During 2022, Jos, a self-employed technology consultant, made gifts in the following amounts. In addition, on professional

Question:

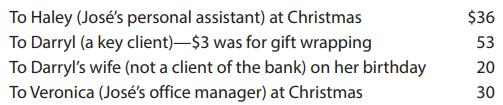

During 2022, José, a self-employed technology consultant, made gifts in the following amounts.

In addition, on professional assistants’ day, José takes Haley to lunch at a local restaurant at a cost of $82. Presuming that José has adequate substantiation, how much can he deduct?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South Western Federal Taxation 2023 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357720103

26th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young

Question Posted: