Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zechariah Company provides an incentive compensation plan under which its president received a bonus equal to 10% of the corporation's income before income tax

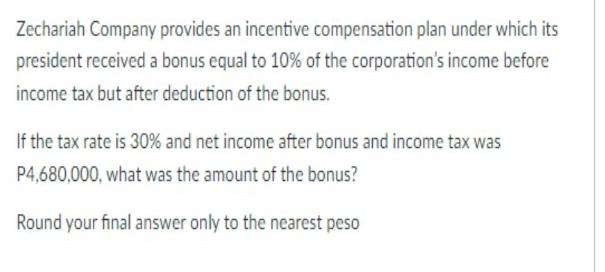

Zechariah Company provides an incentive compensation plan under which its president received a bonus equal to 10% of the corporation's income before income tax but after deduction of the bonus. If the tax rate is 30% and net income after bonus and income tax was P4,680,000, what was the amount of the bonus? Round your final answer only to the nearest peso

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To find the amount of the bonus we can set up the equation as follows Let x be the bonus The presi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started