ZOOM INTO THE IMAGES IF ANYTHING IS UNCLEAR

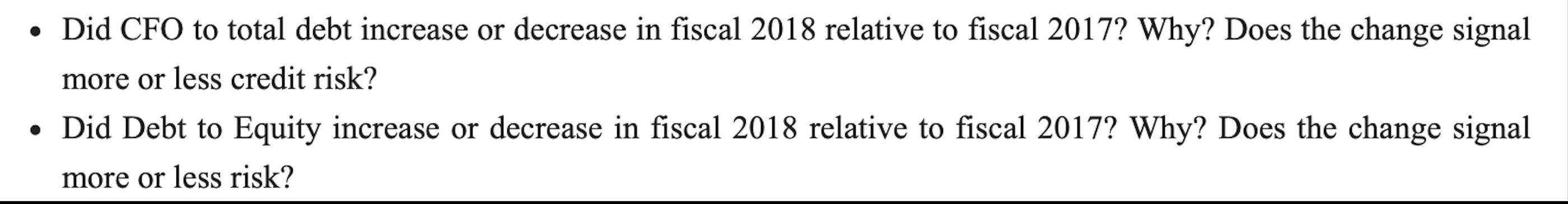

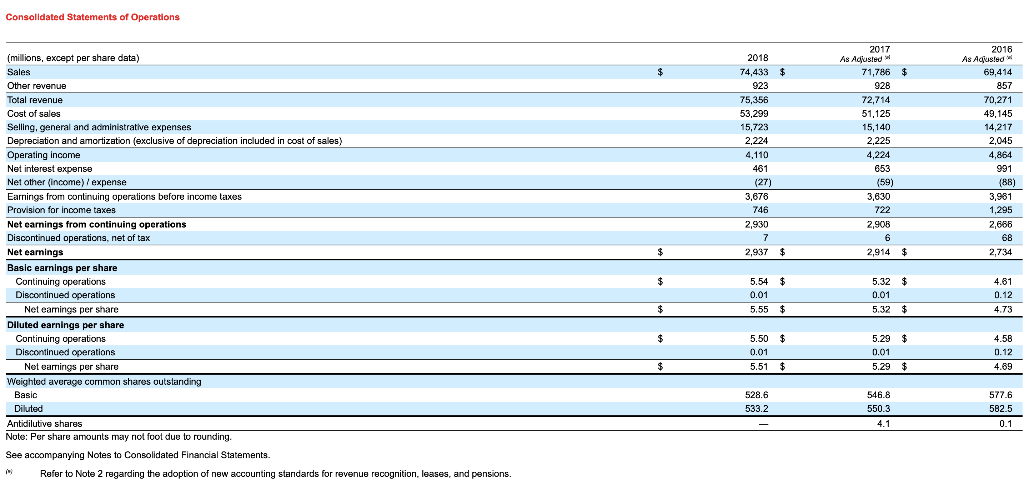

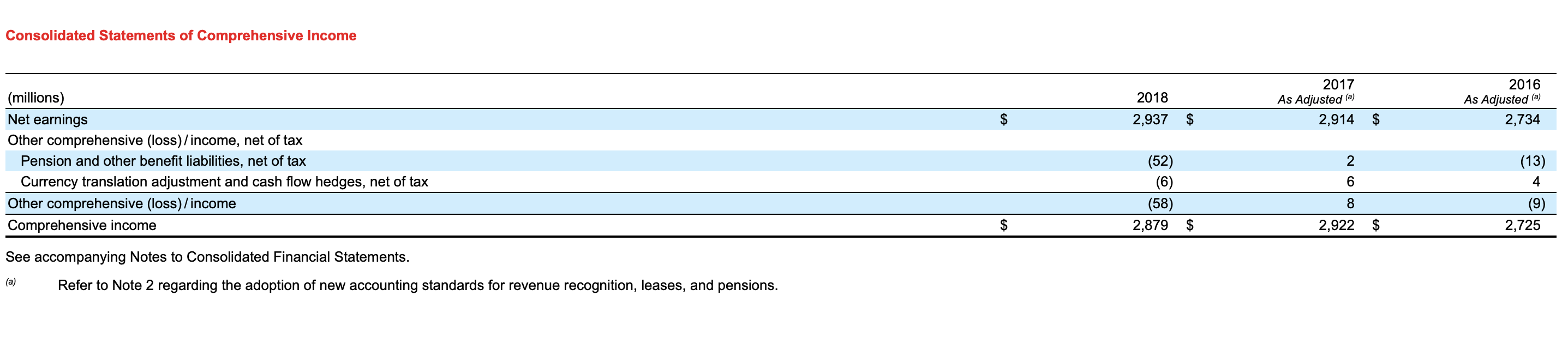

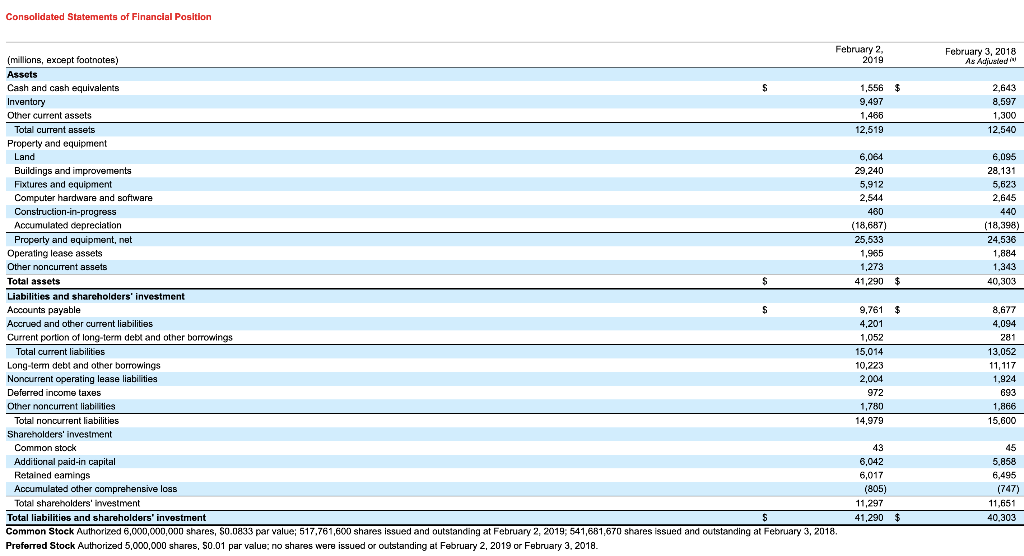

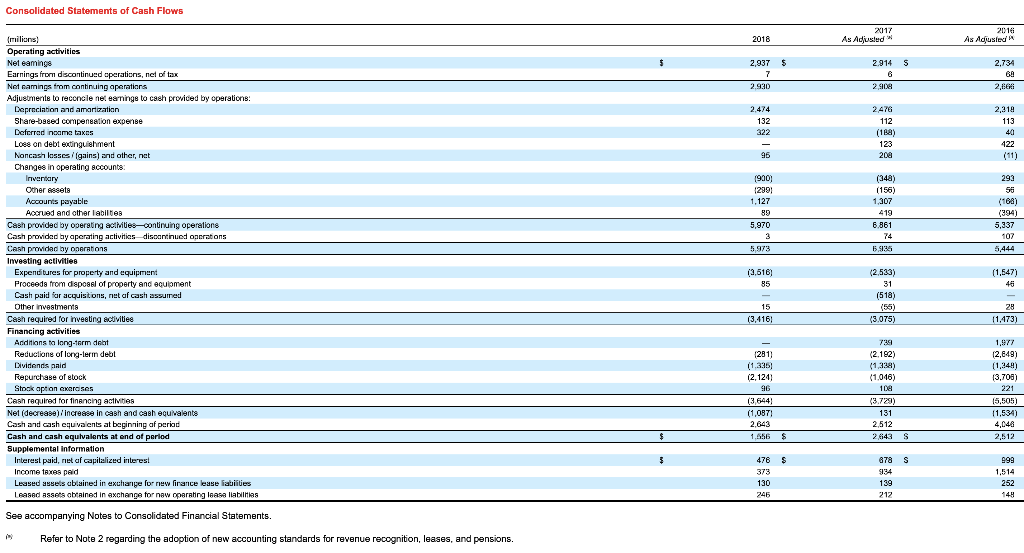

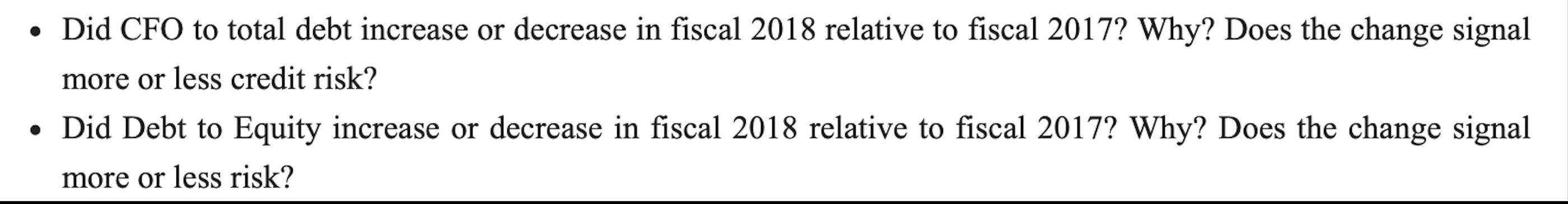

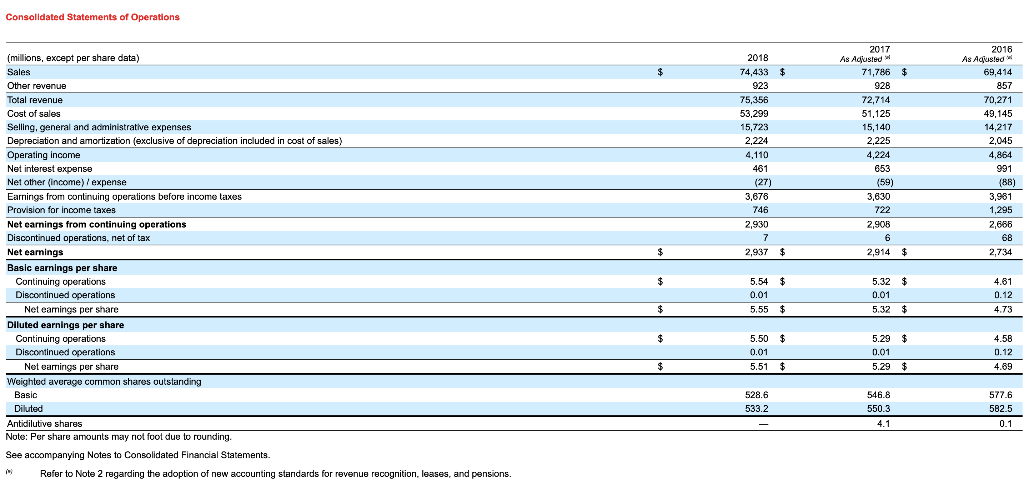

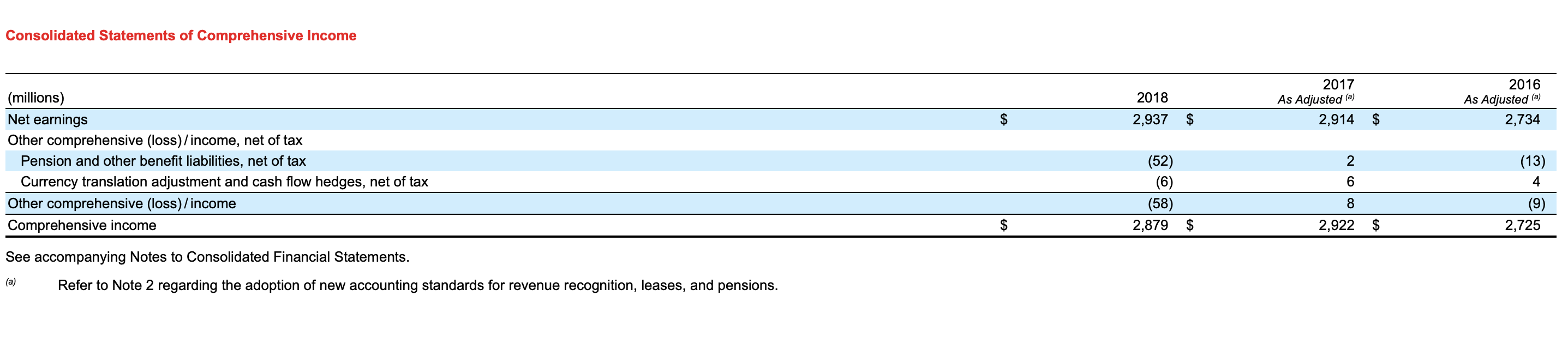

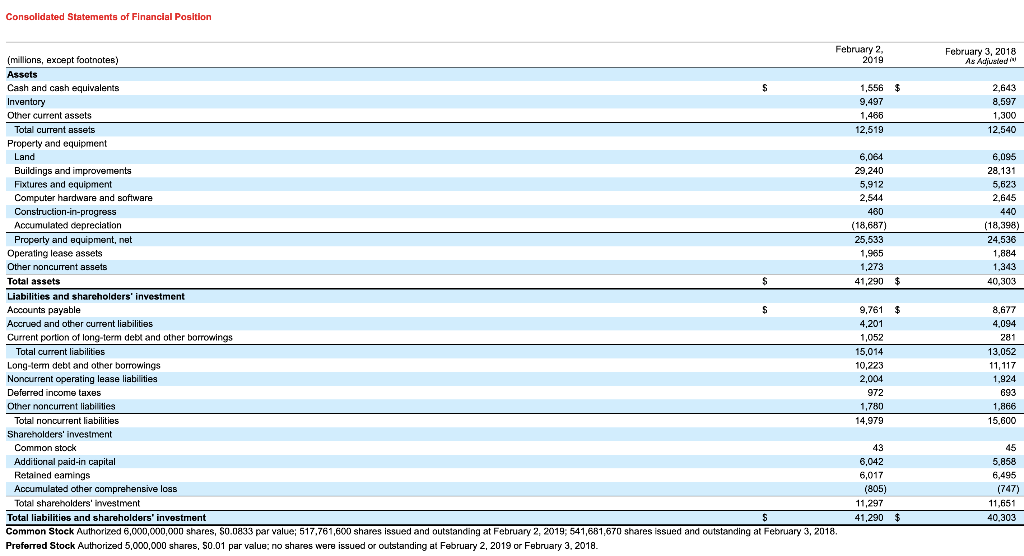

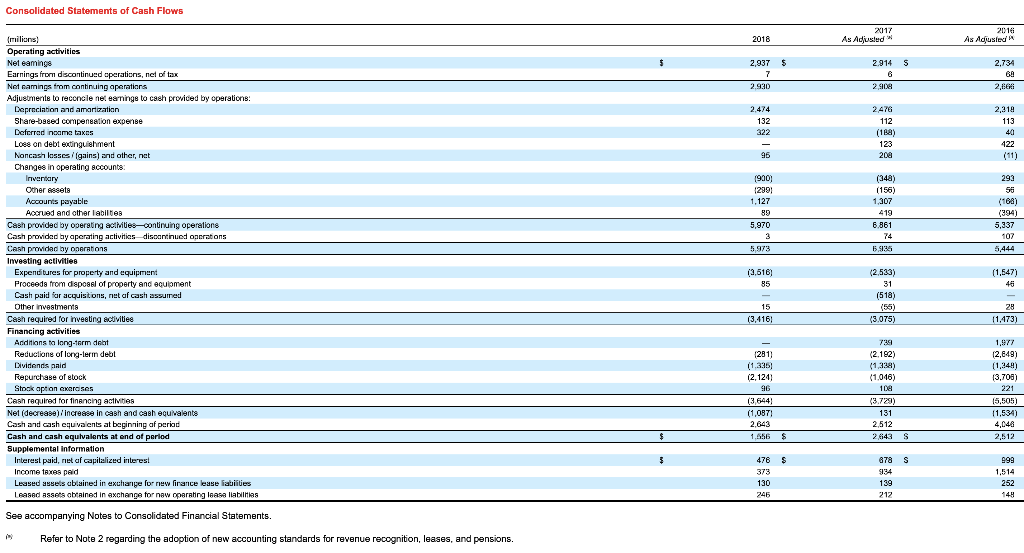

Did CFO to total debt increase or decrease in fiscal 2018 relative to fiscal 2017? Why? Does the change signal more or less credit risk? Did Debt to Equity increase or decrease in fiscal 2018 relative to fiscal 2017? Why? Does the change signal more or less risk? Consolidated Statements of Operations $ $ 2018 74,433 923 75,356 53,299 15.723 2,224 4,110 461 (27) 3,678 746 2,930 2017 As Adjusted 71,786 928 72,714 51,125 15,140 2,225 4,224 653 (59) 3,630 2016 As Adjusted 69,414 857 70,271 49,145 14,217 2,045 4,864 991 188) 2,906 3,981 1,295 2,666 68 2,734 2,937 $ 2,914 $ (millions, except per share data) Sales Other revenue Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income Net interest expense Net other income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earrings per share Weighted average common shares outstanding Basic Diluted Antidilutive shares Note: Por share amounts may not fool due to rounding. See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 5.54 $ $ 4.81 5.32 0.01 5.32 0.12 4.73 $ 5.55 $ $ $ 5.50 $ 0.01 5.51 $ 5.29 0.01 5.29 4.58 0.12 4.69 $ $ 528.6 533.2 - 546.8 550.3 4.1 577.6 582.5 0.1 Consolidated Statements of Comprehensive Income 2018 2,937 2017 As Adjusted (a) 2,914 2016 As Adjusted (a) 2,734 $ $ (millions) Net earnings Other comprehensive (loss)/income, net of tax Pension and other benefit liabilities, net of tax Currency translation adjustment and cash flow hedges, net of tax Other comprehensive (loss)/income Comprehensive income (52) - 2 6 (13) 4 (6) (58) 8 (9) 2,879 $ 2,922 $ 2,725 See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. Consolidated Statements of Financial Position February 3, 2018 As Adiwed $ 2,643 8,597 1,300 12,540 6,095 28.131 5,623 2,645 440 (18.398) 24,536 1,884 1.343 40.303 $ February 2, (millions, except footnotes) 2019 Assets Cash and cash equivalents 1,556 Inventory 9,497 Other current assets 1,466 Total current assets 12,519 Property and equipment Land 6,064 Buildings and improvements 29,240 Fixtures and equipment 5,912 Computer hardware and software 2,544 Construction-in-progress 460 Accumulated depreciation (18,687) Property and equipment, net 25,533 Operating lease assets 1,965 Other noncurrent assets 1,273 Total assets 41.290 Liabilities and shareholders' investment Accounts payable S 9.761 Accrued and other current liabilities 4,201 Current portion of long-term debt and other borrowings 1,052 Total current liabilities 15,014 Long-term debt and other borrowings 10.223 Noncurrent operating lease liabilities 2,004 Deferred income taxes 972 Other noncurrent liabilities 1,780 Total noncurrent liabilities 14,979 Shareholders' investment Common stock Additional paid-in capital 6,042 Retained eamings 6,017 Accumulated other comprehensive loss (805) Total shareholders' investment 11,297 Total liabilities and shareholders' investment 41,290 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019, 541,681,670 shares issued and outstanding at February 3, 2018 Preferred Stock Authorized 5,000,000 shares, 50.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018 $ 8,677 4,094 281 13,052 11,117 1.924 693 1,866 15,600 45 5.858 6,495 (747) 11,651 40,303 $ Consolidated Statements of Cash Flows 2017 2018 As Adjusted 2016 As Adjusted' 2,937 $ 2.914 S 2.734 2.930 2900 2,666 2474 2.219 132 113 2476 112 (188) 123 322 422 200 1900) 293 12991 1.127 89 5,970 (349) (156) 1.307 419 6.861 (106) (394) 5,337 107 5,444 5,973 (milions) Operating activities Net eamings Earnings from discontinued operations, net of tax Net namings from continuing aperations Adjustments to reconcle net earnings to cash provided by operations: Depreciation and amartization Share-b9eed compensation experise Deforrad exame taxes Loes on debt extinguishment Noncash losses i (gains) and other, net Changes in operating accounts: Inventary Other Assets Avacounts payable Accrued and other labilties Cash provided by operating acties-continuing operations Cash provided by aperating activities discontinued operations Cash pridad ay parations Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment Cash paid for acquisitions, net af cash assured Other Investments Cash required for investing activities Financing activities Anditions to long-term dat Reductions of long-lerin debt Dividends naid Recurchase of elock Stock aptan exerases Cash required for financing activities Net (decrease increase in cash and cash equivalents Cash and cash equ valents at baginning af period Cash and cash equivalents at end of period Supplemental information Interest paid, net af capitalized interest Income taxes paid Leased assets abtained in exchange for new firance lease abilities Tagad assets abrained in axchange for now operating lease liabilities (3,516) (2.533) (1,547) (518) (56) (3.075) (3,4161 11,473) 12811 (1.325 (2.1241 (2.192) (1338) (1046) 1,977 12,649) (1,349) 13,708) 221 15,505) 11.534) 4,044 2,512 131 (3,544) (1,087) 2.643 1.456 2,512 2643 $ S $ 878 S 099 476 373 130 245 139 1.514 252 144 See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. Did CFO to total debt increase or decrease in fiscal 2018 relative to fiscal 2017? Why? Does the change signal more or less credit risk? Did Debt to Equity increase or decrease in fiscal 2018 relative to fiscal 2017? Why? Does the change signal more or less risk? Consolidated Statements of Operations $ $ 2018 74,433 923 75,356 53,299 15.723 2,224 4,110 461 (27) 3,678 746 2,930 2017 As Adjusted 71,786 928 72,714 51,125 15,140 2,225 4,224 653 (59) 3,630 2016 As Adjusted 69,414 857 70,271 49,145 14,217 2,045 4,864 991 188) 2,906 3,981 1,295 2,666 68 2,734 2,937 $ 2,914 $ (millions, except per share data) Sales Other revenue Total revenue Cost of sales Selling, general and administrative expenses Depreciation and amortization (exclusive of depreciation included in cost of sales) Operating income Net interest expense Net other income) / expense Earnings from continuing operations before income taxes Provision for income taxes Net earnings from continuing operations Discontinued operations, net of tax Net earings Basic earnings per share Continuing operations Discontinued operations Net earnings per share Diluted earnings per share Continuing operations Discontinued operations Net earrings per share Weighted average common shares outstanding Basic Diluted Antidilutive shares Note: Por share amounts may not fool due to rounding. See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. 5.54 $ $ 4.81 5.32 0.01 5.32 0.12 4.73 $ 5.55 $ $ $ 5.50 $ 0.01 5.51 $ 5.29 0.01 5.29 4.58 0.12 4.69 $ $ 528.6 533.2 - 546.8 550.3 4.1 577.6 582.5 0.1 Consolidated Statements of Comprehensive Income 2018 2,937 2017 As Adjusted (a) 2,914 2016 As Adjusted (a) 2,734 $ $ (millions) Net earnings Other comprehensive (loss)/income, net of tax Pension and other benefit liabilities, net of tax Currency translation adjustment and cash flow hedges, net of tax Other comprehensive (loss)/income Comprehensive income (52) - 2 6 (13) 4 (6) (58) 8 (9) 2,879 $ 2,922 $ 2,725 See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions. Consolidated Statements of Financial Position February 3, 2018 As Adiwed $ 2,643 8,597 1,300 12,540 6,095 28.131 5,623 2,645 440 (18.398) 24,536 1,884 1.343 40.303 $ February 2, (millions, except footnotes) 2019 Assets Cash and cash equivalents 1,556 Inventory 9,497 Other current assets 1,466 Total current assets 12,519 Property and equipment Land 6,064 Buildings and improvements 29,240 Fixtures and equipment 5,912 Computer hardware and software 2,544 Construction-in-progress 460 Accumulated depreciation (18,687) Property and equipment, net 25,533 Operating lease assets 1,965 Other noncurrent assets 1,273 Total assets 41.290 Liabilities and shareholders' investment Accounts payable S 9.761 Accrued and other current liabilities 4,201 Current portion of long-term debt and other borrowings 1,052 Total current liabilities 15,014 Long-term debt and other borrowings 10.223 Noncurrent operating lease liabilities 2,004 Deferred income taxes 972 Other noncurrent liabilities 1,780 Total noncurrent liabilities 14,979 Shareholders' investment Common stock Additional paid-in capital 6,042 Retained eamings 6,017 Accumulated other comprehensive loss (805) Total shareholders' investment 11,297 Total liabilities and shareholders' investment 41,290 Common Stock Authorized 6,000,000,000 shares, $0.0833 par value; 517,761,600 shares issued and outstanding at February 2, 2019, 541,681,670 shares issued and outstanding at February 3, 2018 Preferred Stock Authorized 5,000,000 shares, 50.01 par value; no shares were issued or outstanding at February 2, 2019 or February 3, 2018 $ 8,677 4,094 281 13,052 11,117 1.924 693 1,866 15,600 45 5.858 6,495 (747) 11,651 40,303 $ Consolidated Statements of Cash Flows 2017 2018 As Adjusted 2016 As Adjusted' 2,937 $ 2.914 S 2.734 2.930 2900 2,666 2474 2.219 132 113 2476 112 (188) 123 322 422 200 1900) 293 12991 1.127 89 5,970 (349) (156) 1.307 419 6.861 (106) (394) 5,337 107 5,444 5,973 (milions) Operating activities Net eamings Earnings from discontinued operations, net of tax Net namings from continuing aperations Adjustments to reconcle net earnings to cash provided by operations: Depreciation and amartization Share-b9eed compensation experise Deforrad exame taxes Loes on debt extinguishment Noncash losses i (gains) and other, net Changes in operating accounts: Inventary Other Assets Avacounts payable Accrued and other labilties Cash provided by operating acties-continuing operations Cash provided by aperating activities discontinued operations Cash pridad ay parations Investing activities Expenditures for property and equipment Proceeds from disposal of property and equipment Cash paid for acquisitions, net af cash assured Other Investments Cash required for investing activities Financing activities Anditions to long-term dat Reductions of long-lerin debt Dividends naid Recurchase of elock Stock aptan exerases Cash required for financing activities Net (decrease increase in cash and cash equivalents Cash and cash equ valents at baginning af period Cash and cash equivalents at end of period Supplemental information Interest paid, net af capitalized interest Income taxes paid Leased assets abtained in exchange for new firance lease abilities Tagad assets abrained in axchange for now operating lease liabilities (3,516) (2.533) (1,547) (518) (56) (3.075) (3,4161 11,473) 12811 (1.325 (2.1241 (2.192) (1338) (1046) 1,977 12,649) (1,349) 13,708) 221 15,505) 11.534) 4,044 2,512 131 (3,544) (1,087) 2.643 1.456 2,512 2643 $ S $ 878 S 099 476 373 130 245 139 1.514 252 144 See accompanying Notes to Consolidated Financial Statements. Refer to Note 2 regarding the adoption of new accounting standards for revenue recognition, leases, and pensions