Answered step by step

Verified Expert Solution

Question

1 Approved Answer

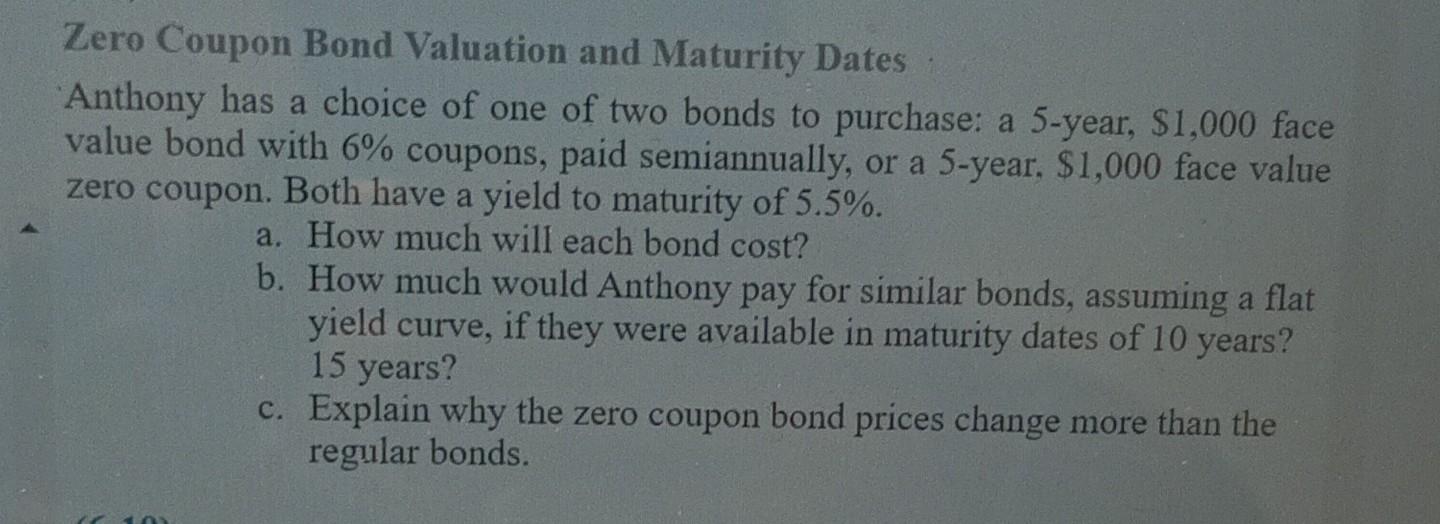

Zero Coupon Bond Valuation and Maturity Dates Anthony has a choice of one of two bonds to purchase: a 5-year, $1,000 face value bond with

Zero Coupon Bond Valuation and Maturity Dates Anthony has a choice of one of two bonds to purchase: a 5-year, $1,000 face value bond with 6% coupons, paid semiannually, or a 5-year, $1,000 face value zero coupon. Both have a yield to maturity of 5.5%. a. How much will each bond cost? b. How much would Anthony pay for similar bonds, assuming a flat yield curve, if they were available in maturity dates of 10 years? 15 years? c. Explain why the zero coupon bond prices change more than the regular bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started