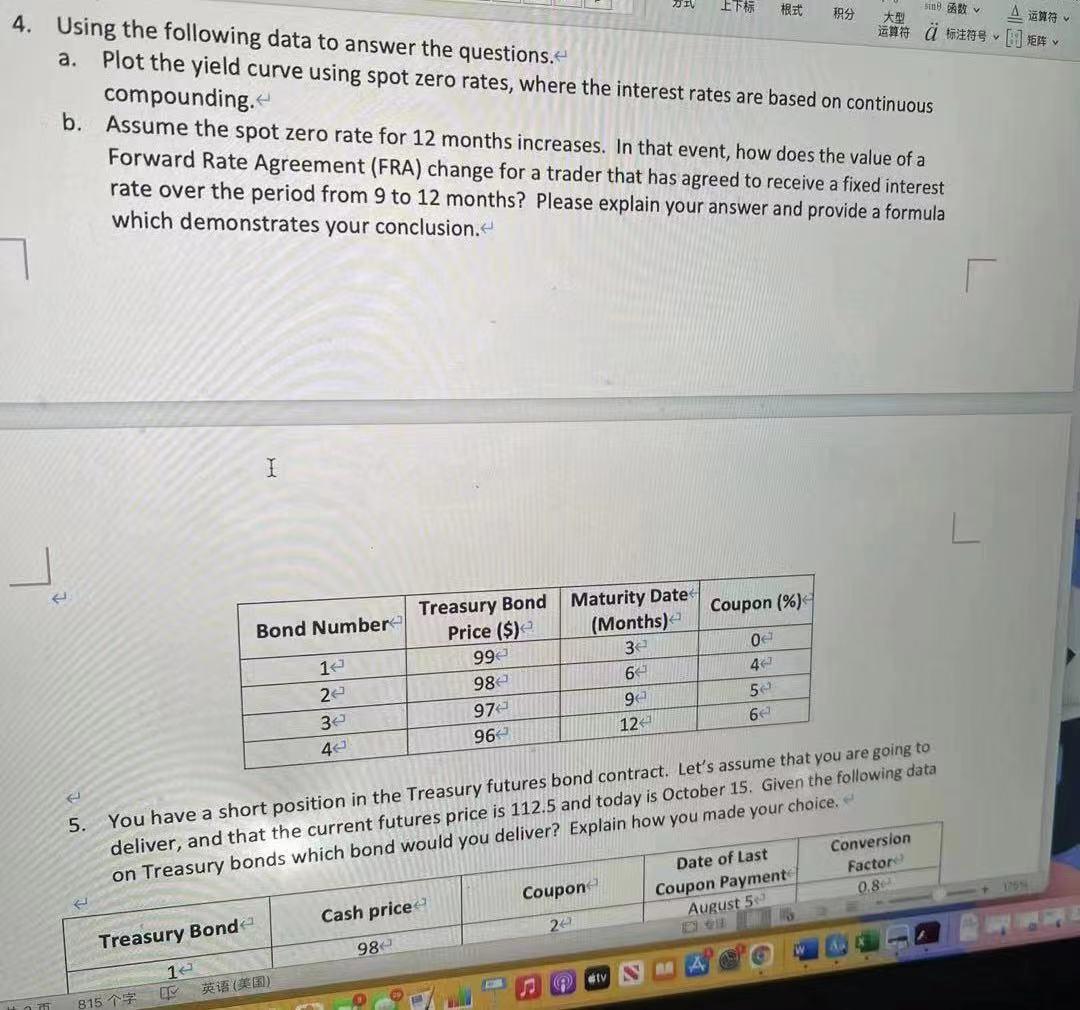

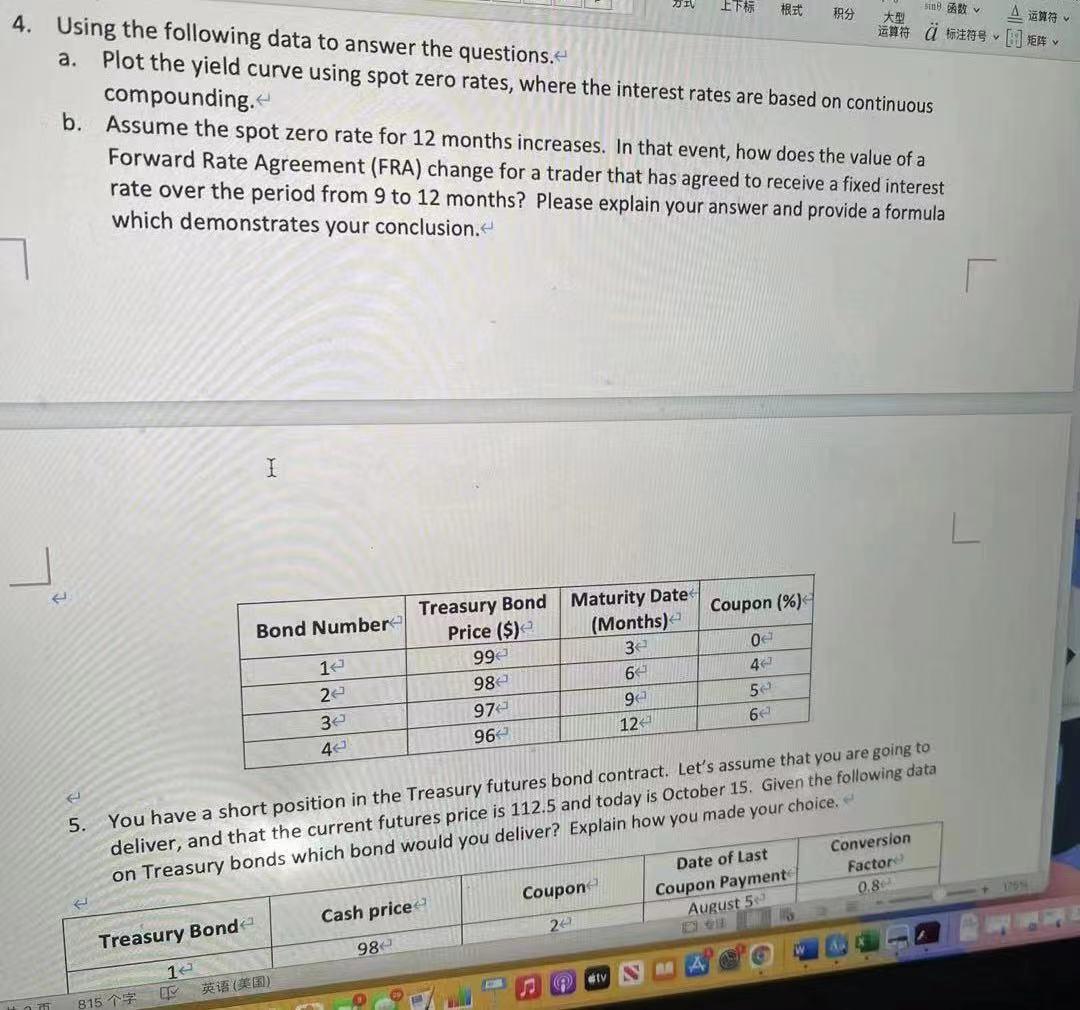

ZIV ETI 199 3129 1. y d y 4. Using the following data to answer the questions. a. Plot the yield curve using spot zero rates, where the interest rates are based on continuous compounding. b. Assume the spot zero rate for 12 months increases. In that event, how does the value of a Forward Rate Agreement (FRA) change for a trader that has agreed to receive a fixed interest rate over the period from 9 to 12 months? Please explain your answer and provide a formula which demonstrates your conclusion. I T T Coupon (%) Bond Number 12 22 32 40 Treasury Bond Maturity Date Price ($) (Months) 99 3 982 6 9 96 12 e 4 5 6 974 5. You have a short position in the Treasury futures bond contract. Let's assume that you are going to deliver, and that the current futures price is 112.5 and today is October 15. Given the following data on Treasury bonds which bond would you deliver? Explain how you made your choice. Conversion Date of Last Coupon Payment August 5 Factore 0.8 Coupon Cash price 20 Treasury Bond 980 16 () 815 ZIV ETI 199 3129 1. y d y 4. Using the following data to answer the questions. a. Plot the yield curve using spot zero rates, where the interest rates are based on continuous compounding. b. Assume the spot zero rate for 12 months increases. In that event, how does the value of a Forward Rate Agreement (FRA) change for a trader that has agreed to receive a fixed interest rate over the period from 9 to 12 months? Please explain your answer and provide a formula which demonstrates your conclusion. I T T Coupon (%) Bond Number 12 22 32 40 Treasury Bond Maturity Date Price ($) (Months) 99 3 982 6 9 96 12 e 4 5 6 974 5. You have a short position in the Treasury futures bond contract. Let's assume that you are going to deliver, and that the current futures price is 112.5 and today is October 15. Given the following data on Treasury bonds which bond would you deliver? Explain how you made your choice. Conversion Date of Last Coupon Payment August 5 Factore 0.8 Coupon Cash price 20 Treasury Bond 980 16 () 815