For calendar year 2021, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their

Question:

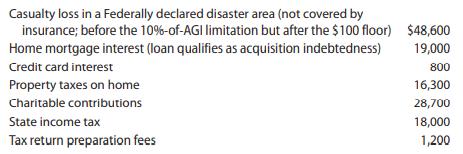

For calendar year 2021, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows:

Calculate the amount of itemized deductions the Gibsons may claim for the year.

Transcribed Image Text:

Casualty loss in a Federally declared disaster area (not covered by insurance; before the 10%-of-AGI limitation but after the $100 floor) Home mortgage interest (loan qualifies as acquisition indebtedness) Credit card interest Property taxes on home Charitable contributions State income tax Tax return preparation fees $48,600 19,000 800 16,300 28,700 18,000 1,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 71% (7 reviews)

Solution Federally declared disaster area after floor uninsured 48600 10 350000 13600 Home mo...View the full answer

Answered By

DIPAK BHOYE

"I am a M.sc (organic chemistry) from NMU India and also a BSc graduate from The University of NMU, india.

I have many years of tutoring experience and I enjoyed teaching all grades students. I have been tutoring with other tutoring sites also and has a very good circle of more than 500 students from USA UK India and some other from South Asia tool am doing one to one tutoring also and like to teach Reactions and mechanism all subjects specially network problem wisi etc and i also like tutoring physics.chemistry Maths and Chemistry subjects and i have also tutoring many students for SAT exam So love tutoring and can taught all grades student. Many of my students' parents message me that your lessons improved our children's grades . So loving tutoring. I love eating and that too of different cuisines. I made many self-papers for this exam which include the basics of chemistry and elementary of all chemistry topics. Initially I worked as a Research Associate at The University of NMU Maharashtra and While at The University I assisted professors with their research work, preparation of course material on corporate finance and equity analyst

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

For calendar year 2014, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Casualty loss after $100 floor (not covered by insurance)...

-

For calendar year 2013, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Casualty loss after $100 floor (not covered by...

-

For calendar year 2016, Stuart and Pamela Gibson file a joint return reflecting AGI of $350,000. Their itemized deductions are as follows: Casualty loss after $100 floor (not covered by...

-

How are writable CDs implemented?

-

Consider the same 3-year swap. Suppose you are a dealer who is paying the fixed oil price and receiving the floating price. Suppose that you enter into the swap and immediately thereafter all...

-

Suppose that the government instituted a per-unit tax on the output of a monopoly firm. How would you graph this situation? What would happen to the market equilibrium after implementation of such a...

-

Use the following balance sheets and income statement to answer 1. Assume that all common stock is issued for cash. What amount of cash dividends is paid during 2013? 2. Assume that no additional...

-

Manceville Air has just produced the first unit of a large industrial compressor that incorporated new technology in the control circuits and a new internal venting system. The first unit took 112...

-

Current Attempt in Progress Crane Company purchased a delivery truck. The total cash payment was $32,042, including the following items. Calculate the cost of the delivery truck. The cost of the...

-

A girl wearing a parachute jumps from a helicopter. She does not open the parachute straight away. The table shows her speed during the 9 seconds after she jumps. a. Copy and complete the table by...

-

Paul and Donna Decker are married taxpayers, ages 44 and 42, respectively, who file a joint return for 2021. The Deckers live at 1121 College Avenue, Carmel, IN 46032. Paul is an assistant manager at...

-

Linda, who files as a single taxpayer, had AGI of $280,000 for 2021. She incurred the following expenses and losses during the year: Calculate Lindas allowable itemized deductions for the year....

-

By reference to any of the countries in Figure 5.2 or 5.3 with which you are familiar, comment on the apparent validity of the groupings. Make notes of points for and against the particular positions...

-

What are knowledge or innovation workers? What are the key elements of professional practice, work environment and work design needed to support the productivity and creativity of knowledge or...

-

What problem does this concept solve or what pain does it alleviate and how compelling is the problem? 2. Who is your specific target customer? 3. How do they currently meet this need for themselves...

-

Consider a person standing in a room where the average wall temperature is 20 C. This person is trying to reach the "thermal comfort" by adjusting the A/C air temperature. Find out the appropriate...

-

If WHO, the World Health Organization,defines health as a state of completephysical, mental and social well-being and not merely the absenceof disease and infirmity (WHO, 2011)and wellness is...

-

As a manager, you want to find a way to motivate Nate and increase his engagement and job satisfaction in the workplace. Drawing upon a behavioral theory of motivation, discuss how you, as a manager,...

-

Solve each equation. Give irrational solutions as decimals correct to the nearest thousandth. e 0.4x = 4 x-2

-

Suppose you are comparing just two means. Among the possible statistics you could use is the difference in means, the MAD, or the max min (the difference between the largest mean and the smallest...

-

Contrast distributive and integrative bargaining.

-

Identify the five steps in the negotiation process.

-

Discuss whether there are individual differences in negotiator effectiveness.

-

The number of hours studied and the scores that students earned are shown. Creating a scatter chart, which statement is true regarding the relationship between the hours of study and scores earned....

-

Five samples of 12 each were extracted from a population. Based on the central limit theorem, what is the best estimate of the SD of the population? A B C D E 270 230 290 238 315 303 274 270 246 244...

-

In a national test, the mean score was 1575 and the standard deviation was 85. What % of the students earned a score between1500 and 1600 if the scores were Normally distributed?

Study smarter with the SolutionInn App