Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zion wants to compute the total cost for preparing a corporate tax return for his client. His labour is the only direct cost at

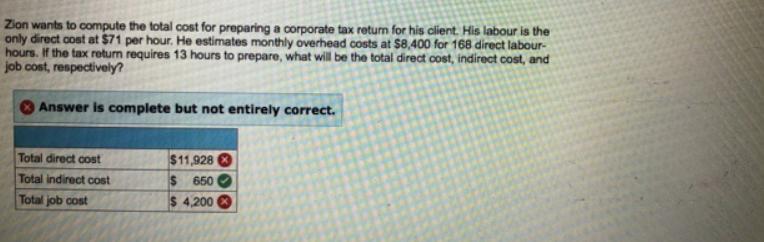

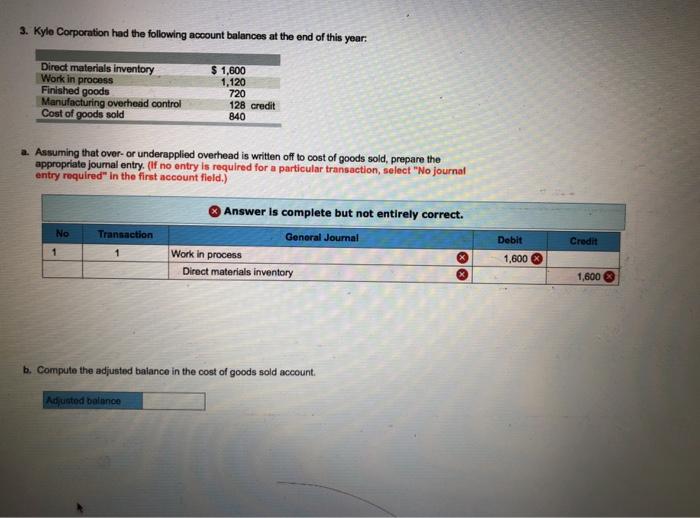

Zion wants to compute the total cost for preparing a corporate tax return for his client. His labour is the only direct cost at $71 per hour. He estimates monthly overhead costs at $8,400 for 168 direct labour- hours. If the tax return requires 13 hours to prepare, what will be the total direct cost, indirect cost, and job cost, respectively? Answer is complete but not entirely correct. Total direct cost Total indirect cost Total job cost $11,928 $ 650 $ 4,200 3. Kyle Corporation had the following account balances at the end of this year: Direct materials inventory Work in process Finished goods Manufacturing overhead control Cost of goods sold No a. Assuming that over- or underapplied overhead is written off to cost of goods sold, prepare the appropriate journal entry. (If no entry is required for a particular transaction, select "No journal entry required" in the first account field.) 1 $ 1,600 1,120 720 Transaction 1 128 credit 840 Answer is complete but not entirely correct. General Journal Work in process Direct materials inventory b. Compute the adjusted balance in the cost of goods sold account. Adjusted balance XX Debit 1,600 Credit 1,600

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down the calculation for each cost component 1 Total Direct Cost Direct Cost Direct Labor ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started