Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zudo Furniture produces living room sets in its three factories, and then ships the sets to two depots. Then, these sets are shipped from depots

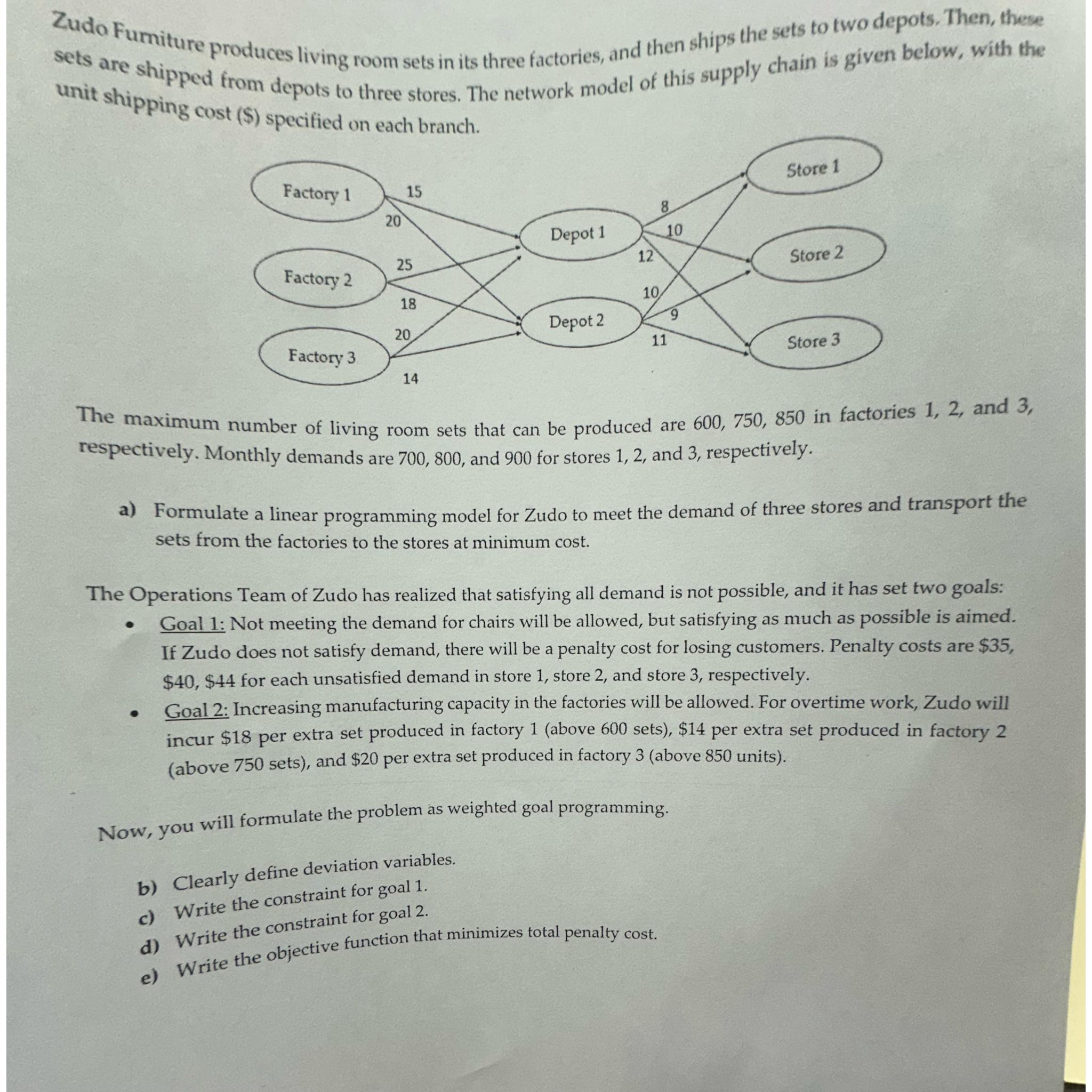

Zudo Furniture produces living room sets in its three factories, and then ships the sets to two depots. Then, these sets are shipped from depots to three stores. The network model of this supply chain is given below, with the unit shipping cost $ specified on each branch.

The maximum number of living room sets that can be produced are in factories and respectively. Monthly demands are and for stores and respectively.

a Formulate a linear programming model for Zudo to meet the demand of three stores and transport the sets from the factories to the stores at minimum cost.

The Operations Team of Zudo has realized that satisfying all demand is not possible, and it has set two goals:

Goal : Not meeting the demand for chairs will be allowed, but satisfying as much as possible is aimed. If Zudo does not satisfy demand, there will be a penalty cost for losing customers. Penalty costs are $ $$ for each unsatisfied demand in store store and store respectively.

Goal : Increasing manufacturing capacity in the factories will be allowed. For overtime work, Zudo will incur $ per extra set produced in factory above sets $ per extra set produced in factory above sets and $ per extra set produced in factory above units

Now, you will formulate the problem as weighted goal programming.

b Clearly define deviation variables.

c Write the constraint for goal

d Write the constraint for goal

e Write the objective function that minimizes total penalty cost.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started