Answered step by step

Verified Expert Solution

Question

1 Approved Answer

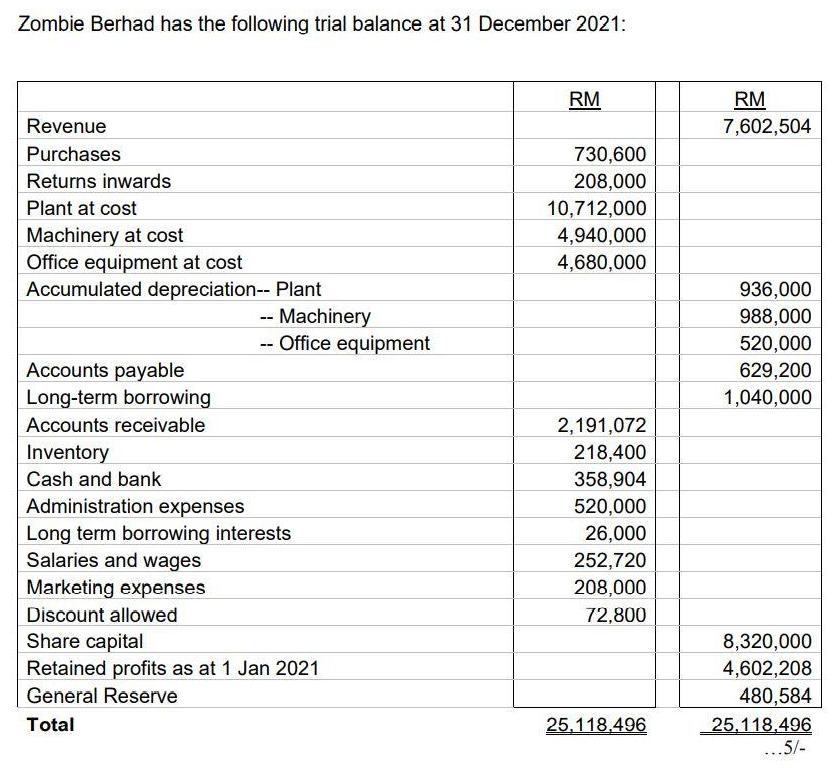

Zombie Berhad has the following trial balance at 31 December 2021: RM RM Revenue 7,602,504 Purchases 730,600 Returns inwards 208,000 Plant at cost Machinery

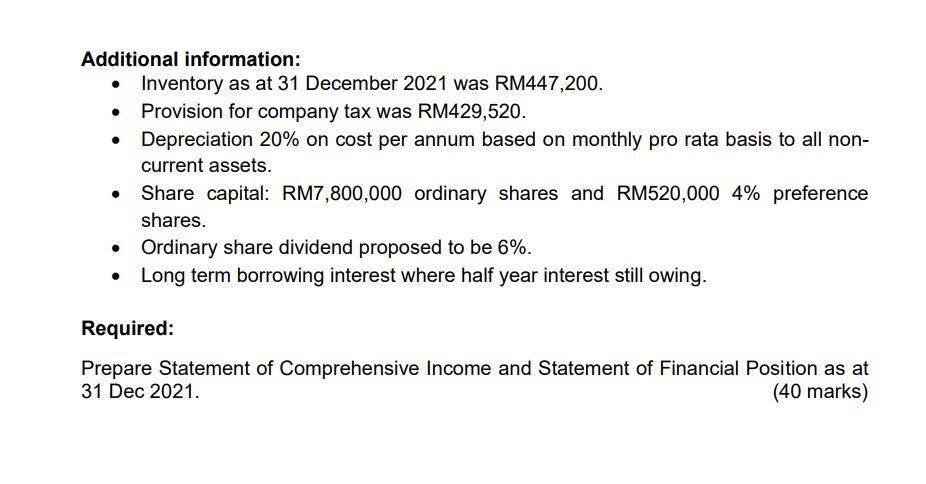

Zombie Berhad has the following trial balance at 31 December 2021: RM RM Revenue 7,602,504 Purchases 730,600 Returns inwards 208,000 Plant at cost Machinery at cost Office equipment at cost Accumulated depreciation-- Plant 10,712,000 4,940,000 4,680,000 936,000 -- Machinery -- Office equipment 988,000 520,000 629,200 Accounts payable Long-term borrowing 1,040,000 Accounts receivable 2,191,072 218,400 358,904 Inventory Cash and bank Administration expenses 520,000 Long term borrowing interests Salaries and wages 26,000 252,720 208,000 Marketing expenses Discount allowed 72,800 Share capital Retained profits as at 1 Jan 2021 8,320,000 4,602,208 480,584 General Reserve Total 25.118.496 25,118,496 ...5/- Additional information: Inventory as at 31 December 2021 was RM447,200. Provision for company tax was RM429,520. Depreciation 20% on cost per annum based on monthly pro rata basis to all non- current assets. Share capital: RM7,800,000 ordinary shares and RM520,000 4% preference shares. Ordinary share dividend proposed to be 6%. Long term borrowing interest where half year interest still owing. Required: Prepare Statement of Comprehensive Income and Statement of Financial Position as at 31 Dec 2021. (40 marks)

Step by Step Solution

★★★★★

3.47 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Zombie Berhad Statement of Comprehensive Income Fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started