Question

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2016 through 2019 except

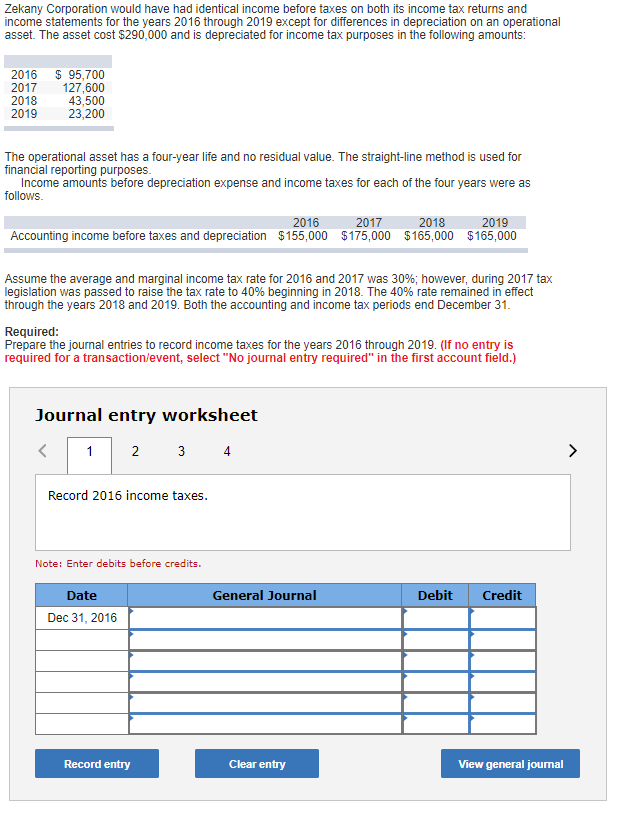

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2016 through 2019 except for differences in depreciation on an operational asset. The asset cost $290,000 and is depreciated for income tax purposes in the following amounts: 2016 $ 95,700 2017 127,600 2018 43,500 2019 23,200 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows. 2016 2017 2018 2019 Accounting income before taxes and depreciation $ 155,000 $ 175,000 $ 165,000 $ 165,000 Assume the average and marginal income tax rate for 2016 and 2017 was 30%; however, during 2017 tax legislation was passed to raise the tax rate to 40% beginning in 2018. The 40% rate remained in effect through the years 2018 and 2019. Both the accounting and income tax periods end December 31. Required: Prepare the journal entries to record income taxes for the years 2016 through 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Zekany Corporation would have had identical income before taxes on both its income tax returns and income statements for the years 2016 through 2019 except for differences in depreciation on an operational asset. The asset cost $290,000 and is depreciated for income tax purposes in the following amounts: 2016 $ 95,700 2017 127,600 2018 43,500 2019 23,200 The operational asset has a four-year life and no residual value. The straight-line method is used for financial reporting purposes. Income amounts before depreciation expense and income taxes for each of the four years were as follows. 2016 2017 2018 2019 Accounting income before taxes and depreciation $ 155,000 $ 175,000 $ 165,000 $ 165,000 Assume the average and marginal income tax rate for 2016 and 2017 was 30%; however, during 2017 tax legislation was passed to raise the tax rate to 40% beginning in 2018. The 40% rate remained in effect through the years 2018 and 2019. Both the accounting and income tax periods end December 31. Required: Prepare the journal entries to record income taxes for the years 2016 through 2019. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started