Question

Zoom Car Corporation (ZCC) plans to purchase approximately 100 vehicles on December 31, 2015, for $2.2 million, plus 10 percent total sales tax. ZCC expects

Zoom Car Corporation (ZCC) plans to purchase approximately 100 vehicles on December 31, 2015, for $2.2 million, plus 10 percent total sales tax. ZCC expects to use the vehicles for 5 years and then sell them for approximately $440,000. ZCC anticipates the following average vehicle use over each year ended December 31:

| 2016 | 2017 | 2018 | 2019 | 2020 | |

| Miles per year | 15,000 | 20,000 | 13,000 | 13,000 | 5,000 |

| To finance the purchase, ZCC signed a 5-year promissory note on December 31, 2015, for $1.98 million, with interest paid annually at the market interest rate of 5 percent. The note carries loan covenants that require ZCC to maintain a minimum times interest earned ratio of 3.0 and a minimum fixed asset turnover ratio of 1.0. ZCC forecasts that the company will generate the following sales and preliminary earnings (prior to recording depreciation on the vehicles and interest on the note). (For purposes of this question, ignore income tax.) |

| (in 000s) | 2016 | 2017 | 2018 | 2019 | 2020 | |||||

| Sales Revenue | $ | 2,200 | $ | 2,700 | $ | 3,000 | $ | 3,100 | $ | 3,200 |

| Income before Depreciation and Interest Expense | 1,100 | 1,300 | 1,500 | 1,600 | 1,700 | |||||

| Required: | |

| 1. | Calculate the amount of interest expense that would be recorded each year. |

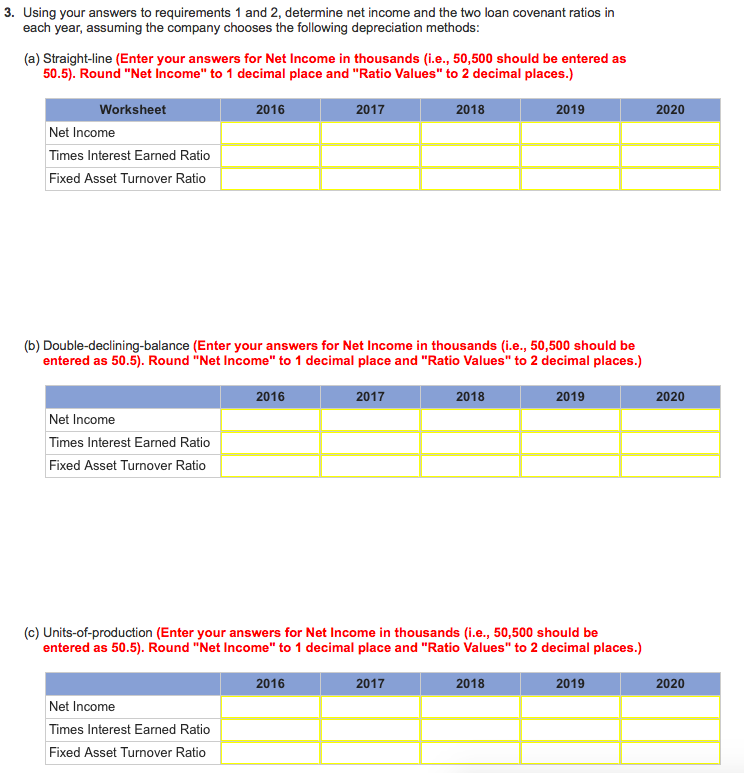

| 2. | Calculate the depreciation expense that would be recorded each year, using the following depreciation methods: |

a) Straight line

b) Double-declining-balance

c) Units-of-production

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started