Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zena Cosmetics is considering investing in a new type of equipment that would allow the company to produce bing cherry lip gloss, which would be

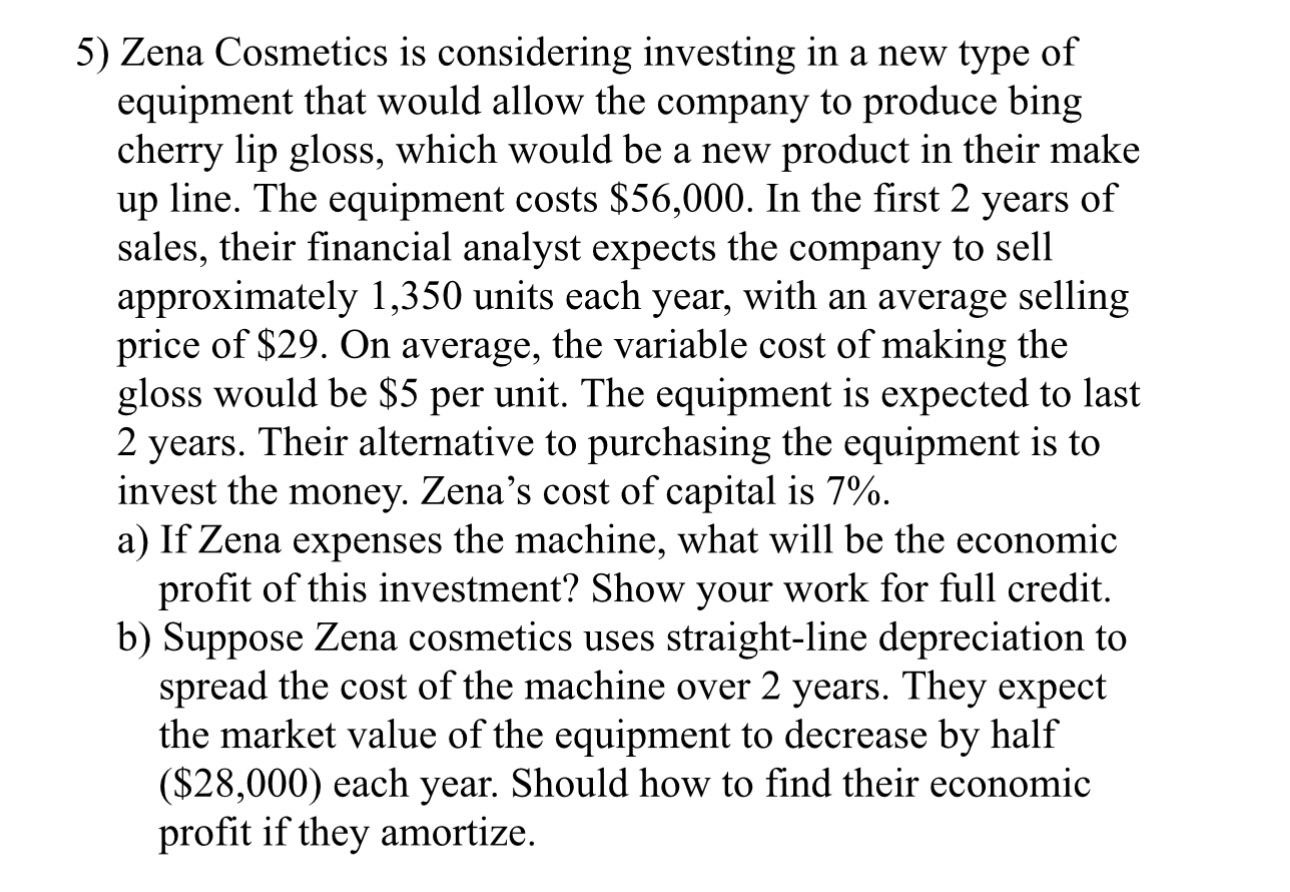

Zena Cosmetics is considering investing in a new type of

equipment that would allow the company to produce bing

cherry lip gloss, which would be a new product in their make

up line. The equipment costs $ In the first years of

sales, their financial analyst expects the company to sell

approximately units each year, with an average selling

price of $ On average, the variable cost of making the

gloss would be $ per unit. The equipment is expected to last

years. Their alternative to purchasing the equipment is to

invest the money. Zena's cost of capital is

a If Zena expenses the machine, what will be the economic

profit of this investment? Show your work for full credit.

b Suppose Zena cosmetics uses straightline depreciation to

spread the cost of the machine over years. They expect

the market value of the equipment to decrease by half

$ each year. Should how to find their economic

profit if they amortize.Zena Cosmetics is considering investing in a new type of

equipment that would allow the company to produce bing

cherry lip gloss, which would be a new product in their make

up line. The equipment costs $ In the first years of

sales, their financial analyst expects the company to sell

approximately units each year, with an average selling

price of $ On average, the variable cost of making the

gloss would be $ per unit. The equipment is expected to last

years. Their alternative to purchasing the equipment is to

invest the money. Zena's cost of capital is

a If Zena expenses the machine, what will be the economic

profit of this investment? Show your work for full credit.

b Suppose Zena cosmetics uses straightline depreciation to

spread the cost of the machine over years. They expect

the market value of the equipment to decrease by half

$ each year. Should how to find their economic

profit if they amortize.Zena Cosmetics is considering investing in a new type of

equipment that would allow the company to produce bing

cherry lip gloss, which would be a new product in their make

up line. The equipment costs $ In the first years of

sales, their financial analyst expects the company to sell

approximately units each year, with an average selling

price of $ On average, the variable cost of making the

gloss would be $ per unit. The equipment is expected to last

years. Their alternative to purchasing the equipment is to

invest the money. Zena's cost of capital is

a If Zena expenses the machine, what will be the economic

profit of this investment? Show your work for full credit.

b Suppose Zena cosmetics uses straightline depreciation to

spread the cost of the machine over years. They expect

the market value of the equipment to decrease by half

$ each year. Should how to find their economic

profit if they amortize.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started