Coline has the following capital gain and loss transactions for 2022. After the capital gain and loss

Question:

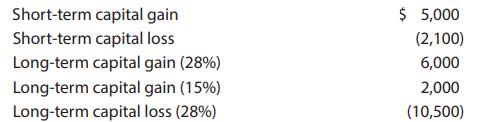

Coline has the following capital gain and loss transactions for 2022.

After the capital gain and loss netting process, what is the amount and character of Coline’s net capital gain or loss?

Transcribed Image Text:

Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (15%) Long-term capital loss (28%) $ 5,000 (2,100) 6,000 2,000 (10,500)

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 72% (11 reviews)

Coline first nets the shortterm gains and losses against ea...View the full answer

Answered By

Armando Jr Evangelista

Hi !

Greetings, I am Shair Baz From Pakistan. I am a professional Chemistry teacher in Punjab Province of Pakistan. I have a teaching experience of 10 years .My professional Qualification is M.Sc In Chemistry from Islami University Bahawalpur Pakistan.

Hopefully i will answer all the questions that you ask.

Thanks....

0.00

0 Reviews

10+ Question Solved

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted:

Students also viewed these Business questions

-

Coline has the following capital gain and loss transactions for 2017. After the capital gain and loss netting process, what is the amount and character of Colines gain or loss? Short-term capital...

-

Coline has the following capital gain and loss transactions for 2015. Short-term capital gain ......................................... $ 5,000 Short-term capital loss...

-

Coline has the following capital gain and loss transactions for 2016. Short-term capital gain .................................. $ 5,000 Short-term capital loss ......................................

-

Fewer than 20% of M&M candies are green. The hypothesis test results in a P-value of 0.0721. Assume a significance level of = 0.05 a. State a conclusion about the null hypothesis. b. Without using...

-

A contractor purchased equipment costing $40,000 in 2010 when the M&S equipment cost index was at 1461.3. He remembers purchasing the same equipment for $21,771 many years ago, but he does not...

-

Robert Noble-Warren (1986) talks about 'lifetime planning' as a series of 'rest and recuperation periods throughout life as well as the planning of financial provision Lifetime planning has to start...

-

Sloppy writing about correlation. Each of the following statements contains a blunder. Explain in each case what is wrong. (a) There is a high correlation between a college students major and his or...

-

The comparative balance sheets of Susan Saboda Design Studio, Inc., at June 30, 2012 and 2011, and transaction data for fiscal 2012, are as follows: Transaction data for the year ended June 30, 2012,...

-

Exercise 5 - 2 1 ( Algo ) Prepaid expenses - insurance LO 5 - 1 0 [ The following information applies to the questions displayed below. ] A company makes the payment of a one - year insurance premium...

-

Thania inherited 1,000 shares of Aqua, Inc. stock from Joe. Joes basis in the stock was $35,000, and the fair market value of the stock on July 1, 2022 (the date of Joes death), was $45,000. The...

-

Dan bought a hotel for $2,600,000 in January 2018. In May 2022, he died and left the hotel to Ed. While Dan owned the hotel, he deducted $289,000 of cost recovery. The fair market value in May 2022...

-

On January 1, 2019, Brewster Company issued 2,000 of its 5-year, $1,000 face value, 11% bonds dated January 1 at an effective annual interest rate (yield) of 9%. Brewster uses the effective interest...

-

Pink Jeep Tours offers off-road tours to individuals and groups visiting the Southwestern U.S. hotspots of Sedona, Arizona, and Las Vegas, Nevada. Take a tour of the companys Web site at...

-

The following are unrelated accounting practices: 1. Pine Company purchased a new \(\$ 30\) snow shovel that is expected to last six years. The shovel is used to clear the firm's front steps during...

-

Identify whether the following statements are true or false. 1. One argument for IFRS is that there is less globalization in the world. 2. IFRS is accepted as GAAP in every country of the world. 3....

-

You will need isometric dot paper for this question. Part of a pattern using four rhombuses is drawn on isometric dot paper below. By drawing two more rhombuses, complete the pattern so that it has a...

-

Fred Flores operates a golf driving range. For each of the following financial items related to his business, indicate the financial statement (or statements) in which the item would be reported:...

-

Why do some people have difficulty saving?

-

Aztec Furnishings makes hand-crafted furniture for sale in its retail stores. The furniture maker has recently installed a new assembly process, including a new sander and polisher. With this new...

-

Brooklyn files as a head of household for 2019. She claimed the standard deduction of $18,350 for regular tax purposes. Her regular taxable income was $80,000. What is Brooklyns AMTI?

-

In 2019, Carson is claimed as a dependent on his parents tax return. Carsons parents provided most of his support. What is Carsons tax liability for the year in each of the following alternative...

-

In 2019, Sheryl is claimed as a dependent on her parents tax return. Sheryl did not provide more than half her own support. What is Sheryls tax liability for the year in each of the following...

-

Break-Even Sales and Sales to Realize Income from Operations For the current year ending October 31, Yentling Company expects fixed costs of $537,600, a unit variable cost of $50, and a unit selling...

-

You buy a stock for $35 per share. One year later you receive a dividend of $3.50 per share and sell the stock for $30 per share. What is your total rate of return on this investment? What is your...

-

Filippucci Company used a budgeted indirect-cost rate for its manufacturing operations, the amount allocated ($200,000) is different from the actual amount incurred ($225,000). Ending balances in the...

Study smarter with the SolutionInn App