Bonnie and Jake (ages 35 and 36, respectively) are married with no dependents and live in Montana

Question:

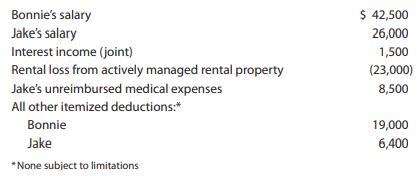

Bonnie and Jake (ages 35 and 36, respectively) are married with no dependents and live in Montana (not a community property state). Because Jake has large medical expenses, they seek your advice about filing separately to save taxes. Their income and expenses for 2021 are as follows:

Determine whether Bonnie and Jake should file jointly or separately for 2021.

Transcribed Image Text:

Bonnie's salary Jake's salary Interest income (joint) Rental loss from actively managed rental property Jake's unreimbursed medical expenses All other itemized deductions:* Bonnie Jake *None subject to limitations $ 42,500 26,000 1,500 (23,000) 8,500 19,000 6,400

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 83% (12 reviews)

Jakes medical expenses are deductible only if they e...View the full answer

Answered By

Labindao Antoque

I graduated in 2018 with a Bachelor of Science degree in Psychology from Dalubhasaan ng Lungsod ng San Pablo. I tutored students in classes and out of classes. I use a variety of strategies to tutor students that include: lecture, discussions about the subject matter, problem solving examples using the principles of the subject matter being discussed in class , homework assignments that are directed towards reinforcing what we learn in class , and detailed practice problems help students to master a concept. I also do thorough research on Internet resources or textbooks so that I know what students need to learn in order to master what is being taught in class .

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-4. Ivan and Irene paid the following in 2012 (all by check or can otherwise be...

-

Planning is one of the most important management functions in any business. A front office managers first step in planning should involve determine the departments goals. Planning also includes...

-

Show that the sum of the squares of the distances from a point P = (c, d) to n fixed points (a 1 , b 1 ), . . . ,(a n , b n ) is minimized when c is the average of the x-coordinates a i and d is the...

-

In each case identify the arbitrage and demonstrate how you would make money by creating a table showing your payoff. a. Consider two European options on the same stock with the same time to...

-

How might you draw an indifference curve map that illustrates the following ideas? a. Margarine is just as good as the high-priced spread. b. Things go better with Coke. c. Popcorn is addictive - the...

-

Information: The following financial statements and additional information are reported. Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange...

-

In 2016 the Better Business Bureau settled 80% of complaints they received in the United States. Suppose you have been hired by the Better Business Bureau to investigate the complaints they received...

-

Bluegill, Inc. produces spin cast fishing reels. The company's controller has provided you with the following information. Beginning balance, Direct Materials Inventory Ending balance, Direct...

-

A heat pump receives heat from a lake that has an average winter time temperature of 6°C and supplies heat into a house having an average temperature of 27°C. (a) If the house loses heat to...

-

A number of years ago, Lee acquired a 20% interest in the BlueSky Partnership for $60,000. The partnership was profitable through 2020, and Lees amount at risk in the partnership interest was...

-

Five years ago Gerald invested $150,000 in a passive activity, his sole investment venture. On January 1, 2020, his amount at risk in the activity was $30,000. His shares of the income and losses...

-

a. What are the differences between a Eurobond and a foreign bond? b. What are Eurodollars?

-

reflective account of your development as a postgraduate learner since joining SBS considering the points below. Critically reflect on one or more points below: Assessment Criteria Use a reflective...

-

Technology, strategy, size, and environment are among the factors that influence leaders' choice of organization structure (Schulman, 2020). The leaders must consider the technology to be used in the...

-

6. Answer the following briefly. a.What is the metric and its hurdle rate for an "Enterprise" to increase its enterprise value? b.What is the metric and its hurdle rate for the corporation's equity...

-

Name the two major preceding management theories that contributed to the development of quality management theory. Briefly explain the major concepts of each of these preceding theories that were...

-

922-19x 8 After finding the partial fraction decomposition. (22 + 4)(x-4) dx = dz Notice you are NOT antidifferentiating...just give the decomposition. x+6 Integrate -dx. x33x The partial fraction...

-

Solve the equation. 2x 1 %3| 3 0 2

-

Test whether the 5-year survival rate for breast cancer is significantly different between African American and Caucasian women who are younger than 50 years of age and have localized disease....

-

Selma operates a contractors supply store. She maintains her books using the cash method. At the end of 2022, her accountant computes her accrual basis income that is used on her tax return. For...

-

Al is a medical doctor who conducts his practice as a sole proprietor. During 2022, he received cash of $280,000 for medical services. Of the amount collected, $40,000 was for services provided in...

-

Al is a medical doctor who conducts his practice as a sole proprietor. During 2022, he received cash of $280,000 for medical services. Of the amount collected, $40,000 was for services provided in...

-

Each week you must submit an annotated bibliography. Entries of current events relating to the economic concepts and the impact on the company or the industry of your company. You must use acceptable...

-

Fluffy Toys Ltd produces stuffed toys and provided you with the following information for the month ended August 2020 Opening WIP Units 5,393 units Units Started and Completed 24,731 units Closing...

-

Part A Equipment 1,035,328 is incorrect Installation 44,672 is incorrect Anything boxed in red is incorrect sents 043/1 Question 9 View Policies Show Attempt History Current Attempt in Progress...

Study smarter with the SolutionInn App