zoom in to see

zoom in to see

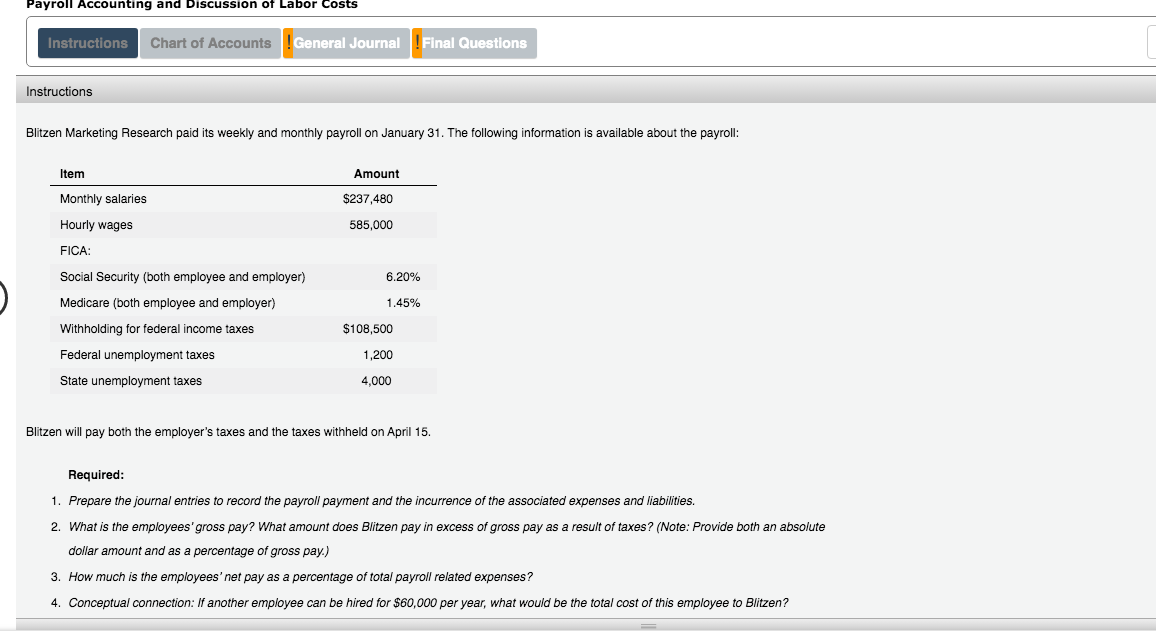

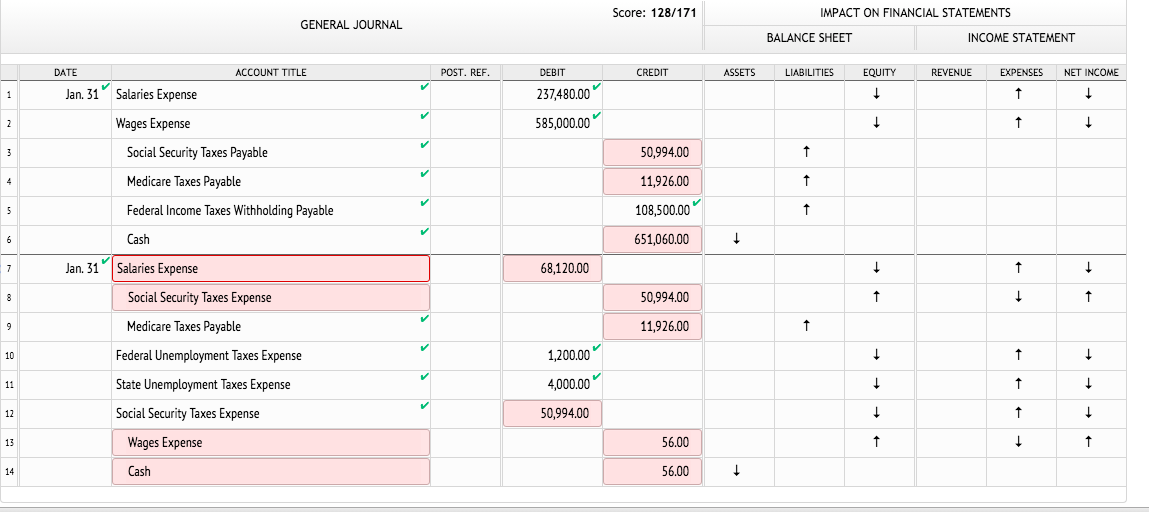

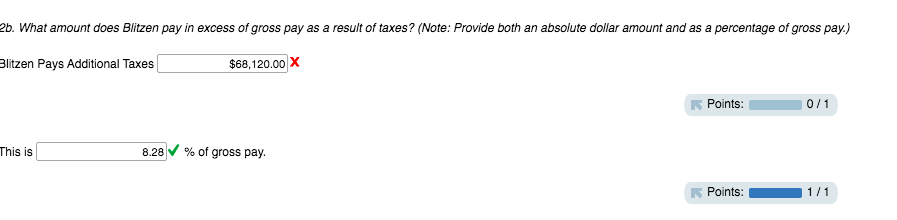

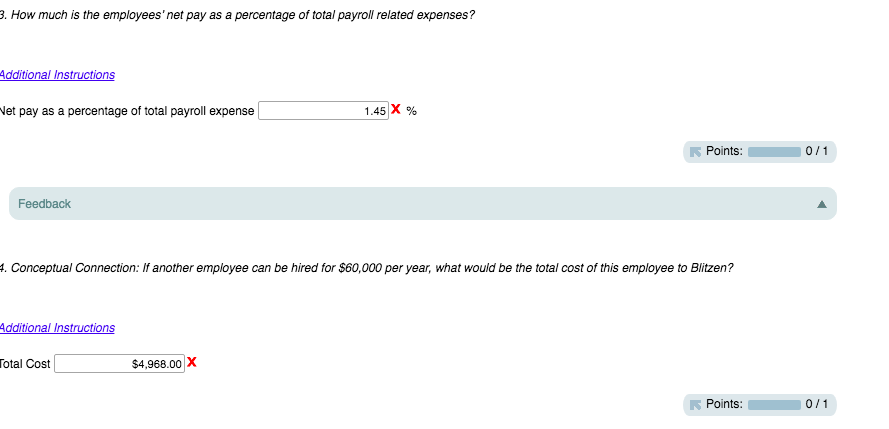

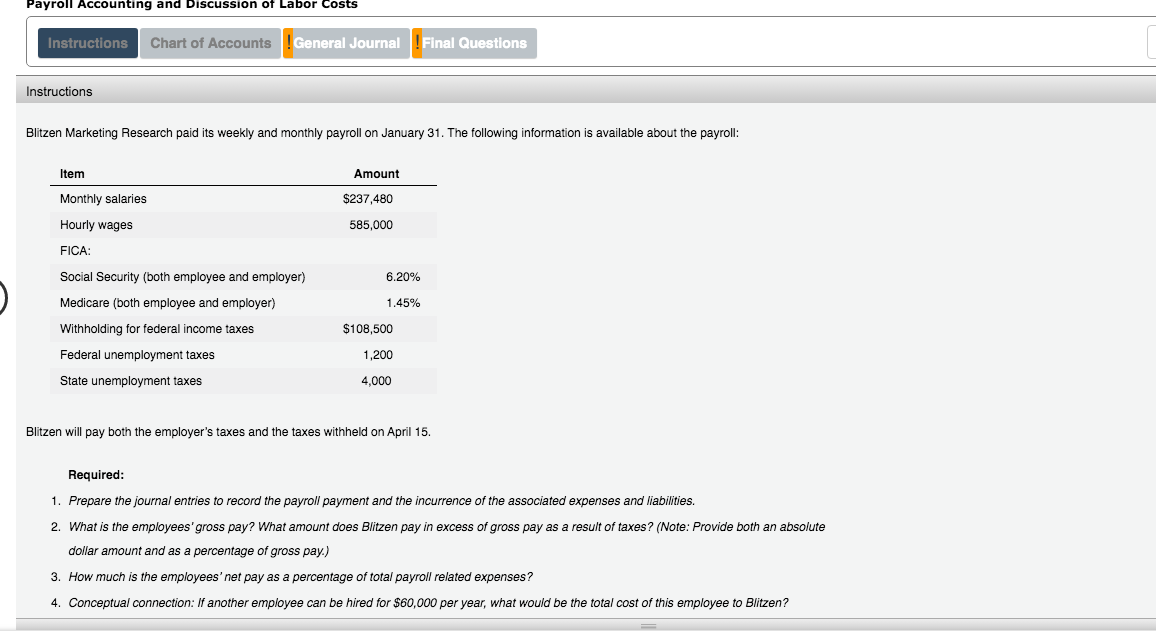

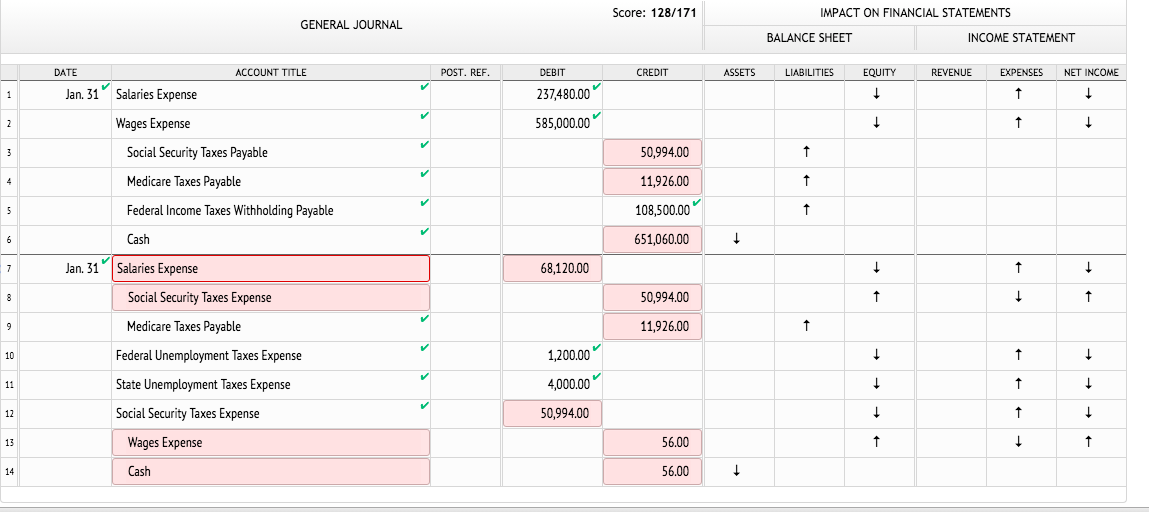

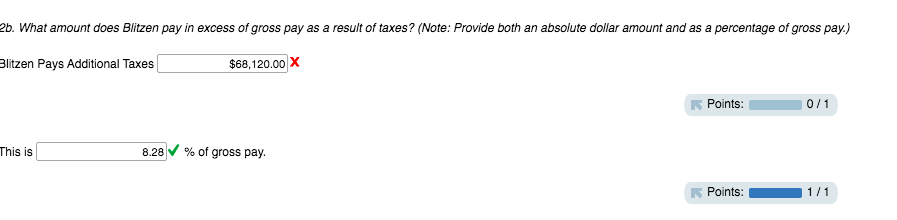

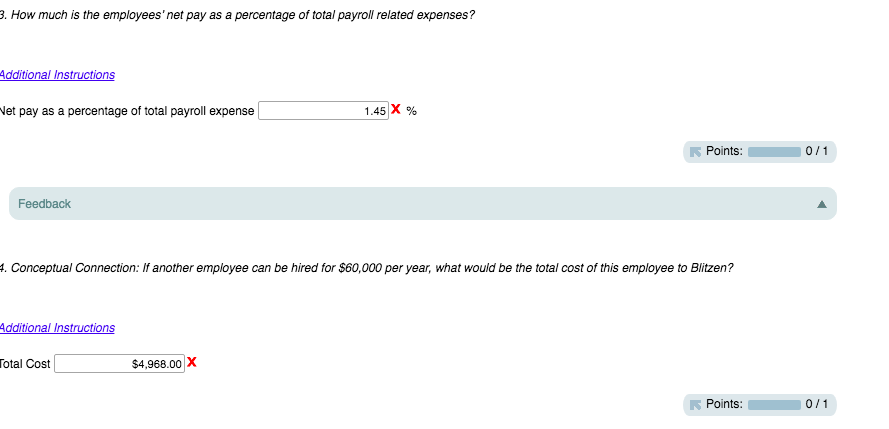

Payroll Accounting and Discussion of Labor Costs Instructions Chart of Accounts General Journal ! Final Questions Instructions Blitzen Marketing Research paid its weekly and monthly payroll on January 31. The following information is available about the payroll: Item Amount Monthly salaries $237,480 Hourly wages 585,000 FICA: 6.20% Social Security (both employee and employer) Medicare (both employee and employer) Withholding for federal income taxes 1.45% $108,500 1,200 Federal unemployment taxes State unemployment taxes 4,000 Blitzen will pay both the employer's taxes and the taxes withheld on April 15. Required: 1. Prepare the journal entries to record the payroll payment and the incurrence of the associated expenses and liabilities. 2. What is the employees' gross pay? What amount does Blitzen pay in excess of gross pay as a result of taxes? (Note: Provide both an absolute dollar amount and as a percentage of gross pay.) 3. How much is the employees' net pay as a percentage of total payroll related expenses? 4. Conceptual connection: If another employee can be hired for $60,000 per year, what would be the total cost of this employee to Blitzen? Score: 128/171 GENERAL JOURNAL IMPACT ON FINANCIAL STATEMENTS BALANCE SHEET INCOME STATEMENT DATE POST. REF. DEBIT CREDIT ASSETS LIABILITIES EQUITY REVENUE EXPENSES NET INCOME 237,480.00 ACCOUNT TITLE Jan. 31 Salaries Expense Wages Expense Social Security Taxes Payable Medicare Taxes Payable 585,000.00 50,994.00 11,926.00 108,500.00 Federal Income Taxes Withholding Payable Cash 651,060.00 Jan. 31 Salaries Expense 68,120.00 Social Security Taxes Expense 50,994.00 11,926.00 Medicare Taxes Payable Federal Unemployment Taxes Expense State Unemployment Taxes Expense Social Security Taxes Expense Wages Expense 1,200.00 4,000.00 50,994.00 56.00 Cash 56.00 2b. What amount does Blitzen pay in excess of gross pay as a result of taxes? (Note: Provide both an absolute dollar amount and as a percentage of gross pay.) Blitzen Pays Additional Taxes $68,120.00 X Points: 0/1 This is 8.28 V % of gross pay. Points: 1/1 3. How much is the employees' net pay as a percentage of total payroll related expenses? Additional Instructions Net pay as a percentage of total payroll expense 1.45 X % Points: 0/1 Feedback 4. Conceptual Connection: If another employee can be hired for $60,000 per year, what would be the total cost of this employee to Blitzen? Additional Instructions Total Cost Points: 0/1

zoom in to see

zoom in to see