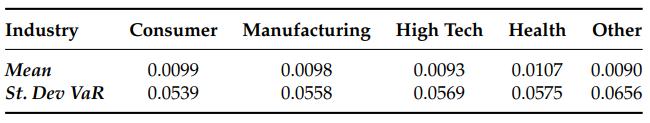

Calculate the monthly VaR at the 99 percent and 90 percent confidence level for various market segments

Question:

Calculate the monthly VaR at the 99 percent and 90 percent confidence level for various market segments given below. These are average value weighted returns obtained from http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. The data include monthly returns from July 1926 through December 2010. Assume a current portfolio value of $100,000.

Transcribed Image Text:

Industry Consumer Mean 0.0099 St. Dev VaR 0.0539 Manufacturing High Tech 0.0098 0.0558 0.0093 0.0569 Health Other 0.0107 0.0090 0.0575 0.0656

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To calculate the Value at Risk VaR for the given market segments at the 99 percent and 90 percent confidence levels we will use the mean and standard ...View the full answer

Answered By

Ashington Waweru

I am a lecturer, research writer and also a qualified financial analyst and accountant. I am qualified and articulate in many disciplines including English, Accounting, Finance, Quantitative spreadsheet analysis, Economics, and Statistics. I am an expert with sixteen years of experience in online industry-related work. I have a master's in business administration and a bachelor’s degree in education, accounting, and economics options.

I am a writer and proofreading expert with sixteen years of experience in online writing, proofreading, and text editing. I have vast knowledge and experience in writing techniques and styles such as APA, ASA, MLA, Chicago, Turabian, IEEE, and many others.

I am also an online blogger and research writer with sixteen years of writing and proofreading articles and reports. I have written many scripts and articles for blogs, and I also specialize in search engine

I have sixteen years of experience in Excel data entry, Excel data analysis, R-studio quantitative analysis, SPSS quantitative analysis, research writing, and proofreading articles and reports. I will deliver the highest quality online and offline Excel, R, SPSS, and other spreadsheet solutions within your operational deadlines. I have also compiled many original Excel quantitative and text spreadsheets which solve client’s problems in my research writing career.

I have extensive enterprise resource planning accounting, financial modeling, financial reporting, and company analysis: customer relationship management, enterprise resource planning, financial accounting projects, and corporate finance.

I am articulate in psychology, engineering, nursing, counseling, project management, accounting, finance, quantitative spreadsheet analysis, statistical and economic analysis, among many other industry fields and academic disciplines. I work to solve problems and provide accurate and credible solutions and research reports in all industries in the global economy.

I have taught and conducted masters and Ph.D. thesis research for specialists in Quantitative finance, Financial Accounting, Actuarial science, Macroeconomics, Microeconomics, Risk Management, Managerial Economics, Engineering Economics, Financial economics, Taxation and many other disciplines including water engineering, psychology, e-commerce, mechanical engineering, leadership and many others.

I have developed many courses on online websites like Teachable and Thinkific. I also developed an accounting reporting automation software project for Utafiti sacco located at ILRI Uthiru Kenya when I was working there in year 2001.

I am a mature, self-motivated worker who delivers high-quality, on-time reports which solve client’s problems accurately.

I have written many academic and professional industry research papers and tutored many clients from college to university undergraduate, master's and Ph.D. students, and corporate professionals. I anticipate your hiring me.

I know I will deliver the highest quality work you will find anywhere to award me your project work. Please note that I am looking for a long-term work relationship with you. I look forward to you delivering the best service to you.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Implementing Enterprise Risk Management Case Studies And Best Practices

ISBN: 9781118745762

2nd Edition

Authors: John Fraser, Betty Simkins, Kristina Narvaez

Question Posted:

Students also viewed these Business questions

-

An investor owns stock in two firms, A and B: 250 shares of A, with a current market price of $28/share for a total $7,000 investment value, with an expected return this year of 7.5% 400 shares of B,...

-

A company paid $1.8 million to acquire the business of a sole trader. The sole trader's assets and liabilities were valued as follows. How much was paid for Goodwill? A. $650 000 B. $750 000 C. $850...

-

List three specific parts of the Case Guide, Objectives and Strategy Section (See below) that you had the most difficulty understanding. Describe your current understanding of these parts. Provide...

-

Considering Vdc = 2 volt, find the load line (Showing all calculations) Data Collection: Theoretical value:R=1kse Measuned valu e:R Ike Vde (volt) Va (volf> VR (volt) I VR CHA) 0.1 0.09 0.00 2 0.00...

-

Two narrow parallel slits separated by 0.850 mm are illuminated by 600-nm light, and the viewing screen is 2.80 m away from the slits. (a) What is the phase difference between the two interfering...

-

What four factors affect the target capital structure? AppendixLO1

-

6. Discuss the relative merits of including risk adjustments in cash flow or in discount ratesespecially for high-growth companies in emergingmarkets.

-

Ray County administers a tax custodial fund, an investment trust fund, and a private-purpose trust fund. The tax custodial fund acts as custodian for the county, a city within the county, and the...

-

How do interest rate expectations influence IRP?

-

Obtain v(t) and i(t) for t > 0 in the circuit in Fig. 16.54 . 5 H ll i(t) 24 V (+ 10u(t) v(t) 200 mF

-

What happens when markets are behaving irrationally? Do VaR estimates hold up in these types of circumstances?

-

Assume a portfolio is currently worth $250 million. If the portfolio has volatility of 12 percent and a holding period of 15 business days, what is the VaR estimate with 97.5 percent confidence? Now...

-

Good accounting systems help in managing cash and controlling who has access to it. 1. What items are included in the category of cash? 2. What items are included in the category of cash equivalents?...

-

PROVIDE A CASE BRIEF FOR THE FOLLOWING CASE PROVIDED BELOW: PEOPLE v. REKTE Court of Appeal, Fourth District, Division 2, California. The PEOPLE, Plaintiff and Respondent, v. Viktors Andris REKTE,...

-

The time between release from prison and another crime charge for a certain group of men is 36 months with a standard deviation of 9 months. What percentage of men get charged with a second crime...

-

capacitance simulation: https://phet.colorado.edu/sims/html/capacitor-lab-basics/latest/capacitor-lab-basics_en.html w Lab 4 (1).docx Homework Help - Q&A from Or x + C...

-

Mel Jackson, a resident of Tennessee, has been a driver for Blues Delivery Company for the past 7 years. For this purpose, he leases a truck from Blue, and his compensation is based on a percentage...

-

On Halloween night, a small boy decided to dress up as a bank robber. He went to house where the lights were on, indicating that the owner was receiving trick-or-treaters. When the homeowner, a...

-

A robotic arm and camera could be used to pick fruit, as shown in Figure E4.3(a). The camera is used to close the feedback loop to a microcomputer, which controls the arm [8, 9]. The transfer...

-

You've been asked to take over leadership of a group of paralegals that once had a reputation for being a tight-knit, supportive team, but you quickly figure out that this team is in danger of...

-

he risks that hedge funds take are regulated by their prime brokers. Discuss this statement.

-

It is important for a hedge fund to be right in the long term. Shortterm gains and losses do not matter. Discuss this statement.

-

Explain the meanings of the terms hurdle rate, highwater mark clause, and clawback clause when used in connection with the incentive fees of hedge funds.

-

If John invested $20,000 in a stock paying annual qualifying dividends equal to 4% of his investment, what would the value of his investment be 5 years from now? Assume Johns marginal ordinary tax...

-

help asap please!

-

Please, help asap! I have one day. Feedback will be given. & show some work. [in Excel] For the final project you will need you to create a spreadsheet /proforma of the cash flows from a property....

Study smarter with the SolutionInn App