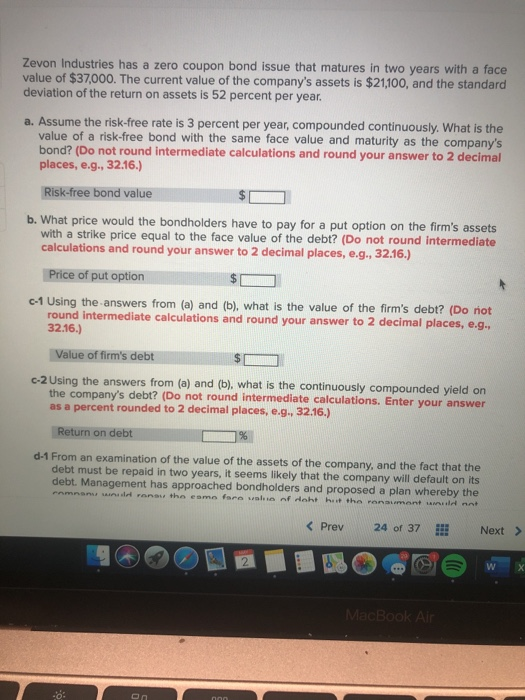

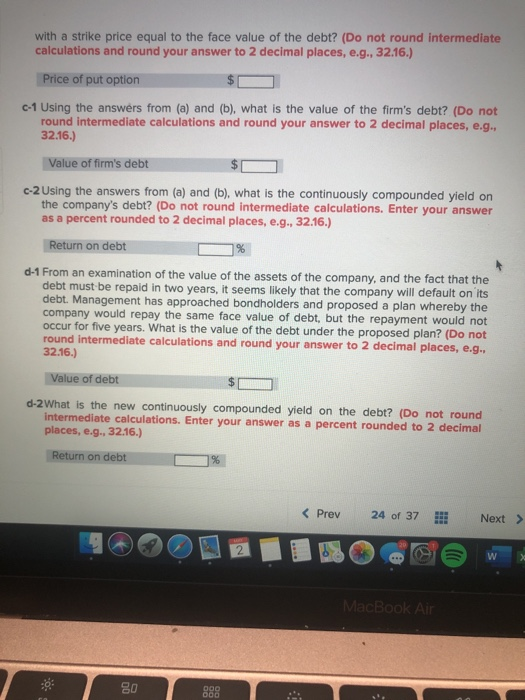

Zevon Industries has a zero coupon bond issue that matures in two years with a face value of $37,000. The current value of the company's assets is $21,100, and the standard deviation of the return on assets is 52 percent per year. a. Assume the risk-free rate is 3 percent per year, compounded continuously. What is the value of a risk-free bond with the same face value and maturity as the company's bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Risk-free bond value b. What price would the bondholders have to pay for a put option on the firm's assets with a strike price equal to the face value of the debt? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price of put option C-1 Using the answers from (a) and (b), what is the value of the firm's debt? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Value of firm's debt c-2 Using the answers from (a) and (b). what is the continuously compounded yield on the company's debt? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Return on debt d-1 From an examination of the value of the assets of the company, and the fact that the debt must be repaid in two years, it seems likely that the company will default on its debt. Management has approached bondholders and proposed a plan whereby the man w on the eam fara walif Hak hit the resumont tu net with a strike price equal to the face value of the debt? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price of put option C-1 Using the answers from (a) and (b), what is the value of the firm's debt? (Do not round Intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) Value of firm's debt c-2 Using the answers from (a) and (b). what is the continuously compounded yield on the company's debt? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Return on debt d-1 From an examination of the value of the assets of the company, and the fact that the debt must be repaid in two years, it seems likely that the company will default on its debt. Management has approached bondholders and proposed a plan whereby the company would repay the same face value of debt, but the repayment would not occur for five years. What is the value of the debt under the proposed plan? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g.. 32.16.) Value of debt d-2 What is the new continuously compounded yield on the debt? (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Return on debt D % MacBook Air 80