Answered step by step

Verified Expert Solution

Question

1 Approved Answer

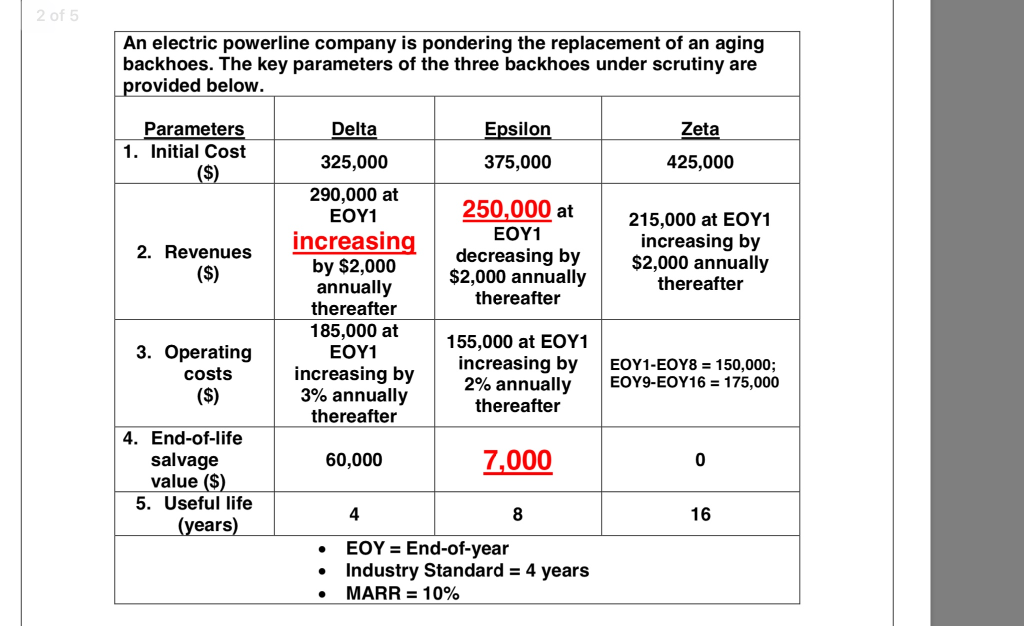

Zetas benefit/cost (B/C) ratio (second decimal; no rounding) is a) 0.99; b) 1.03; c) 1.06; d) 1.08. 2 of 5 An electric powerline company is

Zetas benefit/cost (B/C) ratio (second decimal; no rounding) is a) 0.99; b) 1.03; c) 1.06; d) 1.08.

Zetas benefit/cost (B/C) ratio (second decimal; no rounding) is a) 0.99; b) 1.03; c) 1.06; d) 1.08.

2 of 5 An electric powerline company is pondering the replacement of an aging backhoes. The key parameters of the three backhoes under scrutiny are provided below. Delta Parameters 1. Initial Cost Epsilon Zeta 425,000 325,000 375,000 ($) 290,000 at EOY1 250,000 at 215,000 at EOY1 increasing by $2,000 annually thereafter EOY1 increasing by $2,000 annually thereafter 2. Revenues decreasing by $2,000 annually thereafter (S) 185,000 at EOY1 155,000 at EOY1 increasing by 2% annually thereafter 3. Operating 1-E8 150,000; EOY9-EOY16 = 175,000 increasing by 3% annually thereafter costs (S) 4. End-of-life 7,000 salvage value ($) 5. Useful life (years) 60,000 0 4 8 16 EOY End-of-year Industry Standard 4 years MARR 10% 2 of 5 An electric powerline company is pondering the replacement of an aging backhoes. The key parameters of the three backhoes under scrutiny are provided below. Delta Parameters 1. Initial Cost Epsilon Zeta 425,000 325,000 375,000 ($) 290,000 at EOY1 250,000 at 215,000 at EOY1 increasing by $2,000 annually thereafter EOY1 increasing by $2,000 annually thereafter 2. Revenues decreasing by $2,000 annually thereafter (S) 185,000 at EOY1 155,000 at EOY1 increasing by 2% annually thereafter 3. Operating 1-E8 150,000; EOY9-EOY16 = 175,000 increasing by 3% annually thereafter costs (S) 4. End-of-life 7,000 salvage value ($) 5. Useful life (years) 60,000 0 4 8 16 EOY End-of-year Industry Standard 4 years MARR 10%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started