Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zumba Ltd entered into an agreement to lease specialised equipment for a five-year period, commencing January 1, 2021. At that date, the equipment had

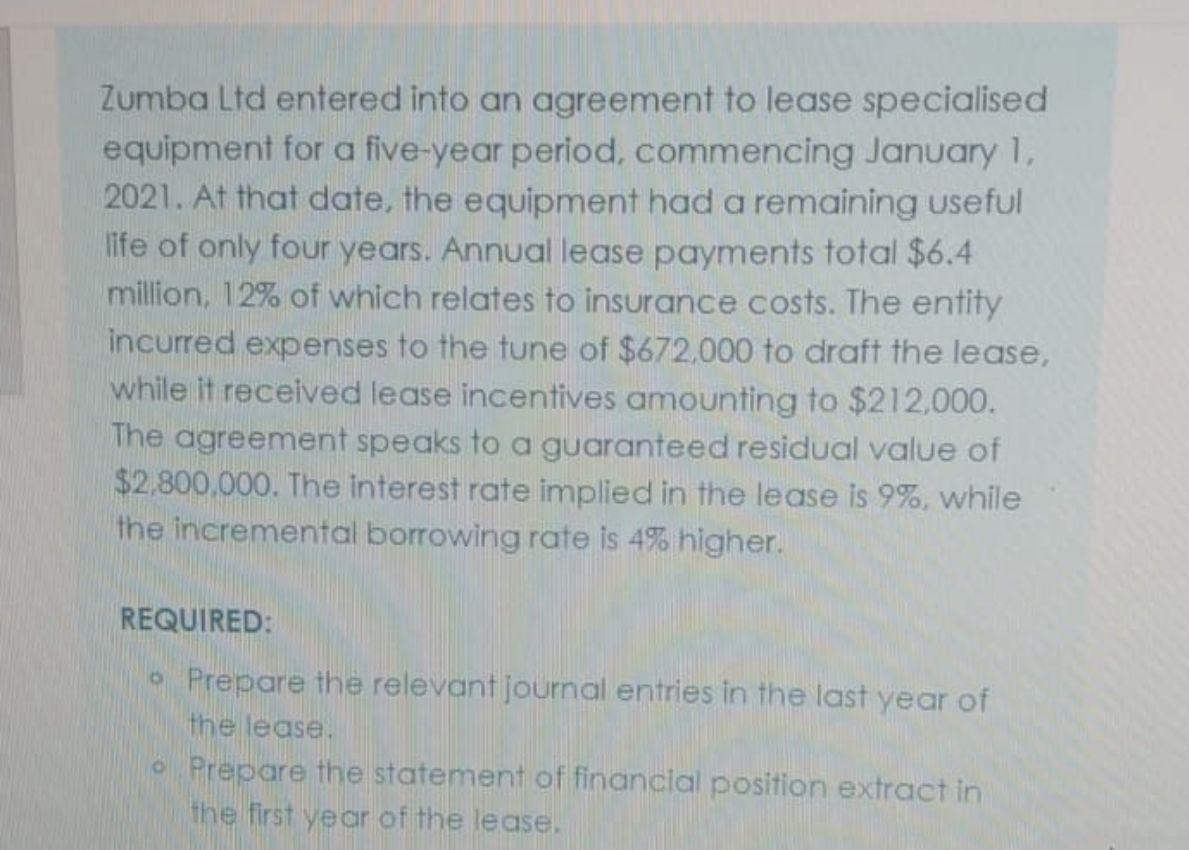

Zumba Ltd entered into an agreement to lease specialised equipment for a five-year period, commencing January 1, 2021. At that date, the equipment had a remaining useful life of only four years. Annual lease payments total $6.4 million, 12% of which relates to insurance costs. The entity incurred expenses to the tune of $672,000 to draft the lease, while it received lease incentives amounting to $212,000. The agreement speaks to a guaranteed residual value of $2,800,000. The interest rate implied in the lease is 9%, while the incremental borrowing rate is 4% higher. REQUIRED: Prepare the relevant journal entries in the last year of the lease. Prepare the statement of financial position extract in the first year of the lease.

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

aDecember 31 2019 Prepaid insurance 576000 Accumulated amortization of lease incentive 212000 Liabil...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started