Zoom in and it's clear. Thanks!

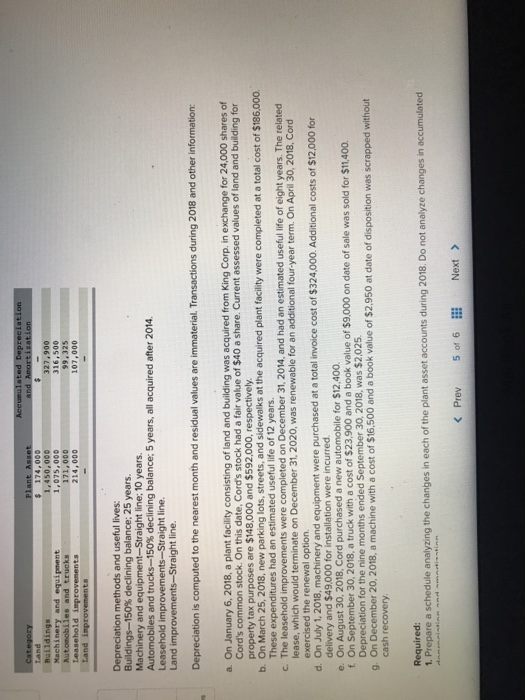

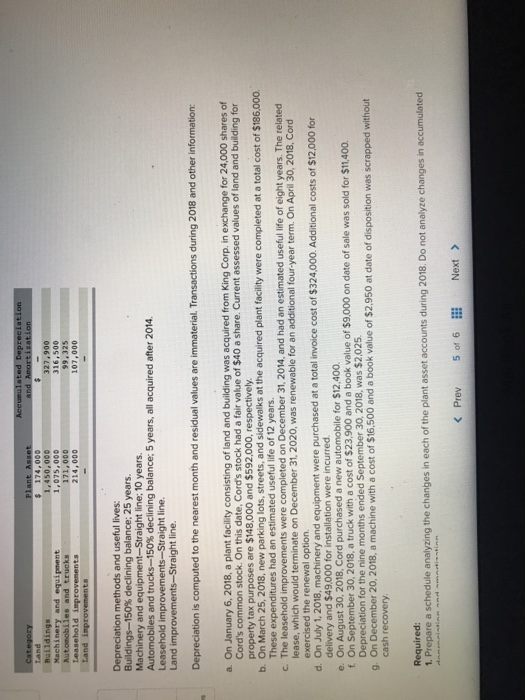

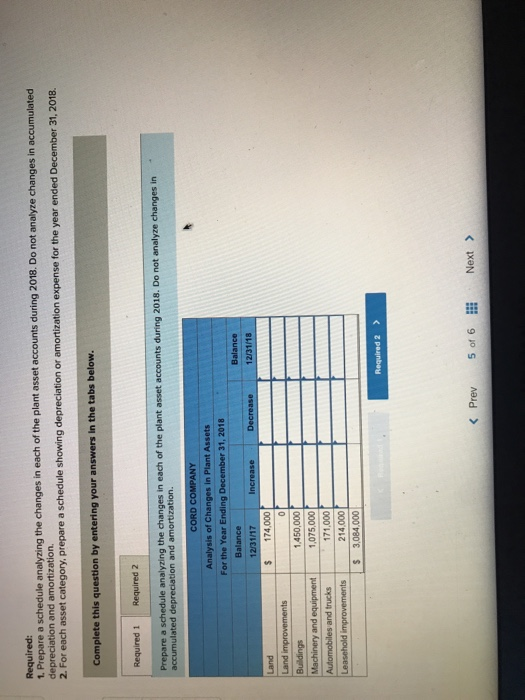

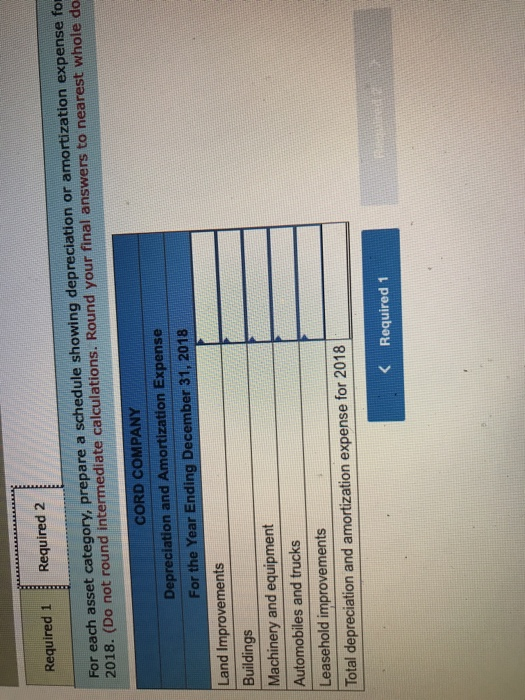

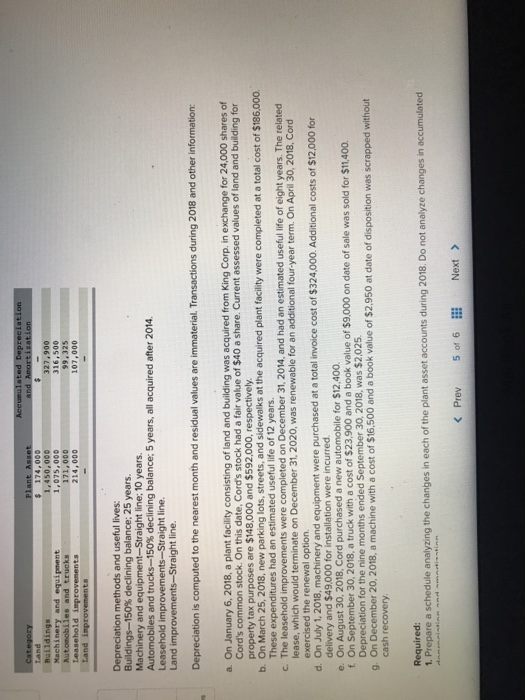

174,000 1,450,000 1,075, 000 171,000 214,000 Baildings 327,900 316,500 107,000 Depreciation methods and useful lives: Buildings-150% declining balance: 25 years. Machinery and equipment-Straight line; 10 years. s and trucks-150% declining balance: 5 years, all acquired after 2014. Leasehold im Land i nts-Straight line Straight line. Depreciation is computed to the nearest month and residual values are immaterial Transactions during 2018 and other information a. On January 6, 2018, a plant facility consisting of land and building was acquired from King Corp. in exchange for 24,000 shares of Cord's common stock. On this date, Cord's stock had a fair value of $40 a share. Current assessed values of land and building for property tax purposes are $148,000 and $592,000, respectively These expenditures had an estimated useful life of 12 years lease, which would terminate on December 31, 2020, was renewable for an additional four-year term. On April 30, 2018, Cord b. On March 25, 2018, new parking lots, streets, and sidewalks at the acquired plant facility were completed at a total cost of $186,000 c. The improve ments were completed on December 31, 2014, and had an estimated useful life of eight years. The related exercised the renewal option d. On July 1, 2018, machinery and equipment were purchased at a total invoice cost of $324,000. Additional costs of $12,000 for delivery and $49,000 for installation were incurred e. On August 30, 2018, Cord purchased a new automobile for $12.400 f On September 30, 2018, a truck with a cost of $23,900 and a book value of $9,000 on date of sale was sold for $11,400. Depreciation for the nine months ended September 30, 2018, was $2.025 cash recovery g. On December 20, 2018, a machine with a cost of $16,500 and a book value of $2,950 at date of disposition was scrapped without Required: 1. Prepare a schedule analyzing the changes in each of the plant asset accounts during 2018. Do not analyze changes in accumulated Required 1 Required 2 For each asset category, prepare a schedule showing depreciation or amortization expense for 2018. (Do not round intermediate calculations. Round your final answers to nearest whole do CORD COMPANY Depreciation and Amortization Expense For the Year Ending December 31, 2018 Land Improvements Buildings Machinery and equipment Automobiles and trucks Leasehold improvements Total depreciation and amortization expense for 2018