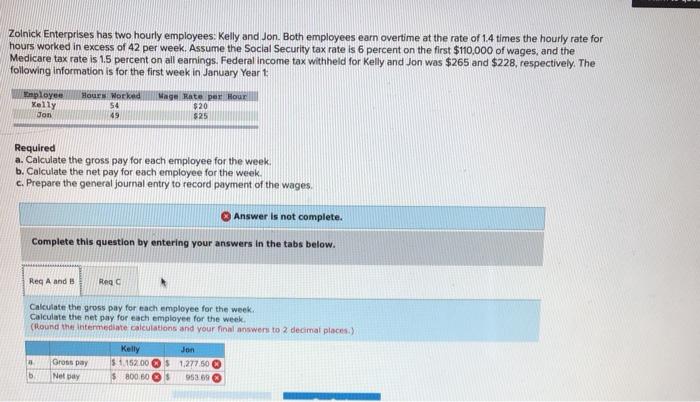

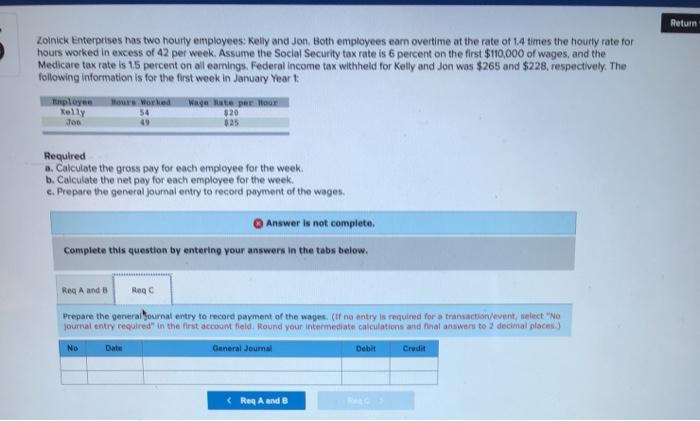

Zolnick Enterprises has two hourly employees: Kelly and Jon. Both employees earn overtime at the rate of 1.4 times the hourly rate for hours worked in excess of 42 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages, and the Medicare tax rate is 1.5 percent on all earnings. Federal income tax withheld for Kelly and Jon was $265 and $228, respectively. The following information is for the first week in January Yeart: Employee Kelly Jon Hours Worked 54 49 Mage Rate per Mour $20 $25 Required a. Calculate the gross pay for each employee for the week. b. Calculate the net pay for each employee for the week. c. Prepare the general journal entry to record payment of the wages. Answer is not complete. Complete this question by entering your answers in the tabs below. Reg A and Rega Calculate the gross pay for each employee for the week Calculate the net pay for each employee for the week (Round the intermediate calculations and your final swers to 2 decimal places) Gross Day Net Day Kelly Jon $ 1.152.00 $ 1,277.50 $ 800.60 $ 953.68 D Return Zoinick Enterprises has two hourly employees: Kelly and Jon. Both employees earn overtime at the rate of 1.4 times the hourly rate for hours worked in excess of 42 per week. Assume the Social Security tax rate is 6 percent on the first $110,000 of wages, and the Medicare tax rate is 15 percent on all earnings, Federal income tax withheld for Kelly and Jon was $265 and $228. respectively. The following information is for the first week in January Yeart Toployee Kelly Jon He World 54 Wagente per $20 $25 Required a. Calculate the gross pay for each employee for the week. b. Calculate the net pay for each employee for the week. c. Prepare the general journal entry to record payment of the wages. Answer is not complete Complete this question by entering your answers in the tabs below. Reg A and B Reg Prepare the general tournal entry to record payment of the wages (if ne entry is required for a transaction/event, lect "No journal entry required in the first accoont field. Round your intermediate calculations and final answers to 2 decimal places NO General Journal Det Credit