Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except

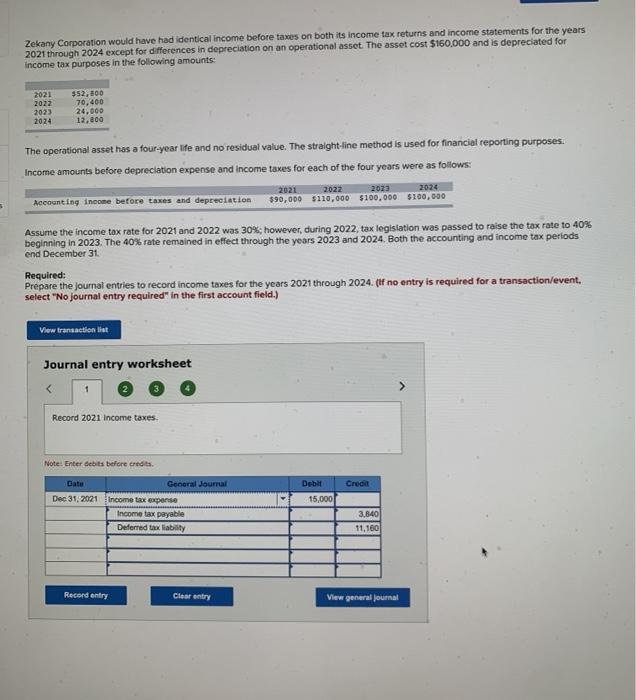

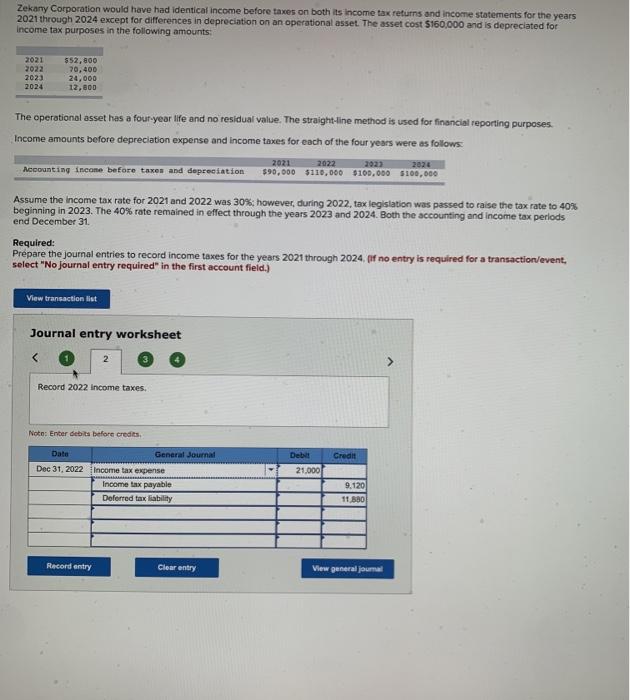

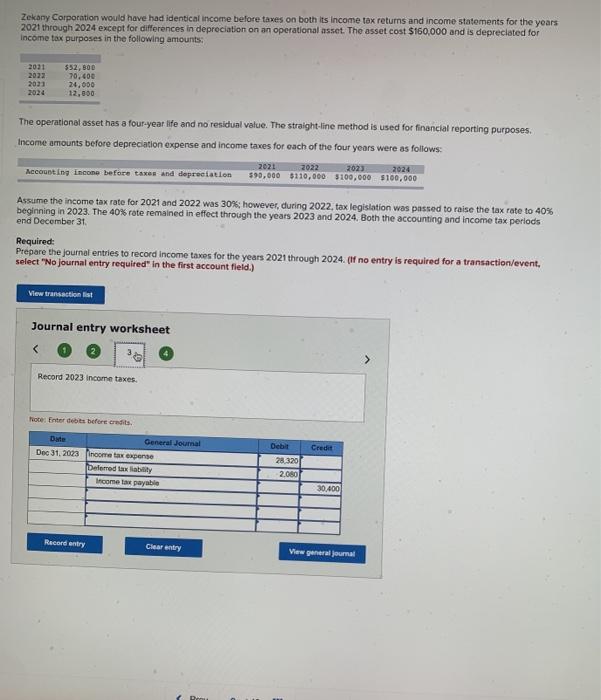

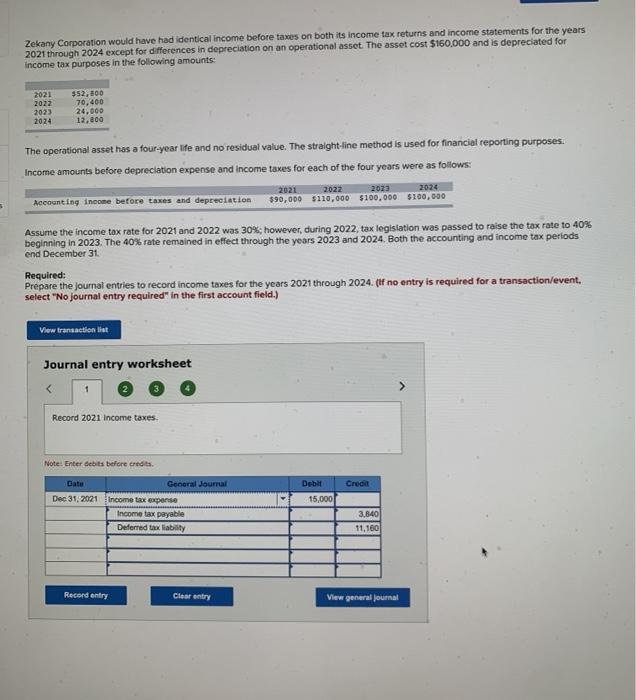

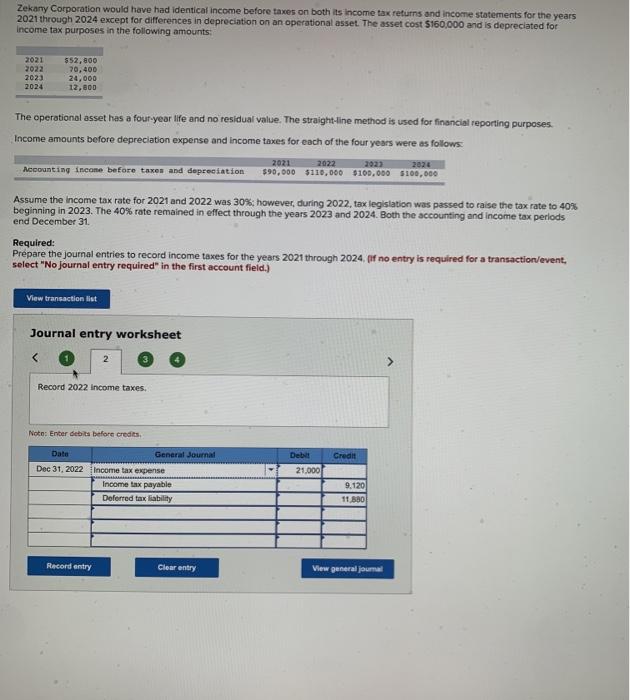

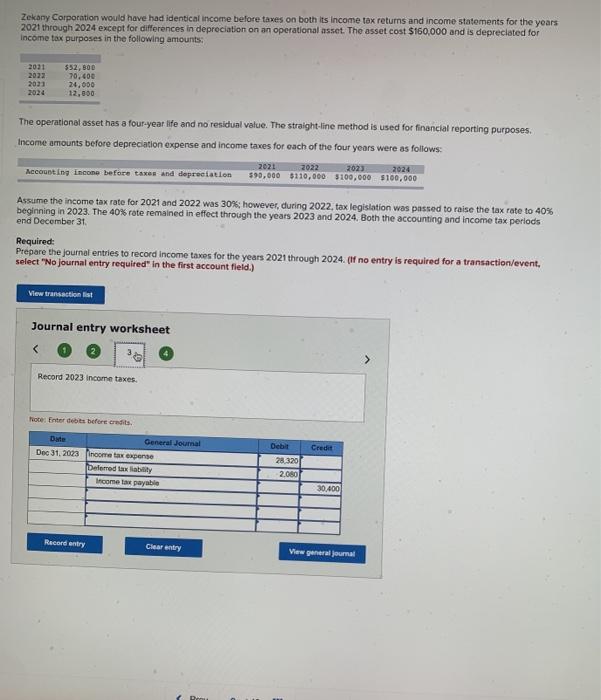

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for income tax purposes in the following amounts: 2021 2022 2023 2024 $52, 100 70,400 24.000 12,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 2024 390,000 $110,000 $100,000 $100,000 Accounting income before taxes and depreciation Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 Record 2021 Income taxes. Note: Enter debits before credits Credit Debit 15,000 Bate General Journal Dec 31, 2021 Income tax expense Income tax payable Deferred tax liability 3,840 11,160 Record entry Clear entry View general Journal Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for Income tax purposes in the following amounts: 2021 2022 2023 2024 $52,800 70, 400 24,000 12,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 Accounting income before taxes and depreciation $90,000 $110,000 $100,000 $100,000 Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction ist Journal entry worksheet 2 > Record 2022 income taxes, Note: Enter debits before credits Debil Credit Date Dec 31, 2022 21.000 General Journal Income tax expense Income tax payable Deferred tax liability 9.120 11.580 Record entry Clear entry View general journal Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for Income tax purposes in the following amounts: 2031 2022 2021 552,800 70.400 24,000 12,000 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: Accounting incone before taxes and depreciation 2021 2022 2024 $90,000 $110,000 $100,000 $100,000 Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (1 no entry is required for a transaction/event. select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record 2023 income taxes Note: Enter debits before credits Debit Cred General Journal Dec 31, 2023 Income tax expense Delmed tax ability Income tax payable 28 320 2.050 30,400 Record entry Clear entry View general journal

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for income tax purposes in the following amounts: 2021 2022 2023 2024 $52, 100 70,400 24.000 12,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 2024 390,000 $110,000 $100,000 $100,000 Accounting income before taxes and depreciation Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet 1 Record 2021 Income taxes. Note: Enter debits before credits Credit Debit 15,000 Bate General Journal Dec 31, 2021 Income tax expense Income tax payable Deferred tax liability 3,840 11,160 Record entry Clear entry View general Journal Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for Income tax purposes in the following amounts: 2021 2022 2023 2024 $52,800 70, 400 24,000 12,800 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: 2021 2022 2023 Accounting income before taxes and depreciation $90,000 $110,000 $100,000 $100,000 Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction ist Journal entry worksheet 2 > Record 2022 income taxes, Note: Enter debits before credits Debil Credit Date Dec 31, 2022 21.000 General Journal Income tax expense Income tax payable Deferred tax liability 9.120 11.580 Record entry Clear entry View general journal Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2021 through 2024 except for differences in depreciation on an operational asset. The asset cost $160,000 and is depreciated for Income tax purposes in the following amounts: 2031 2022 2021 552,800 70.400 24,000 12,000 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows: Accounting incone before taxes and depreciation 2021 2022 2024 $90,000 $110,000 $100,000 $100,000 Assume the income tax rate for 2021 and 2022 was 30%; however, during 2022, tax legislation was passed to raise the tax rate to 40% beginning in 2023. The 40% rate remained in effect through the years 2023 and 2024. Both the accounting and income tax periods end December 31 Required: Prepare the journal entries to record income taxes for the years 2021 through 2024. (1 no entry is required for a transaction/event. select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record 2023 income taxes Note: Enter debits before credits Debit Cred General Journal Dec 31, 2023 Income tax expense Delmed tax ability Income tax payable 28 320 2.050 30,400 Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started