Aman, a sole proprietor and rental property owner, had the following expenses in 2017: Payment to tax

Question:

Payment to tax lawyer for advice related to business tax liability ........................... $1,000

Property taxes paid on rental home ............................................................................ 2,000

Management fee for Aman€™s retirement portfolio ..................................................... 500

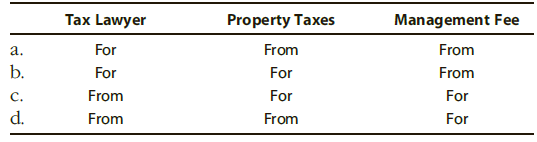

Specify whether each expense would be deducted for adjusted gross income (AGI) or from AGI on Aman€™s 2017 tax return.

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

South-Western Federal Taxation 2018 Comprehensive

ISBN: 9781337386005

41st Edition

Authors: David M. Maloney, William H. Hoffman, Jr., William A. Raabe, James C. Young

Question Posted: