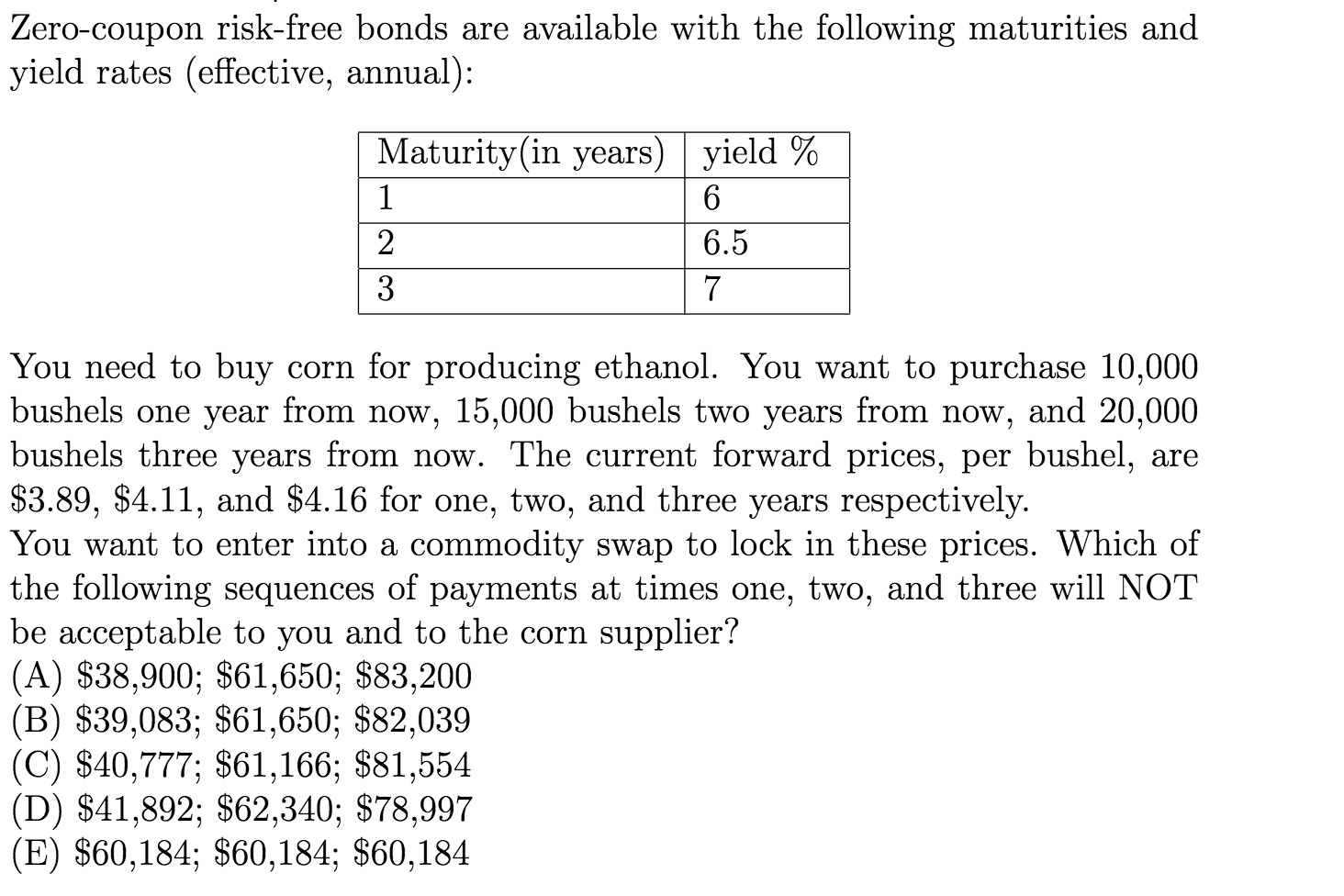

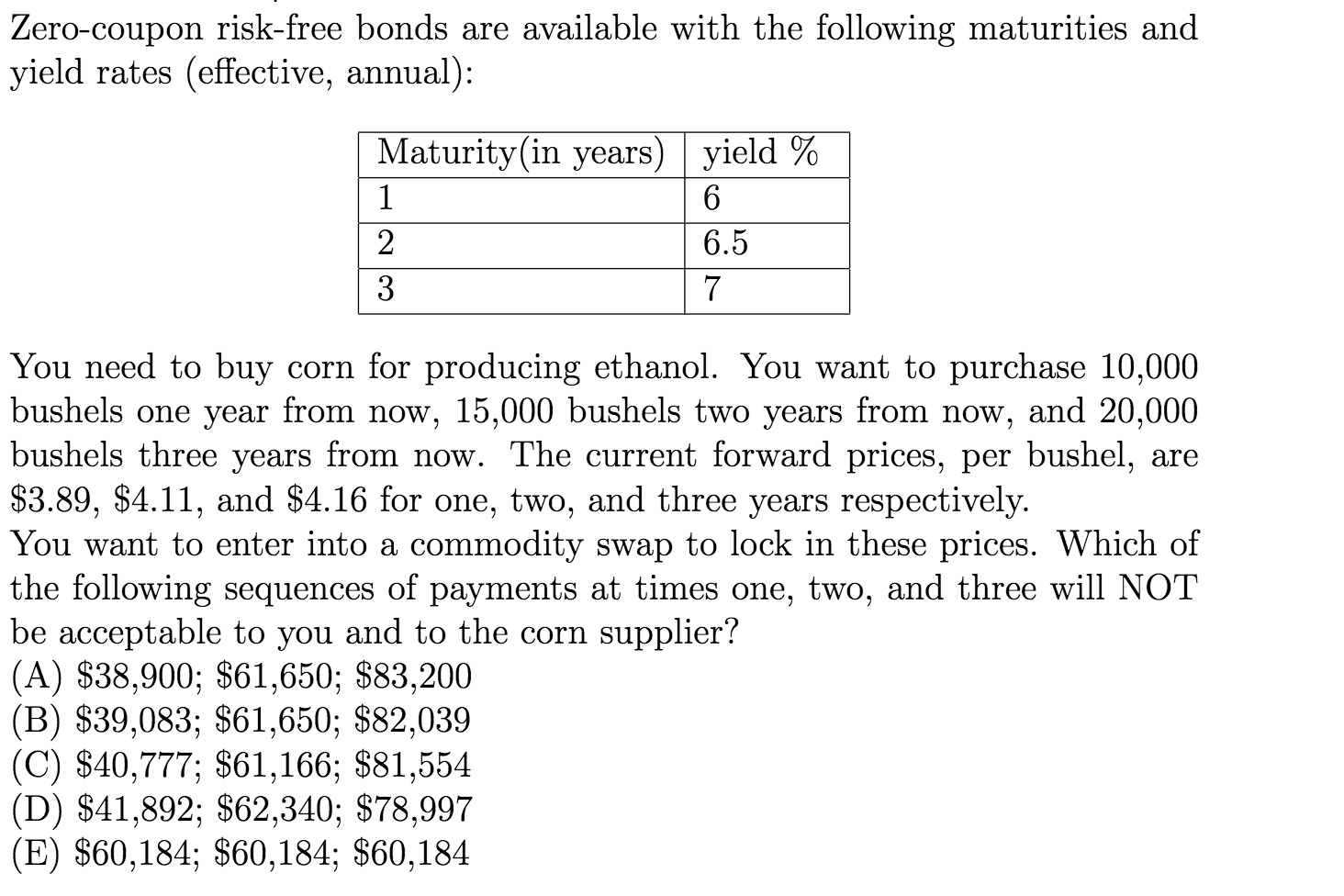

Zero-coupon risk-free bonds are available with the following maturities and yield rates (effective, annual): Maturity (in years) yield % 1 6 2 6.5 3 7 You need to buy corn for producing ethanol. You want to purchase 10,000 bushels one year from now, 15,000 bushels two years from now, and 20,000 bushels three years from now. The current forward prices, per bushel, are $3.89, $4.11, and $4.16 for one, two, and three years respectively. You want to enter into a commodity swap to lock in these prices. Which of the following sequences of payments at times one, two, and three will NOT be acceptable to you and to the corn supplier? (A) $38,900; $61,650; $83,200 (B) $39,083; $61,650; $82,039 (C) $40,777; $61,166; $81,554 (D) $41,892; $62,340; $78,997 (E) $60,184; $60,184; $60,184 73.2 Change forward prices to $3.90, $4.10, $4.30 per bushel in 1, 2, 3 years from now. And calculate the (level) payment if you negotiate a swap for the same price every year. In the Note on Interest Rate Swaps by Jeffrey Beckley, question (5) is quite long and complicated, so it will be the remainder of this assignment. Let's begin by clarifying: when they say the variable rate is the 1-year spot rate they mean the 1-year forward rates, just like we had in class on Monday 12 April. Double check by finishing the problem with the numbers given in the problem, and check your answer with the solution at the end of the Note. Then to turn in, change the spot rates in the table to .95, 9,.85, .8, and .75 for zero-coupon bonds maturing in 1, 2, 3, 4, 5 years respectively. Calculate the 1 year forward rates (which you will have to use in this question anyway) and complete the rest of the parts with the new numbers. Zero-coupon risk-free bonds are available with the following maturities and yield rates (effective, annual): Maturity (in years) yield % 1 6 2 6.5 3 7 You need to buy corn for producing ethanol. You want to purchase 10,000 bushels one year from now, 15,000 bushels two years from now, and 20,000 bushels three years from now. The current forward prices, per bushel, are $3.89, $4.11, and $4.16 for one, two, and three years respectively. You want to enter into a commodity swap to lock in these prices. Which of the following sequences of payments at times one, two, and three will NOT be acceptable to you and to the corn supplier? (A) $38,900; $61,650; $83,200 (B) $39,083; $61,650; $82,039 (C) $40,777; $61,166; $81,554 (D) $41,892; $62,340; $78,997 (E) $60,184; $60,184; $60,184 73.2 Change forward prices to $3.90, $4.10, $4.30 per bushel in 1, 2, 3 years from now. And calculate the (level) payment if you negotiate a swap for the same price every year. In the Note on Interest Rate Swaps by Jeffrey Beckley, question (5) is quite long and complicated, so it will be the remainder of this assignment. Let's begin by clarifying: when they say the variable rate is the 1-year spot rate they mean the 1-year forward rates, just like we had in class on Monday 12 April. Double check by finishing the problem with the numbers given in the problem, and check your answer with the solution at the end of the Note. Then to turn in, change the spot rates in the table to .95, 9,.85, .8, and .75 for zero-coupon bonds maturing in 1, 2, 3, 4, 5 years respectively. Calculate the 1 year forward rates (which you will have to use in this question anyway) and complete the rest of the parts with the new numbers