Answered step by step

Verified Expert Solution

Question

1 Approved Answer

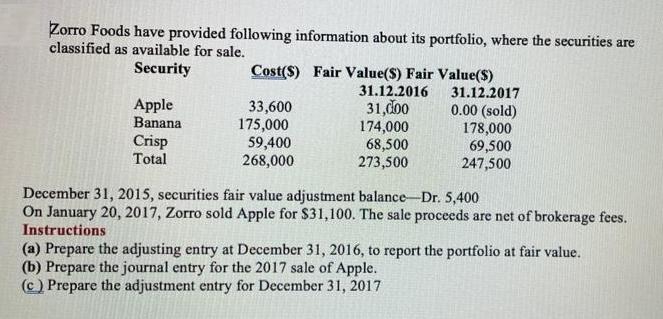

Zorro Foods have provided following information about its portfolio, where the securities are classified as available for sale. Security Cost(S) Fair Value($) Fair Value($)

Zorro Foods have provided following information about its portfolio, where the securities are classified as available for sale. Security Cost(S) Fair Value($) Fair Value($) 31.12.2016 31.12.2017 Apple 33,600 31,000 0.00 (sold) Banana 175,000 174,000 178,000 Crisp 59,400 68,500 69,500 Total 268,000 273,500 247,500 December 31, 2015, securities fair value adjustment balance Dr. 5,400 On January 20, 2017, Zorro sold Apple for $31,100. The sale proceeds are net of brokerage fees. Instructions (a) Prepare the adjusting entry at December 31, 2016, to report the portfolio at fair value. (b) Prepare the journal entry for the 2017 sale of Apple. (c) Prepare the adjustment entry for December 31, 2017

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a Security Cost Fair Value Fair Value 31122016 31122017 Apple 33600 31000 000 sold Banana 175000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started