Answered step by step

Verified Expert Solution

Question

1 Approved Answer

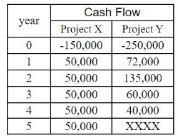

Zeal Ltd is studying two investment options X and Y, with expected future cash flows as shown below: What is discounted payback period of Project

Zeal Ltd is studying two investment options X and Y, with expected future cash flows as shown below:

- What is discounted payback period of Project X. The opportunity cost of capital 13% for project X

- What is discounted payback period of Project Y. The opportunity cost of capital 9% for project Y

- What is net present value of Project X. The opportunity cost of capital 13% for project X

- What is net present value of Project Y. The opportunity cost of capital 9% for project Y.

- What is internal rate of return of Project X. The opportunity cost of capital 13% for project X.

- What is internal rate of return of Project Y. The opportunity cost of capital 13% for project X.

- Which project(s) should be accepted if The projects are mutually exclusive and there is no capital constraint. Your answer would only be "X" or "Y"

- Which project(s) should be accepted if The projects are independent and there is no capital constraint? Your answer should be one of these "Both" , "One", "None"

- Which project(s) should be accepted if The projects are independent and there is a total of Rs. 300,000 of financing for capital outlays in the coming period. Your answer would only be "X" or "Y".

- What is payback period of Project Y. The opportunity cost of capital 9% for project Y

*Note: please answer all the questions and you may use excel or financial calculators just need the answer not the methods or calculations

year 0 1 2 3 4 S Cash Flow Project X Project Y - 150.000 -250,000 50.000 72,000 50.000 135.000 50.000 60,000 50,000 40,000 50,000 XXXXStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started