Siena Industries (a sole proprietorship) sold three 1231 assets during 2021. Data on these property dispositions

Question:

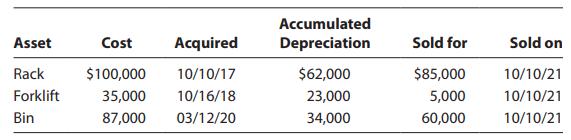

Siena Industries (a sole proprietorship) sold three § 1231 assets during 2021. Data on these property dispositions are as follows:

a. Determine the amount and the character of the recognized gain or loss from the disposition of each asset.

b. Assuming that Siena has no nonrecaptured net § 1231 losses from prior years, analyze these transactions and determine the amount (if any) that will be treated as a long-term capital gain.

Transcribed Image Text:

Asset Rack Forklift Bin Cost Acquired $100,000 10/10/17 35,000 10/16/18 87,000 03/12/20 Accumulated Depreciation $62,000 23,000 34,000 Sold for $85,000 5,000 60,000 Sold on 10/10/21 10/10/21 10/10/21

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (6 reviews)

Solution a Determine the amount and the character of the recognized gain or loss from the ...View the full answer

Answered By

James Warinda

Hi! I’m James Otieno and I'm an experienced professional online tutor with countless hours of success in tutoring many subjects in different disciplines. Specifically, I have handled general management and general business as a tutor in Chegg, Help in Homework and Trans tutor accounts.

I believe that my experience has made me the perfect tutor for students of all ages, so I'm confident I can help you too with finding the solution to your problems. In addition, my approach is compatible with most educational methods and philosophies which means it will be easy for you to find a way in which we can work on things together. In addition, my long experience in the educational field has allowed me to develop a unique approach that is both productive and enjoyable.

I have tutored in course hero for quite some time and was among the top tutors awarded having high helpful rates and reviews. In addition, I have also been lucky enough to be nominated a finalist for the 2nd annual course hero award and the best tutor of the month in may 2022.

I will make sure that any student of yours will have an amazing time at learning with me, because I really care about helping people achieve their goals so if you don't have any worries or concerns whatsoever you should place your trust on me and let me help you get every single thing that you're looking for and more.

In my experience, I have observed that students tend to reach their potential in academics very easily when they are tutored by someone who is extremely dedicated to their academic career not just as a businessman but as a human being in general.

I have successfully tutored many students from different grades and from all sorts of backgrounds, so I'm confident I can help anyone find the solution to their problems and achieve

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Siena Industries (a sole proprietorship) sold three ? 1231 assets during 2019. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized gain or...

-

Siena Industries (a sole proprietorship) sold three § 1231 assets during 2014. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized...

-

Siena Industries (a sole proprietorship) sold three § 1231 assets on October 10, 2017. Data on these property dispositions are as follows. a. Determine the amount and the character of the...

-

The root cause of underdevelopment and environmental degradation is the overdevelopment of a handful of rich nations. Discuss.

-

T-bone Pickens is a corporate raider. This means that he looks for companies that are not maximizing profits, buys them, and then tries to operate them at higher profits. T-bone is examining the...

-

A project that provides annual cash flows of $15,400 for nine years costs $67,000 today. Is this a good project if the required return is 8 percent? What if it's 20 percent? At what discount rate...

-

What are the requirements for an equity security to be listed as a long-term investment? AppendixLO1

-

Tom and Mary James just had a baby. They heard that the cost of providing a college education for this baby will be $100,000 in 18 years. Tom normally receives a Christmas bonus of $4,000 every year...

-

Vulcan Company's contribution format Income statement for June is as follows: Vulcan Company Income Statement For the Month Ended Oune 30 Sales $900,000 Variable expenses 400,00 Contribution margin...

-

A minivan starts from rest on the road whose constant radius of curvature is 40 m and whose bank angle is 10. The motion occurs in a horizontal plane. If the constant forward acceleration of the...

-

Amber Industries (a sole proprietorship) sold three 1231 assets during 2021. Data on these property dispositions are as follows: a. Determine the amount and the character of the recognized gain or...

-

Keshara has the following net 1231 results for each of the years shown. What would be the nature of the net gains in 2020 and 2021? Tax Year 2016 2017 2018 2019 2020 2021 Net 1231 Loss $18,000...

-

Why are roofers paid more than other workers with similar amounts of education?

-

The following information about the payroll for the week ended December 30 was obtained from the records of Saine Co.: Salaries: Sales salaries Deductions: $180,000 Income tax withheld $65,296...

-

You have just been hired as the chief executive officer (CEO) in a medium-sized organization. The organization is not suffering financially, but neither is it doing as well as it could do. This is...

-

The following is the selling price and cost information about three joint products: X Y Z Anticipated production 1 2 , 0 0 0 lbs . 8 , 0 0 0 lbs . 7 , 0 0 0 lbs . Selling price / lb . at split - off...

-

calculate the maximum bending compressive stress of the following section under NEGATIVE bending moment of 216KN.m. 216mm 416mm 316mm 115mm

-

Need assistance with the following forms: 1040 Schedule 1 Schedule 2 Schedule C Schedule SE Form 4562 Form 8995 Appendix B, CP B-3 Christian Everland (SS number 412-34-5670) is single and resides at...

-

Use the given row transformation to change each matrix as indicated. -4 times row 1 added to row 2 4 7

-

The trade-off theory relies on the threat of financial distress. But why should a public corporation ever have to land in financial distress? According to the theory, the firm should operate at the...

-

a. Who is liable for additional taxes on a joint return? b. Why is this so important?

-

Can couples change from joint returns to separate returns? Separate to joint?

-

This year, Yung Tseng, a U.S. citizen, supported his nephew who is attending school in the United States. Yung is a U.S. citizen, but his nephew is a citizen of Hong Kong. The nephew has a student...

-

Which of the following statements regarding traditional cost accounting systems is false? a. Products are often over or under cost in traditional cost accounting systems. b. Most traditional cost...

-

Bart is a college student. Since his plan is to get a job immediately after graduation, he determines that he will need about $250,000 in life insurance to provide for his future wife and children...

-

Reporting Financial Statement Effects of Bond Transactions (please show me how you got the answers) Lundholm, Inc., which reports financial statements each December 31, is authorized to issue...

Study smarter with the SolutionInn App