Three C corporations reported the following results for the calendar tax year 2021. a. Determine each corporations

Question:

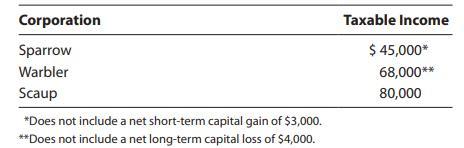

Three C corporations reported the following results for the calendar tax year 2021.

a. Determine each corporation’s Federal income tax liability.

b. Construct a single Microsoft Excel formula that will produce the correct answer for all of the entities in part (a).

Transcribed Image Text:

Corporation Sparrow Warbler Scaup *Does not include a net short-term capital gain of $3,000. *Does not include a net long-term capital loss of $4,000. Taxable Income $ 45,000* 68,000** 80,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 70% (10 reviews)

a Sparrow Taxable income of 45000 does not include a net shortterm capital gain of 3000 so their tot...View the full answer

Answered By

Dulal Roy

As a tutor, I have gained extensive hands-on experience working with students one-on-one and in small group settings. I have developed the ability to effectively assess my students' strengths and weaknesses, and to customize my teaching approach to meet their individual needs.

I am proficient at breaking down complex concepts into simpler, more digestible pieces, and at using a variety of teaching methods (such as visual aids, examples, and interactive exercises) to engage my students and help them understand and retain the material.

I have also gained a lot of experience in providing feedback and guidance to my students, helping them to develop their problem-solving skills and to become more independent learners. Overall, my hands-on experience as a tutor has given me a deep understanding of how to effectively support and encourage students in their learning journey.

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Individual Income Taxes

ISBN: 9780357519073

45th Edition

Authors: James C. Young, Annette Nellen, William A. Raabe, Mark Persellin, William H. Hoffman

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Marcella (a calendar year taxpayer) purchased a sculpture for $5,000. When the sculpture is worth $12,000 (as later determined by the IRS), Marcella donates it to the Peoria Museum of Art, a public...

-

ZA Berhad is an investment holding company located in Malaysia. Property development, building, property investment, and management services are the primary activities of the corporation and its...

-

(i) One person using a hammer will take five days to nail new shingles on the roof of a 300 m2 house. (ii) Two persons using a hammer but working together (one holds a shingle, the other swings the...

-

On January 1, 2017, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland's outstanding voting stock, representing a 60 percent...

-

What specific steps would you instruct your corporate - level HR director to take to minimize the chances that a problem such as this would occur again?

-

The Dynaco Manufacturing Company has an assembly line that feeds two drill presses. As partially completed products come off the line, they are lined up to be worked on as drill presses become...

-

(A 1,3) (B 1,2) with explanation Effect of Transactions on Accounting Equation a. A vacant lot acquired for $234,000 is sold for $548,000 in cash. What is the effect of the sale on the total amount...

-

Tree Top Company is a service based company that rents canoes for use on local lakes and rivers. At the beginning of the new year, Tree Top Company decided to carry and sell T-shirts with its logo...

-

On December 6, 2021, Kestrel Company (a calendar year taxpayer) authorizes a cash donation of $50,000 to the Memphis Public Library. The pledge is carried out as follows: $15,000 on December 12,...

-

Citron, a calendar year taxpayer, began business in January 2020. It had a long-term capital gain of $5,000 in 2020 and a long-term capital loss of $10,000 in 2021. For both years, Citron had an...

-

Dansville Restaurant Supply manufactures commercial stoves and ovens for restaurants and bakeries. The company uses job costing to calculate the costs of its jobs with direct labor cost as its...

-

Determine the missing amount in each of the following cases: Assets Liabilities $190,000 $62,000 ? $53,000 $115,000 ? Stockholders' Equity ? $31,000 $61,000

-

For the following four unrelated situations, A through D, calculate the unknown amounts appearing in each column: A B C Beginning Assets. $45,000 $32,000 $53,000 ? Liabilities.. 32,000 15,000 49,000...

-

On December 31, Greg Jones completed his first year as a financial planner. The following data are available from his accounting records: a. Compute Greg's net income for the year just ended using...

-

The Benson Company has collected the following production cost data: {Required:} What would be the incremental production costs for an additional 10 units after the Benson Company has produced 8...

-

Once the largest professional services firm in the world and arguably the most respected, Arthur Andersen LLP (AA) has disappeared. The Big 5 accounting firms are now the Big 4. Why did this happen?...

-

Write an equation for the hyperbola. Vertices at (4, 5), (4, 1); asymptotes y = 7(x - 4) + 3

-

a. Determine the domain and range of the following functions.b. Graph each function using a graphing utility. Be sure to experiment with the window and orientation to give the best perspective of the...

-

Susans salary is $44,000 and she received dividends of $600. She received a statement from SJ partnership indicating that her share of the partnerships income was $4,000. The partnership distributed...

-

Holly inherited $10,000 of City of Atlanta bonds in February. In March, she received interest of $500, and in April she sold the bonds at a $200 gain. Holly redeemed Series EE U.S. savings bonds that...

-

Tim retired during the current year at age 58. He purchased an annuity from American National Life Company for $40,000. The annuity pays Tim $500 per month for life. a. Compute Tims annual exclusion....

-

All of the following are included on Form 1040, page 1, EXCEPT: The determination of filing status. The Presidential Election Campaign check box. The income section. The paid preparer signature line.

-

Question One: (25 marks) (X) Inc. purchased 80% of the outstanding voting shares of (Y) for $360,000 on July 1, 2017. On that date, (Y) had common shares and retained earnings worth $180,000 and...

-

Regarding Enron, this was a company that resulted in the creation of the Sarbanes-Oxley Act and many reforms to the accounting profession. Research the company and answer the following...

Study smarter with the SolutionInn App