Gray is a 50% partner in Fabco Partnership. Grays tax basis in Fabco on January 1, year

Question:

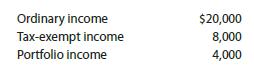

Gray is a 50% partner in Fabco Partnership. Gray’s tax basis in Fabco on January 1, year 4, was $5,000. Fabco made no distributions to the partners during year 4 and recorded the following.

What is Gray’s tax basis in Fabco on December 31, year 4?

a. $21,000

b. $16,000

c. $12,000

d. $10,000

Transcribed Image Text:

Ordinary income Tax-exempt income $20,000 8,000 Portfolio income 4,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 62% (16 reviews)

Greys tax basis must be increased by His share in ordi...View the full answer

Answered By

Marvine Ekina

Marvine Ekina

Dedicated and experienced Academic Tutor with a proven track record for helping students to improve their academic performance. Adept at evaluating students and creating learning plans based on their strengths and weaknesses. Bringing forth a devotion to education and helping others to achieve their academic and life goals.

PERSONAL INFORMATION

Address: , ,

Nationality:

Driving License:

Hobbies: reading

SKILLS

????? Problem Solving Skills

????? Predictive Modeling

????? Customer Service Skills

????? Creative Problem Solving Skills

????? Strong Analytical Skills

????? Project Management Skills

????? Multitasking Skills

????? Leadership Skills

????? Curriculum Development

????? Excellent Communication Skills

????? SAT Prep

????? Knowledge of Educational Philosophies

????? Informal and Formal Assessments

0.00

0 Reviews

10+ Question Solved

Related Book For

South-Western Federal Taxation 2022 Essentials Of Taxation Individuals And Business Entities

ISBN: 9780357519431

25th Edition

Authors: Annette Nellen, Andrew D. Cuccia, Mark Persellin, James C. Young, David M. Maloney

Question Posted:

Students also viewed these Business questions

-

1. (2 points) Prove or disprove that the sum of any even integer and any odd integer is odd.

-

Part 1 of 11 The notes to the Wolfe Ltd financial statements reported the following data on December 31, Year 1 (end of the fiscal year) Click the icon to view the financial statement data.) Wolfe...

-

You are the accountant for a reporting entity, Storm Ltd. You have received a phone call from the managing director concerning the following. On 1 July 2018, Storm Ltd acquired an asset for $500,000,...

-

Calculate the following ratios for both 2021 and 2020 years: current ratio, quick ratio, debt to equity ratio, debt ratio, gross profit ratio, net profit ratio, return on equity, return on total...

-

What is a blog?

-

See the balance sheet of a not-for-prot hospital presented on page 84. It is intended to display the hospitals fund structure. Inasmuch as it does not conform to FASB standards, it is inappropriate...

-

A company is considering an investment paying $10,000 every six months for three years. The first payment would be received in six months. If this company requires an 8% annual return, what is the...

-

A location analysis for Temponi Control, a small manufacturer of parts for high-technology cable systems, has been narrowed down to four locations. Temponi will need to train assemblers, testers, and...

-

Given the data below for a firm in its first year of operation, determine net income under the accrual basis of accounting. $12590 $9770 115450

-

Recall that we have two write policies and write allocation policies, and their combinations can be implemented either in L1 or L2 cache. Assume the following choices for L1 and L2 caches: L1...

-

John Parsons (123-45-6781) and George Smith (123-45-6782) are 70% and 30% owners, respectively, of Premium, Inc. (11-1111111), a candy company located at 1005 16th Street, Cut and Shoot, TX 77303....

-

Ryan Ross (111-11-1112), Oscar Omega (222-22-2223), Clark Carey (333-33-3334), and Kim Kardigan (444-44-4445) are equal active members in ROCK the Ages LLC. ROCK serves as agent and manager for...

-

Deglman Manufacturing Company uses a simple manufacturing accounting system. At the end of its fiscal year on August 31, 2011, the adjusted trial balance contains the following accounts. Physical...

-

Door-to-Door Marketing.A small nonprofit organization is planning a door-to-door marketing campaign to sell Christmas wrapping and gifts. They plan to visit 10 homes. Consultants have estimated that...

-

OTHELLO - ACT III QUESTION 1 What are the clowns and musicians doing in front of the castle? QUESTION 2 For what purpose is Cassio there? QUESTION 3 Cassio asks Iago to ask whom to make an...

-

How does the power of the situation affect how we think, feel, and behave, not just in the lab but in our day-to-day lives? What does social psychological research have to offer as we understand how...

-

[Replace this text, including the brackets, with an introduction of the claim and the scenario of this hypothesis test. State your null and alternative hypothesis in sentence format. State your null...

-

Explain how drug addiction affects the brain. Does the childhood environment affect their likelihood of becoming addicted? Give evidence of how it does or does not affect this. Please compare two...

-

On September 1, 2010, A Company purchased 100 percent of the voting stock of B Company for $480,000 in cash. The separate condensed balance sheets immediately after the purchase were as follows:...

-

Derive Eq. (18.33) from Eq. (18.32).

-

This year William provided $4,200 of services to a large client on credit. Unfortunately, this client has recently encountered financial difficulties and has been unable to pay William for the...

-

Dustin has a contract to provide services to Dado Enterprises. In November of year 0, Dustin billed Dado $10,000 for the services he rendered during the year. Dado is an accrual-method proprietorship...

-

Erin is considering switching her business from the cash method to the accrual method at the beginning of next year (year 1). Determine the amount and timing of her 481 adjustment assuming the IRS...

-

THIS IS ONE QUESTION WITH TWO PARTS. PLEASE ANSWER COMPLETELY AND SHOW ALL WORK. (NO EXCEL) Information for Question 1: State Probability Retum on A Return on B Return on C Retum on Portfolio X Boom...

-

Direct materials (5.0 Ibs. @ $5.00 per Ib.) Direct labor (2.0 hrs. @ $13.00 per hr.) Overhead (2.0 hrs. @ $18.50 per hr.) Total standard cost $25.00 26.00 37.00 $88.00 The predetermined overhead rate...

-

Problem 1-28 (Algo) (LO 1-4, 1-5, 1-6b 1-7) Harper, Inc., acquires 40 percent of the outstanding voting stock of Kinman Company on January 1, 2020, for $316,100 in cash. The book value of Kinman's...

Study smarter with the SolutionInn App