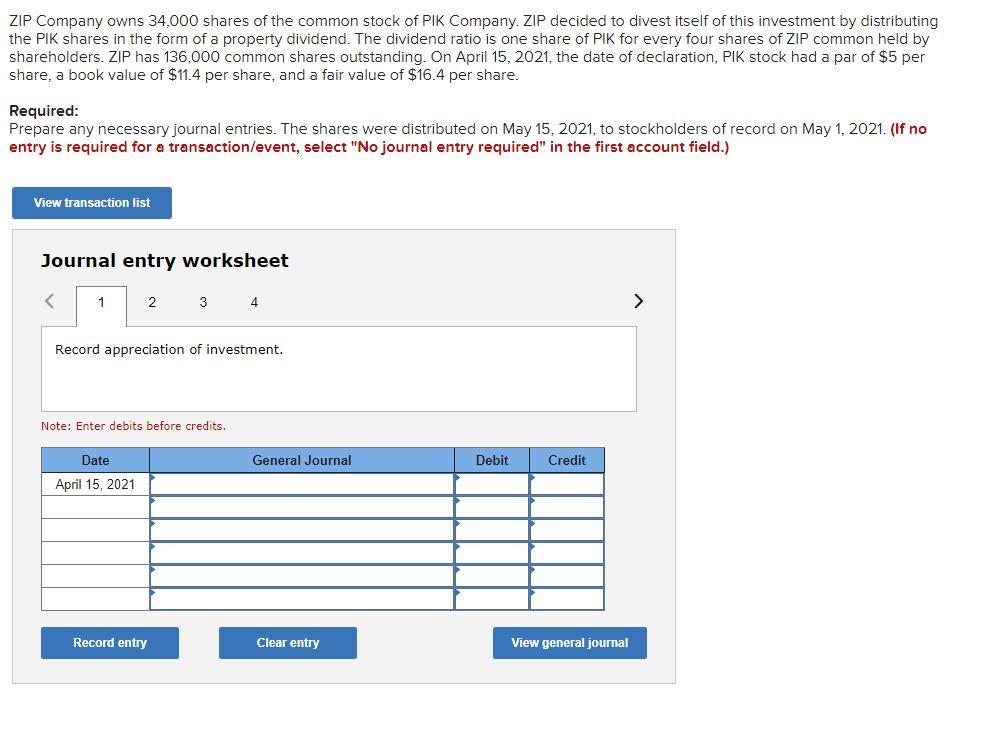

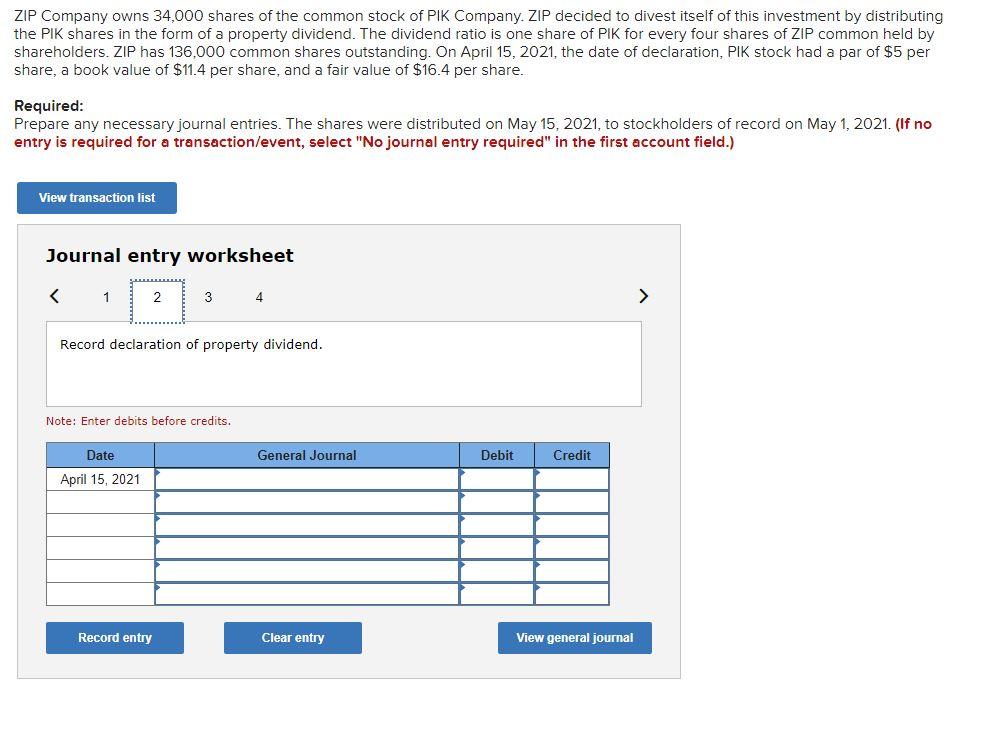

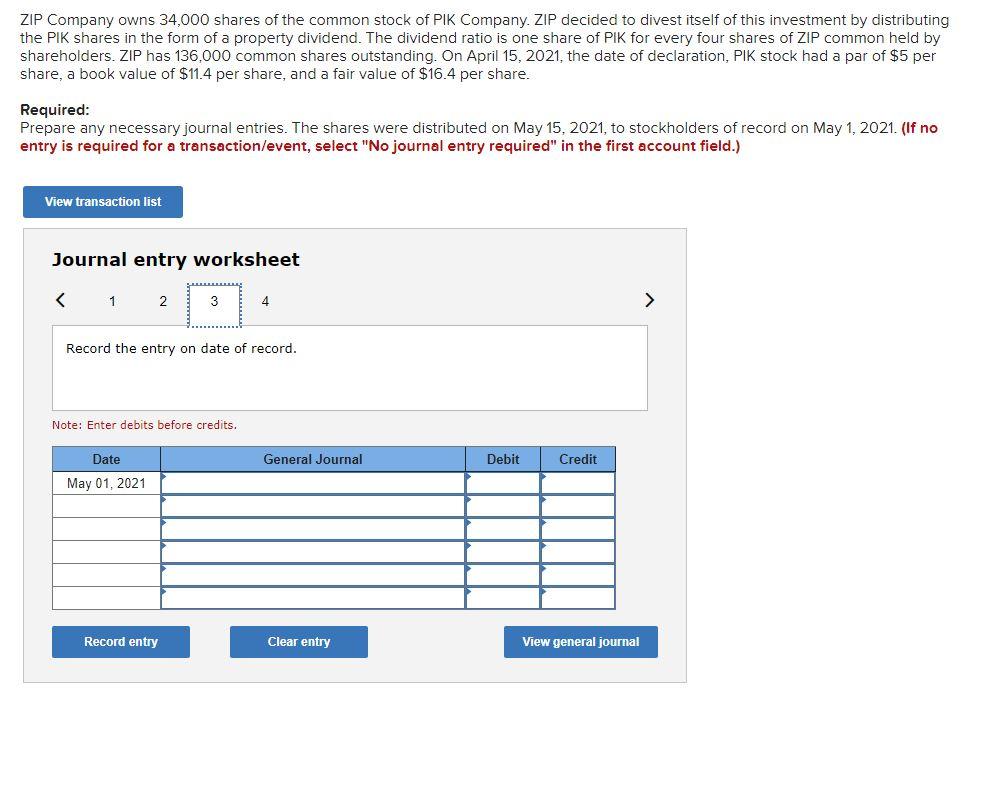

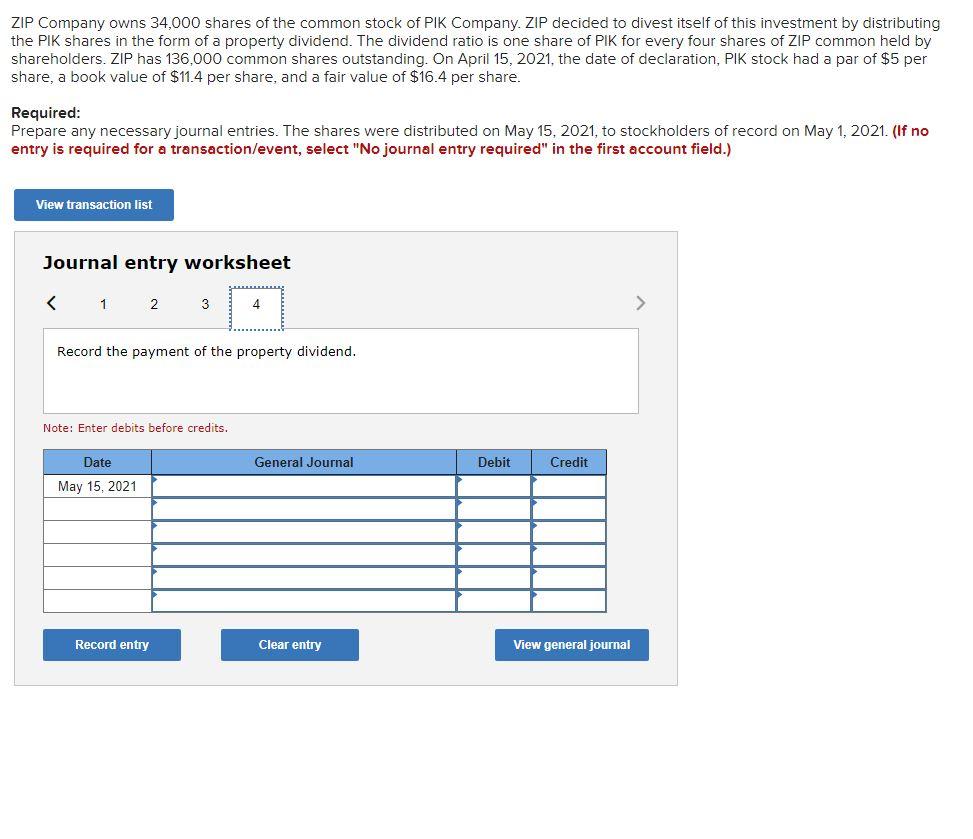

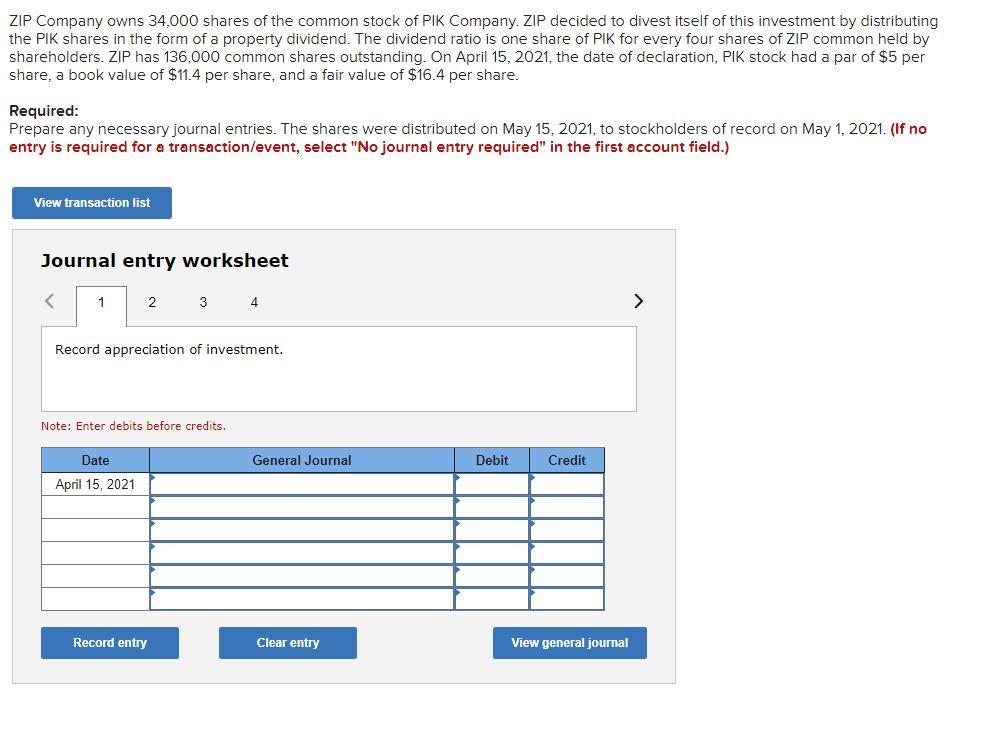

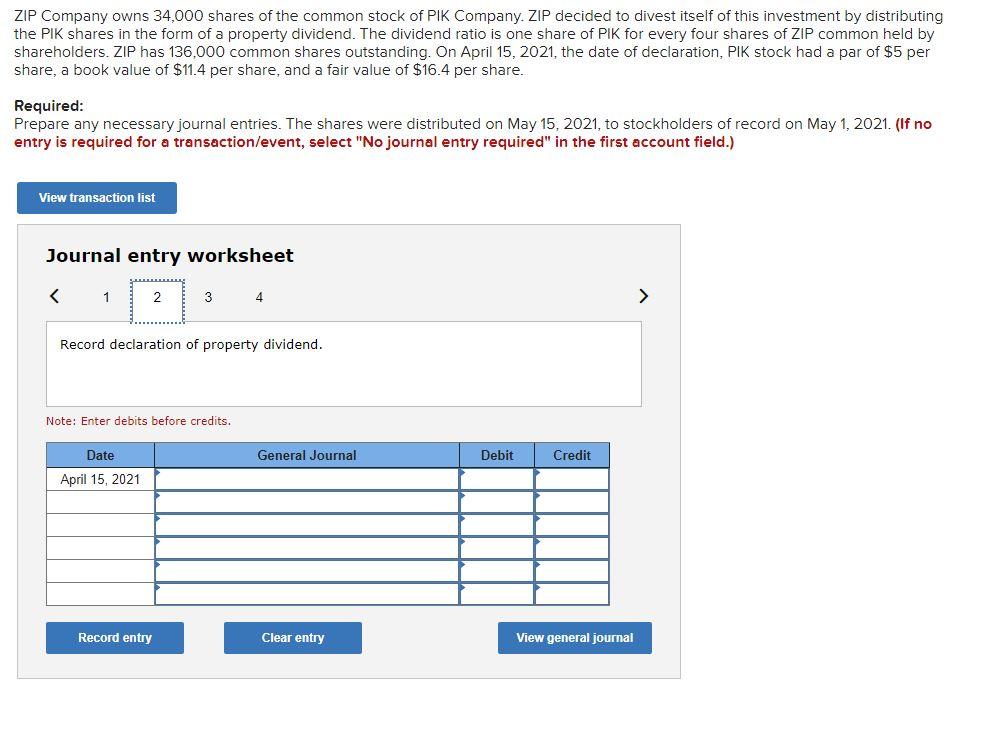

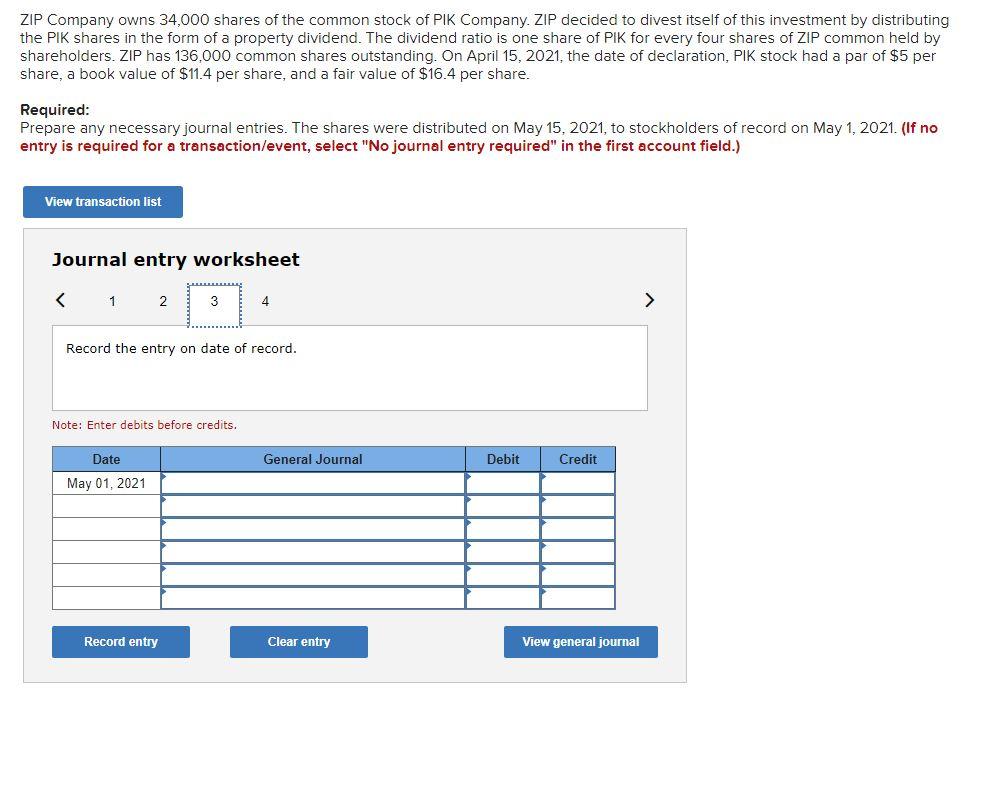

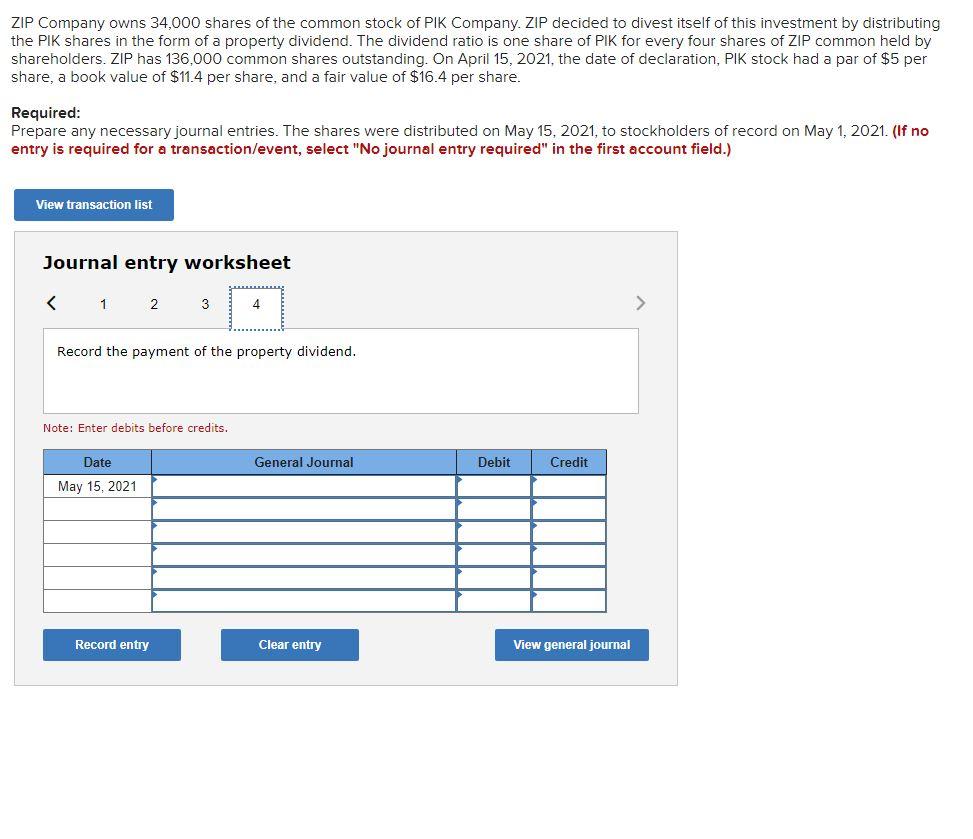

ZIP Company owns 34,000 shares of the common stock of PIK Company. ZIP decided to divest itself of this investment by distributing the PIK shares in the form of a property dividend. The dividend ratio is one share of PIK for every four shares of ZIP common held by shareholders. ZIP has 136,000 common shares outstanding. On April 15, 2021, the date of declaration, PIK stock had a par of $5 per share, a book value of $11.4 per share, and a fair value of $16.4 per share. Required: Prepare any necessary journal entries. The shares were distributed on May 15, 2021, to stockholders of record on May 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) View transaction list Journal entry worksheet Record appreciation of investment. Note: Enter debits before credits. General Journal Debit Credit Date April 15, 2021 Record entry Clear entry View general journal ZIP Company owns 34,000 shares of the common stock of PIK Company. ZIP decided to divest itself of this investment by distributing the PIK shares in the form of a property dividend. The dividend ratio is one share of PIK for every four shares of ZIP common held by shareholders. ZIP has 136,000 common shares outstanding. On April 15, 2021, the date of declaration, PIK stock had a par of $5 per share, a book value of $11.4 per share, and a fair value of $16.4 per share. Required: Prepare any necessary journal entries. The shares were distributed on May 15, 2021, to stockholders of record on May 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 4 > Record declaration of property dividend. Note: Enter debits before credits. Date General Journal Debit Credit April 15, 2021 Record entry Clear entry View general journal ZIP Company owns 34,000 shares of the common stock of PIK Company. ZIP decided to divest itself of this investment by distributing the PIK shares in the form of a property dividend. The dividend ratio is one share of PIK for every four shares of ZIP common held by shareholders. ZIP has 136,000 common shares outstanding. On April 15, 2021, the date of declaration, PIK stock had a par of $5 per share, a book value of $11.4 per share, and a fair value of $16.4 per share. Required: Prepare any necessary journal entries. The shares were distributed on May 15, 2021, to stockholders of record on May 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the entry on date of record. Note: Enter debits before credits. Date General Journal Debit Credit May 01, 2021 Record entry Clear entry View general journal ZIP Company owns 34,000 shares of the common stock of PIK Company. ZIP decided to divest itself of this investment by distributing the PIK shares in the form of a property dividend. The dividend ratio is one share of PIK for every four shares of ZIP common held by shareholders. ZIP has 136,000 common shares outstanding. On April 15, 2021, the date of declaration, PIK stock had a par of $5 per share, a book value of $11.4 per share, and a fair value of $16.4 per share. Required: Prepare any necessary journal entries. The shares were distributed on May 15, 2021, to stockholders of record on May 1, 2021. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 > Record the payment of the property dividend. Note: Enter debits before credits. General Journal Debit Credit Date May 15, 2021 Record entry Clear entry View general journal