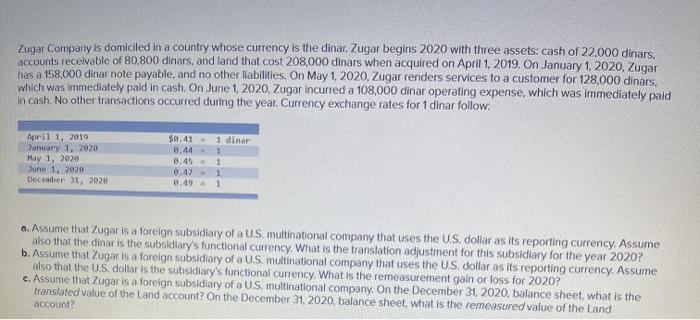

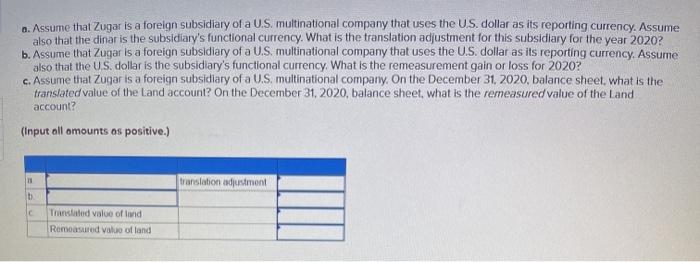

Zugar Company is domiciled in a country whose currency is the dinar. Zugar begins 2020 with three assets: cash of 22.000 dinars. accounts receivable of 80,800 dinars, and land that cost 208,000 dinars when acquired on April 1, 2019. On January 1, 2020. Zugar has a 158,000 dinar note payable, and no other liabilities. On May 1, 2020, Zugar renders services to a customer for 128.000 dinars, which was immediately paid in cash On June 1, 2020, Zugar incurred a 108,000 dinar operating expense, which was immediately paid in cash. No other transactions occurred during the year. Currency exchange rates for 1 dinar follow: 1 dinar April 1, 2019 January 1, 2020 May 1, 2020 une 1. 2020 December 31, 2020 $0.41 0.44 0.45 1 1 1 8.49 o. Assume that Zugar is a foreign subsidiary of a U.S. multinational company that uses the US dollar as its reporting currency. Assume also that the dinar is the subsidiary's functional currency. What is the translation adjustment for this subsidiary for the year 2020? b. Assume that Zugar is a foreign subsidiary of a US multinational company that uses the U.S. dollar as its reporting currency. Assume also that the US dollar is the subsidiary's functional currency. What is the remeasurement gain or loss for 2020? c. Assume that Zugar is a foreign subsidiary of a U.S. multinational company. On the December 31, 2020, balance sheet, what is the translated value of the Land account? On the December 31, 2020, balance sheet, what is the remeasured value of the Land account? 6. Assume that Zugar is a foreign subsidiary of a U.S. multinational company that uses the US dollar as its reporting currency. Assume also that the dinar is the subsidiary's functional currency. What is the translation adjustment for this subsidiary for the year 2020? b. Assume that Zugar is a foreign subsidiary of a U.S. multinational company that uses the U.S. dollar as its reporting currency. Assume also that the U.S. dollar is the subsidiary's functional currency. What is the remeasurement gain or loss for 2020? c. Assume that Zugar is a foreign subsidiary of a U.S. multinational company. On the December 31, 2020, balance sheet. what is the translated value of the Land account? On the December 31, 2020, balance sheet, what is the remeasured value of the Land account? (Input ollomounts os positive.) translation adjustment le Translated value of land Romeasured value of land