Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zermatt Holdings Ltd (ZHL) is a public company and was established on the 1st July 20X1 The company decided to go to the public for

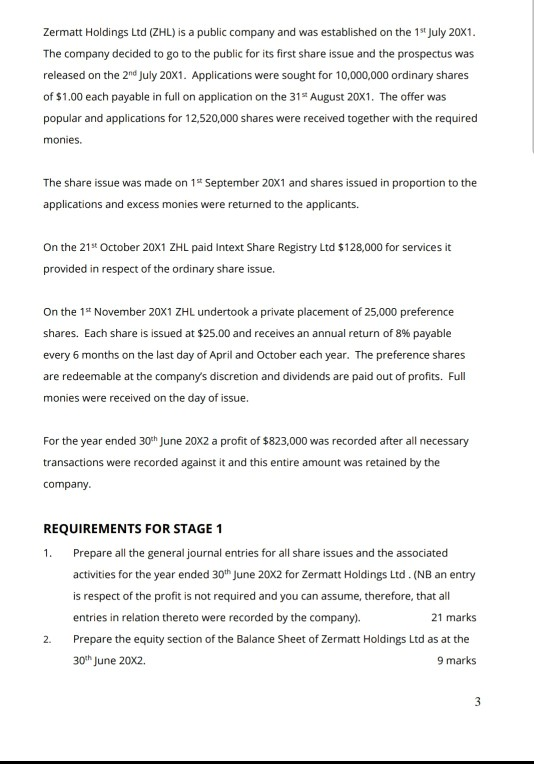

Zermatt Holdings Ltd (ZHL) is a public company and was established on the 1st July 20X1 The company decided to go to the public for its first share issue and the prospectus was released on the 2nd July 20X1. Applications were sought for 10,000,000 ordinary shares of $1.00 each payable in full on application on the 31st August 20X1. The offer was popular and applications for 12,520,000 shares were received together with the required monies. The share issue was made on 1t September 20X1 and shares issued in proportion to the applications and excess monies were returned to the applicants. On the 21* October 20X1 ZHL paid Intext Share Registry Ltd $128,000 for services it provided in respect of the ordinary share issue. On the 1t November 20X1 ZHL undertook a private placement of 25,000 preference shares. Each share is issued at $25.00 and receives an annual return of 8% payable every 6 months on the last day of April and October each year. The preference shares are redeemable at the company's discretion and dividends are paid out of profits. Full monies were received on the day of issue. For the year ended 30*h June 20X2 a profit of $823,000 was recorded after all necessary transactions were recorded against it and this entire amount was retained by the company REQUIREMENTS FOR STAGE 1 1. Prepare all the general journal entries for all share issues and the associated activities for the year ended 30th June 20X2 for Zermatt Holdings Ltd (NB an entry is respect of the profit is not required and you can assume, therefore, that al entries in relation thereto were recorded by the company). 21 marks 2. Prepare the equity section of the Balance Sheet of Zermatt Holdings Ltd as at the 9 marks 30th June 20x2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started