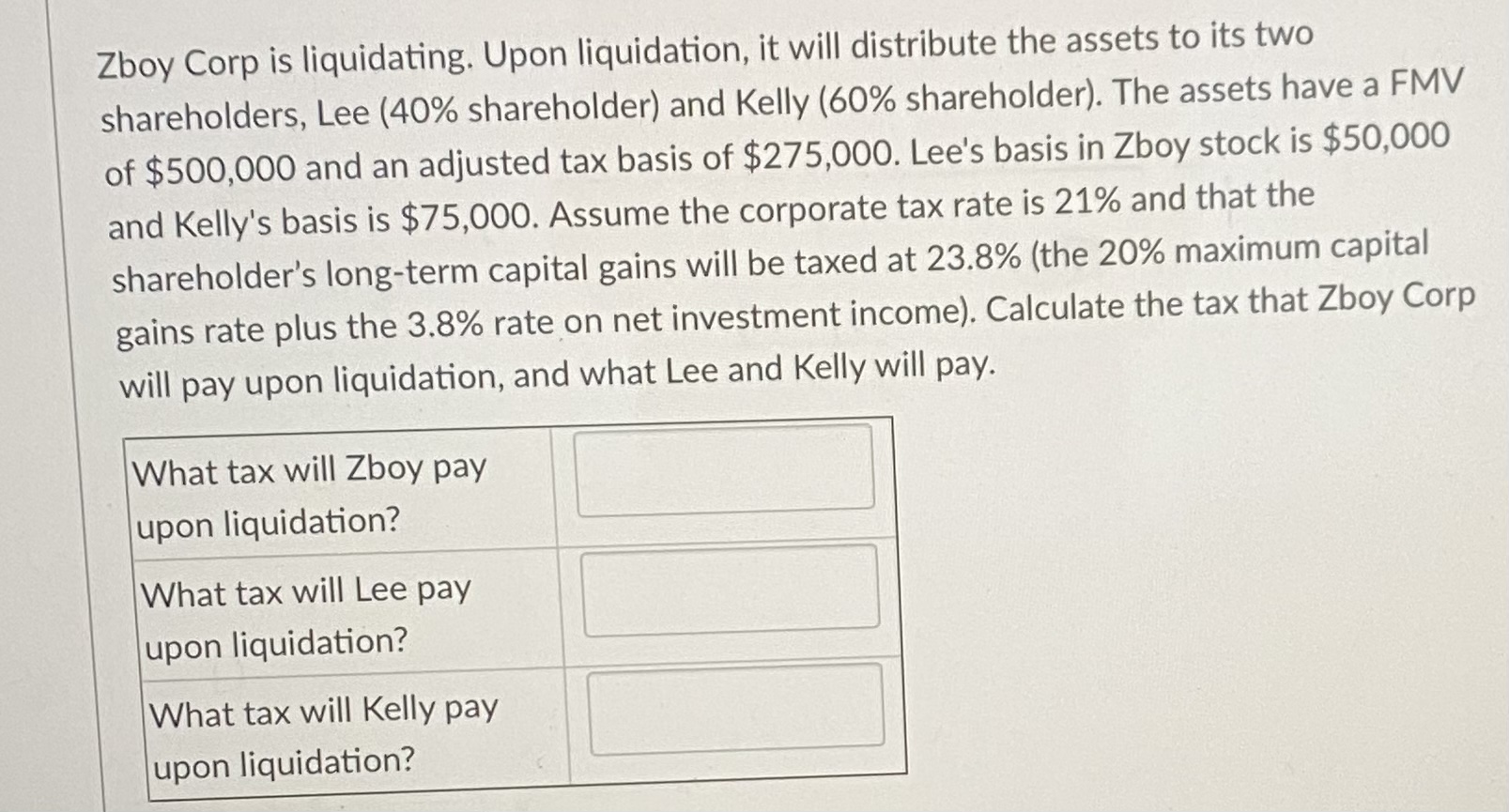

Zboy Corp is liquidating. Upon liquidation, it will distribute the assets to its two shareholders, Lee (40% shareholder) and Kelly (60% shareholder). The assets have a FMV of $500,000 and an adjusted tax basis of $275,000. Lee's basis in Zboy stock is $50,000 and Kelly's basis is $75,000. Assume the corporate tax rate is 21% and that the shareholder's long-term capital gains will be taxed at 23.8% (the 20% maximum capital gains rate plus the 3.8% rate on net investment income). Calculate the tax that Zboy Corp will pay upon liquidation, and what Lee and Kelly will pay. What tax will Zboy pay upon liquidation? What tax will Lee pay upon liquidation? What tax will Kelly pay upon liquidation?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the taxes that Zboy Corp Lee and Kelly will pay upon liquidation we need to consider th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started