Answered step by step

Verified Expert Solution

Question

1 Approved Answer

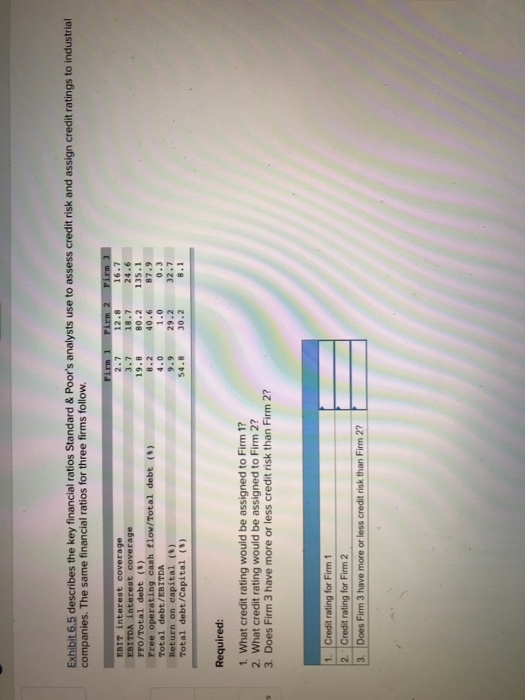

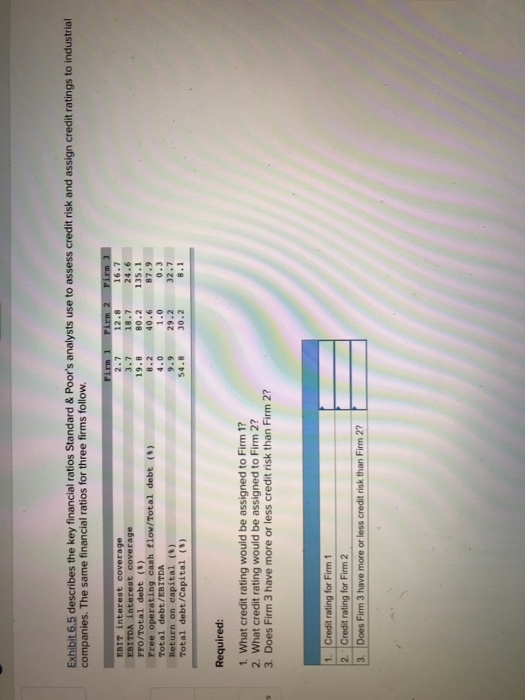

Zoom in and it's clear. Thanks! Exhibit 6.5 describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit

Zoom in and it's clear. Thanks!

Exhibit 6.5 describes the key financial ratios Standard & Poor's analysts use to assess credit risk and assign credit ratings to industrial companies. The same financial ratios for three firms follow 16.7 3.7 18.7 24.6 19.8 80.2 135.1 8.2 40.6 87.9 0.3 9.9 29.2 32.7 8.1 2.7 12.8 EBITDA interest coverage FFO/Total debt () Free operating cash flow/Total debt () 1.0 Total debt/EBITDA Return on capital (%) Total debt/capital (%) 54.8 30.2 Required: 1. What credit rating would be assigned to Firm 1? 2. What credit rating would be assigned to Firm 2? s 3. Does Firm 3 have more or less credit risk than Firm 2? Credit rating for Firm 1 2. Credit rating for Firm 2 3. Does Firm 3 have more or less credit risk than Firm 2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started