List the bankruptcy costs incurred by the company in Business Snapshot 1.1. BUSINESS SNAPSHOT 1.1 The Hidden

Question:

List the bankruptcy costs incurred by the company in Business Snapshot 1.1.

Transcribed Image Text:

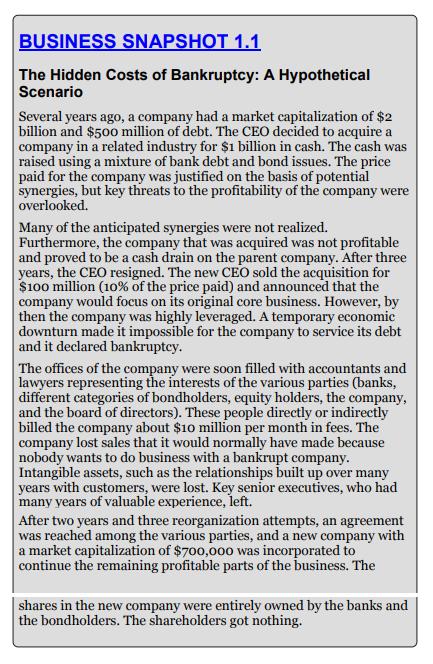

BUSINESS SNAPSHOT 1.1 The Hidden Costs of Bankruptcy: A Hypothetical Scenario Several years ago, a company had a market capitalization of $2 billion and $500 million of debt. The CEO decided to acquire a company in a related industry for $1 billion in cash. The cash was raised using a mixture of bank debt and bond issues. The price paid for the company was justified on the basis of potential synergies, but key threats to the profitability of the company were overlooked. Many of the anticipated synergies were not realized. Furthermore, the company that was acquired was not profitable and proved to be a cash drain on the parent company. After three years, the CEO resigned. The new CEO sold the acquisition for $100 million (10% of the price paid) and announced that the company would focus on its original core business. However, by then the company was highly leveraged. A temporary economic downturn made it impossible for the company to service its debt and it declared bankruptcy. The offices of the company were soon filled with accountants and lawyers representing the interests of the various parties (banks, different categories of bondholders, equity holders, the company, and the board of directors). These people directly or indirectly billed the company about $10 million per month in fees. The company lost sales that it would normally have made because nobody wants to do business with a bankrupt company. Intangible assets, such as the relationships built up over many years with customers, were lost. Key senior executives, who had many years of valuable experience, left. After two years and three reorganization attempts, an agreement was reached among the various parties, and a new company with a market capitalization of $700,000 was incorporated to continue the remaining profitable parts of the business. The shares in the new company were entirely owned by the banks and the bondholders. The shareholders got nothing.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Professional fees 10 million per mo...View the full answer

Answered By

Susan Juma

I'm available and reachable 24/7. I have high experience in helping students with their assignments, proposals, and dissertations. Most importantly, I'm a professional accountant and I can handle all kinds of accounting and finance problems.

4.40+

15+ Reviews

45+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

1. Blueprint Problem: Absorption Costing and Variable Costing Absorption Costing versus Variable Costing The cost of manufactured products consists of direct materials, direct labor, and factory...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Q1: How would a supply chain management and customer relationship management system help the company? What are limitations? 1 answer

-

In this age of globalization, some thought leaders argue that all industries are becoming global and that all firms need to adopt a global standardization strategy. Do you agree? Why or why not?

-

Which atom is larger, lithium (Li) or beryllium (Be)? Explain your answer.

-

Supply chain management performance. The leadership characteristics of supply chain managers were investigated in the Journal of the International Academy for Case Studies (Vol. 26, 2020). Each in a...

-

In a certain large city, hot dog vendors are perfectly competitive, and face a market price of $1.00 per hot dog. Each hot dog vendor has the following total cost schedule: Number of Hot Dogs per Day...

-

Triangle Fastener Corporation accumulates costs for its single product using process costing. Direct material is added at the beginning of the production process, and conversion activity occurs...

-

The return from the market last year was 10% and the risk free rate was 5%. A hedge fund manager with a beta of 0.6 has an alpha of 4%. What return did the hedge fund manager earn?

-

Why do you think that banks are regulated to ensure that they do not take too much risk but most other companies (for example, those in manufacturing and retailing) are not?

-

An entrepreneur of a new venture has had no success in getting financing from formal venture capitalists. He now has decided to turn to the informal risk capital market. Who is in this market? How...

-

A company which manufactures microwaves advertises that 90% of their microwaves are flawless, requiring no adjustments. Their quality control department tests this percentage on a regular basis. On...

-

A new retail store is being planned for a site that contains 40 ft of soft clay (c 0.075 ft2/day, y = 100 pcf). The clay layer is overlain by 15 ft of sand (y = 112 pcf) and is underlain by dense...

-

Perez Bags (PB) is a designer of high-quality backpacks and purses. Each design is made in small batches. Each spring, PB comes out with new designs for the backpack and for the purse. The company...

-

Find a recent (within the last 12 months) article or economic blog related to price fixing, provide an executive summary of the information. Include an APA reference and/or link. How does the fact...

-

A rectangular block of a material with a modulus of rigidity G=90 ksi is bonded to two rigid horizontal plates. The lower plate is fixed, while the upper plate is subjected to a horizontal force P....

-

Explain the IRSs position regarding whether a liquidation transaction will be considered open or closed.

-

a. What is meant by the term tax haven? b. What are the desired characteristics for a country if it expects to be used as a tax haven? c. What are the advantages leading an MNE to use a tax haven...

-

Give an example of a recent purchase you made where the purchase wasnt just a single transaction but rather part of an ongoing relationship with the seller. Discuss what the seller has done (or could...

-

Discuss how the micro-macro dilemma relates to each of the following products: high-powered engines in cars, nuclear power, bank credit cards, and pesticides that improve farm production.

-

s problem introduces you to the computer-aided prob lem (CAP) softwarewhich is at the O n line Learning Center for this textand gets you started with the use of spreadsheet analysis for marketing...

-

Assume that an investment of $100,000 is expected to grow during the next year by 8% with SD 20%, and that the return is normally distributed. Whats the 5% VaR for the investment? A. $24,898 B....

-

Simpson Ltd is a small IT company, which has 2 million shares outstanding and a share price of $20 per share. The management of Simpson plans to increase debt and suggests it will generate $3 million...

-

The following are the information of Chun Equipment Company for Year 2 . ( Hint: Some of the items will not appear on either statement, and ending retained earnings must be calculated. ) Salaries...

Study smarter with the SolutionInn App