Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ZEUS PLC X TYCHE update question (Already send by picture in the question paper). 1 You are a shareholder in Tyche Insurance plc and have

ZEUS PLC X TYCHE

update question

(Already send by picture in the question paper).

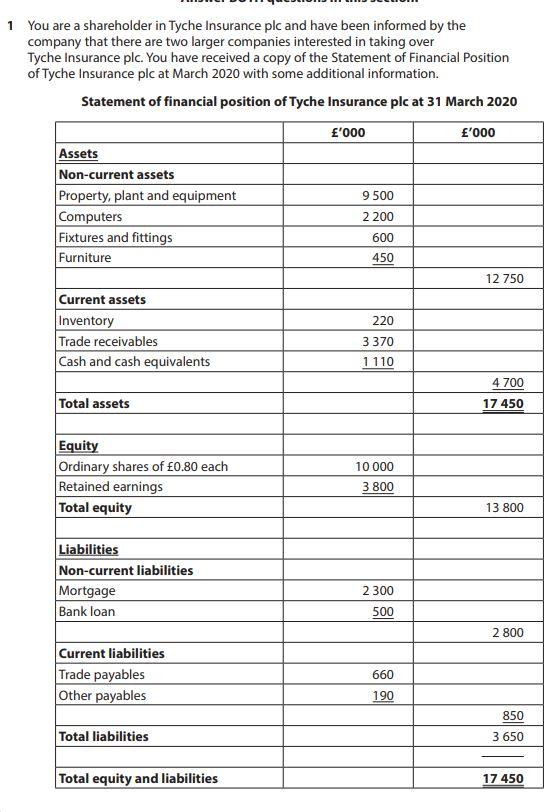

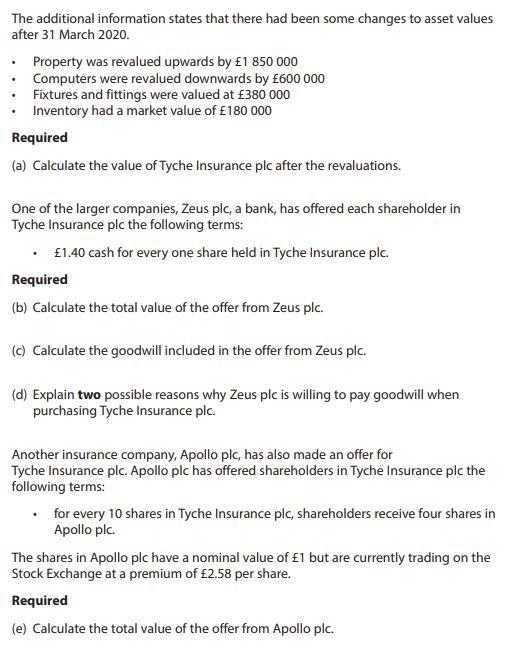

1 You are a shareholder in Tyche Insurance plc and have been informed by the company that there are two larger companies interested in taking over Tyche Insurance plc. You have received a copy of the Statement of Financial Position of Tyche Insurance plc at March 2020 with some additional information. Statement of financial position of Tyche Insurance plc at 31 March 2020 '000 '000 Assets Non-current assets Property, plant and equipment Computers Fixtures and fittings Furniture 9 500 2 200 600 450 12 750 220 Current assets Inventory Trade receivables Cash and cash equivalents 3 370 1110 4 700 Total assets 17 450 10 000 Equity Ordinary shares of 0.80 each Retained earnings Total equity 3 800 13 800 Liabilities Non-current liabilities Mortgage Bank loan 2 300 500 2 800 Current liabilities Trade payables Other payables 660 190 850 Total liabilities 3 650 Total equity and liabilities 17 450 The additional information states that there had been some changes to asset values after 31 March 2020. Property was revalued upwards by 1 850 000 Computers were revalued downwards by 600 000 Fixtures and fittings were valued at 380 000 Inventory had a market value of 180 000 Required (a) Calculate the value of Tyche Insurance plc after the revaluations. One of the larger companies, Zeus plc, a bank, has offered each shareholder in Tyche Insurance plc the following terms: 1.40 cash for every one share held in Tyche Insurance plc. Required (b) Calculate the total value of the offer from Zeus plc. (c) Calculate the goodwill included in the offer from Zeus plc. (d) Explain two possible reasons why Zeus plc is willing to pay goodwill when purchasing Tyche Insurance plc. Another insurance company, Apollo plc, has also made an offer for Tyche Insurance plc. Apollo plc has offered shareholders in Tyche Insurance plc the following terms: for every 10 shares in Tyche Insurance plc, shareholders receive four shares in Apollo plc. The shares in Apollo plc have a nominal value of 1 but are currently trading on the Stock Exchange at a premium of 2.58 per share. Required (e) Calculate the total value of the offer from Apollo plc

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started